SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

5th Edition

ISBN: 9781264010653

Author: Edmonds

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 18E

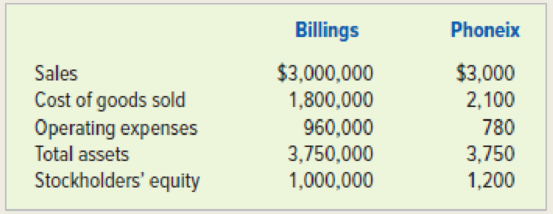

Using common size statements and ratios to make comparisons

At the end of 2018 the following information is available for Billings and Phoneix companies:

Required

a. Prepare common size income statements for each company.

b. One company is a high-end retailer, and the other operates a discount store. Which is the discounter? Support your selection by referring to the common size statements.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a

division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition:

Current assets

$846,000

Current liabilities

$564,000

Noncurrent assets

2,538,000

Long-term liabilities

470,000

Stockholder's equity

2,350,000

Total assets

$3,384,000

Total liabilities and stockholder's equity

$3,384,000

It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At

December 31, 2026, Pharoah reports the following balance sheet information:

Current assets

$752,000

Noncurrent assets (including goodwill recognized in purchase)

2,256,000

Current liabilities

(658,000)

Long-term liabilities

(470,000)

Net assets

$1,880,000

It is determined that the fair value of the Pharoah division is $2,068,000.

On May 31, 2026, Oriole Company paid $3,290,000 to acquire all of the common stock of Pharoah Corporation, which became a

division of Oriole. Pharoah reported the following balance sheet at the time of the acquisition:

Current assets

$846,000

Current liabilities

$564,000

Noncurrent assets

2,538,000

Long-term liabilities

470,000

Stockholder's equity

2,350,000

Total assets

$3,384,000

Total liabilities and stockholder's equity

$3,384,000

It was determined at the date of the purchase that the fair value of the identifiable net assets of Pharoah was $2,914,000. At

December 31, 2026, Pharoah reports the following balance sheet information:

Current assets

$752,000

Noncurrent assets (including goodwill recognized in purchase)

2,256,000

Current liabilities

(658,000)

Long-term liabilities

(470,000)

Net assets

$1,880,000

It is determined that the fair value of the Pharoah division is $2,068,000.

The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025.

1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business.

2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful.

3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years.

4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029.

5.) Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…

Chapter 3 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

Ch. 3 - 1. Define merchandise inventory. What types of...Ch. 3 - 2. What is the difference between a product cost...Ch. 3 - 3. How is the cost of goods available for sale...Ch. 3 - 4. What portion of cost of goods available for...Ch. 3 - 5. When are period costs expensed? When are...Ch. 3 - 6. If PetCo had net sales of 600,000, goods...Ch. 3 - Prob. 7QCh. 3 - 8. What are the effects of the following types of...Ch. 3 - 9. Northern Merchandising Company sold inventory...Ch. 3 - 10. If goods are shipped FOB shipping point, which...

Ch. 3 - 11. Define transportation-in. Is it a product or a...Ch. 3 - Prob. 12QCh. 3 - Prob. 13QCh. 3 - 14. Dyer Department Store purchased goods with the...Ch. 3 - 15. Eastern Discount Stores incurred a 5,000 cash...Ch. 3 - 16. What is the purpose of giving credit terms to...Ch. 3 - Prob. 17QCh. 3 - 18. Ball Co. purchased inventory with a list price...Ch. 3 - 22. Explain the difference between purchase...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - 25. What is the advantage of using common size...Ch. 3 - 27. What is the purpose of preparing a schedule of...Ch. 3 - 28. Explain how the periodic inventory system...Ch. 3 - Prob. 25QCh. 3 - Exercise 3-1 Determining the cost of financing...Ch. 3 - Exercise 3-2 Comparing a merchandising company...Ch. 3 - Exercise 3-3 Effect of inventory transactions on...Ch. 3 - Exercise 3-4 Effect of inventory transactions on...Ch. 3 - Exercise 3-5 Recording inventory transactions in a...Ch. 3 - Exercise 4-6A Understanding the freight terms FOB...Ch. 3 - Exercise 3-7 Effect of purchase returns and...Ch. 3 - Exercise 3-8 Accounting for product costs:...Ch. 3 - Effect of product cost and period cost: Horizontal...Ch. 3 - Cash Discounts and Purchase Returns On April 6,...Ch. 3 - Exercise 4-9A Determining the effect of inventory...Ch. 3 - Inventory financing costs Bill Norman comes to you...Ch. 3 - Effect of shrinkage: Perpetual system Ho Designs...Ch. 3 - Comparing gross margin and gain on sale of land...Ch. 3 - Single-step and multistep income statements The...Ch. 3 - Prob. 16ECh. 3 - Effect of cash discounts on financial statements:...Ch. 3 - Using common size statements and ratios to make...Ch. 3 - Prob. 19ECh. 3 - Determining cost of goods sold: Periodic system...Ch. 3 - Identifying product and period costs Required...Ch. 3 - Problem 4-23A Identifying freight costs Required...Ch. 3 - Effect of purchase returns and allowances and...Ch. 3 - Preparing a schedule of cost of goods sold and...Ch. 3 - Prob. 25PCh. 3 - Comprehensive cycle problem: Perpetual system At...Ch. 3 - Prob. 27PCh. 3 - Comprehensive cycle problem: Periodic system...Ch. 3 - Prob. 1ATCCh. 3 - ATC 3-2 Group Exercise Multistep income statement...Ch. 3 - Prob. 3ATCCh. 3 - Prob. 4ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License