ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

18th Edition

ISBN: 9781260949766

Author: RECK

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 21EP

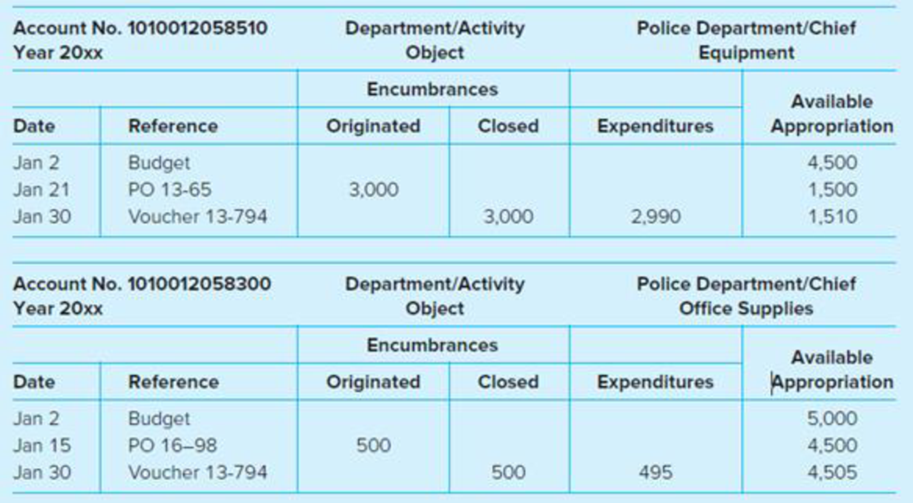

On February 15, the Town of Evergreen police chief’s administrative assistant is preparing a purchase order to place an order for a new computer. The computer is estimated to cost $1,600. Prior to submitting the purchase order, he is required to verify that an appropriation is available in a sufficient amount to cover the cost of the new computer. His computer display shows the following current information for the Police Chief Equipment account and Office Supplies account.

Required

Review the police chief accounts as of February 15, and answer the following questions, assuming you are the administrative assistant.

- a. Is the available appropriation balance sufficient to authorize placing the purchase order for the new computer?

- b. You notice an available appropriation balance in the office supply account. Under what circumstances might the office supplies appropriation balance be used for the equipment purchase?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please given correct answer general Accounting

Hii ticher please given correct answer general Accounting

None

Chapter 3 Solutions

ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

Ch. 3 - Prob. 1QCh. 3 - Discuss the different ways in which depreciation...Ch. 3 - Prob. 3QCh. 3 - Prob. 4QCh. 3 - Explain the essential differences between revenues...Ch. 3 - Prob. 6QCh. 3 - How do Budgetary Fund Balance and Fund Balances...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - The city manager of University City is finalizing...Ch. 3 - Prob. 16.1EPCh. 3 - Prob. 16.2EPCh. 3 - Which of the following accounts neither increases...Ch. 3 - Prob. 16.4EPCh. 3 - Which of the following statements is true for...Ch. 3 - An internal allocation of funds on a periodic...Ch. 3 - Prob. 16.7EPCh. 3 - Prob. 16.8EPCh. 3 - Before placing a purchase order, a department...Ch. 3 - Prob. 16.10EPCh. 3 - Which of the following is correct concerning the...Ch. 3 - Prob. 16.12EPCh. 3 - Prob. 16.13EPCh. 3 - Prob. 16.14EPCh. 3 - Supplies ordered by the Public Works function of...Ch. 3 - Prob. 17EPCh. 3 - Prob. 18EPCh. 3 - Prob. 19EPCh. 3 - The following information is provided about the...Ch. 3 - On February 15, the Town of Evergreen police...Ch. 3 - The Town of Willingdon adopted the following...Ch. 3 - During July, the first month of the fiscal year,...Ch. 3 - The Town of Bedford Falls approved a General Fund...Ch. 3 - The printout of the Revenues and Appropriations...Ch. 3 - Review the computer-generated budgetary comparison...Ch. 3 - Prob. 27EPCh. 3 - Greenville has provided the following information...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: general Accountingarrow_forwardHow much will you accumulated after 35 year?arrow_forwardOn a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:9781305224414

Author:JENNINGS

Publisher:Cengage

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License