Concept explainers

Effect of purchase returns and allowances and purchase discounts on the financial statements: Perpetual system

The following events were completed by Dana’s Imports in September 2018:

Sept. 1 Acquired $50,000 cash from the issue of common stock.

1 Purchased $28,000 of merchandise on account with terms 2/10, n/30.

5 Paid $600 cash for freight to obtain merchandise purchased on September 1.

8 Sold merchandise that cost $15,000 to customers for $31,000 on account, with terms 2/10, n/30.

8 Returned $600 of defective merchandise from the September 1 purchase to the supplier.

10 Paid cash for the balance due on the merchandise purchased on September 1.

20 Received cash from customers of September 8 sale in settlement of the account balances, but not within the discount period.

30 Paid $2,450 cash for selling expenses.

Required

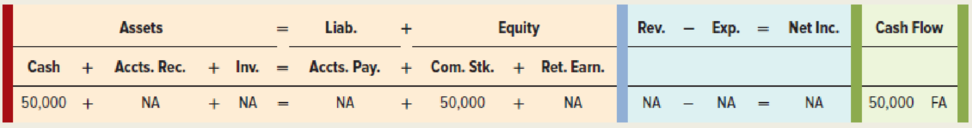

a. Record each event in a statements model like the following one. The first event is recorded as an example.

b. Prepare an income statement for the month ending September 30.

c. Prepare a statement of

d. Explain why there is a difference between net income and cash flow from operating activities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning