ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

18th Edition

ISBN: 9781260949766

Author: RECK

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 28EP

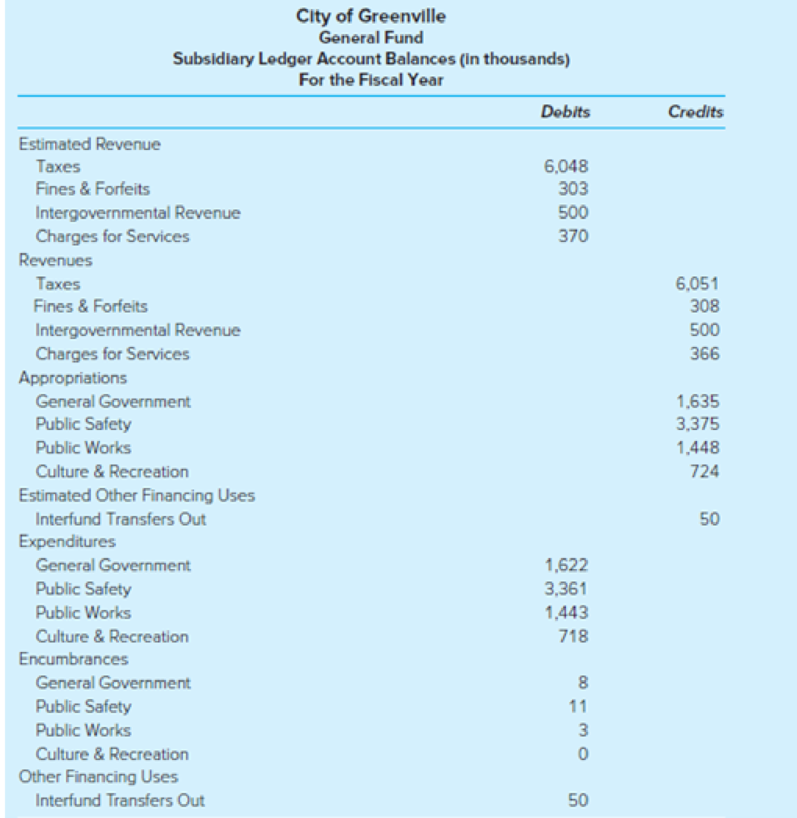

Greenville has provided the following information from its General Fund Revenues and Appropriations/Expenditure/Encumbrances subsidiary ledgers for the fiscal year ended. Assume the beginning fund balances are $152 (in thousands) and that the budget was not amended during the year.

Required

- a. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance.

- b. Prepare a General Fund schedule of revenues, expenditures, and changes in fund balance—budget and actual (assume the budget is prepared on a GAAP basis).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On

January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct

materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at

a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory

account on January 1.

During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs

49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events

occurred during the month.

1.

Purchased additional raw materials of $75,600 on account.

2.

Incurred factory labor costs of $58,800.

3.

Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…

Determine the amount to be paid in full settlement of each invoice, assuming that credit for returns and

allowances was received prior to payment and that all invoices were paid within the discount period.

Freight Paid

Returns and

Merchandise

by Seller

Freight Terms

Allowances

a.

$9,400

$282

FOB Shipping Point, 1/10, net 30

$900

b.

$8,600

$60

FOB Destination, 2/10, net 45

$1,900

a. $

b. $

Travis Company purchased merchandise on account from a supplier for $13,200, terms 2/10, net 30 on December 26. Travis Company paid for the merchandise on December 31, within the discount period.

Required:

Under a perpetual inventory system, record the journal entries required for the above transactions. Refer to the Chart of Accounts for exact wording of account titles.

Chapter 3 Solutions

ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

Ch. 3 - Prob. 1QCh. 3 - Discuss the different ways in which depreciation...Ch. 3 - Prob. 3QCh. 3 - Prob. 4QCh. 3 - Explain the essential differences between revenues...Ch. 3 - Prob. 6QCh. 3 - How do Budgetary Fund Balance and Fund Balances...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - The city manager of University City is finalizing...Ch. 3 - Prob. 16.1EPCh. 3 - Prob. 16.2EPCh. 3 - Which of the following accounts neither increases...Ch. 3 - Prob. 16.4EPCh. 3 - Which of the following statements is true for...Ch. 3 - An internal allocation of funds on a periodic...Ch. 3 - Prob. 16.7EPCh. 3 - Prob. 16.8EPCh. 3 - Before placing a purchase order, a department...Ch. 3 - Prob. 16.10EPCh. 3 - Which of the following is correct concerning the...Ch. 3 - Prob. 16.12EPCh. 3 - Prob. 16.13EPCh. 3 - Prob. 16.14EPCh. 3 - Supplies ordered by the Public Works function of...Ch. 3 - Prob. 17EPCh. 3 - Prob. 18EPCh. 3 - Prob. 19EPCh. 3 - The following information is provided about the...Ch. 3 - On February 15, the Town of Evergreen police...Ch. 3 - The Town of Willingdon adopted the following...Ch. 3 - During July, the first month of the fiscal year,...Ch. 3 - The Town of Bedford Falls approved a General Fund...Ch. 3 - The printout of the Revenues and Appropriations...Ch. 3 - Review the computer-generated budgetary comparison...Ch. 3 - Prob. 27EPCh. 3 - Greenville has provided the following information...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forward

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License