1.

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

1.

Explanation of Solution

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

Step 1: Calculate the annual salary of Employee LR, Employee RB and Employee GL.

| Employee | Monthly salary (A) | Annual salary (A×12months) |

| Employee LR | $6,240 per month | $74,880.00 |

| Employee RB | $4,680 per month | $56,160.00 |

| Employee GL | $4,900 per month | $58,800.00 |

Table (1)

Step 2: Calculate the regular earnings of each employees.

| Employee | Annual salary (A) | Regular Weekly earnings |

| Employee MA | $97,240 | $1,870.00 |

| Employee BC | $91,000 | $1,750.00 |

| Employee LR | $74,880 | $1,440.00 |

| Employee RB | $56,160 | $1,080.00 |

| Employee GL | $58,800 | $1,130.77 |

| Total | $378,080 | $7,270.77 |

Table (2)

Thus, the total regular earnings for the weekly payroll ended December 13, 2019 is $7,270.77

2.

Calculate the overtime earnings if any applicable to any employee.

2.

Explanation of Solution

Calculate the overtime earnings for Employee GL.

| Employee | Weekly earnings (A) | Regular hourly rate (B) |

Overtime hourly rate (C) |

Overtime earnings (D) |

| Employee GL | $1,130.77 | $28.27 | $42.40 | $339.23 |

Table (3)

Thus, the overtime earnings for Employee GL is $339.23.

3.

Calculate the total regular, overtime earnings and bonus.

3.

Explanation of Solution

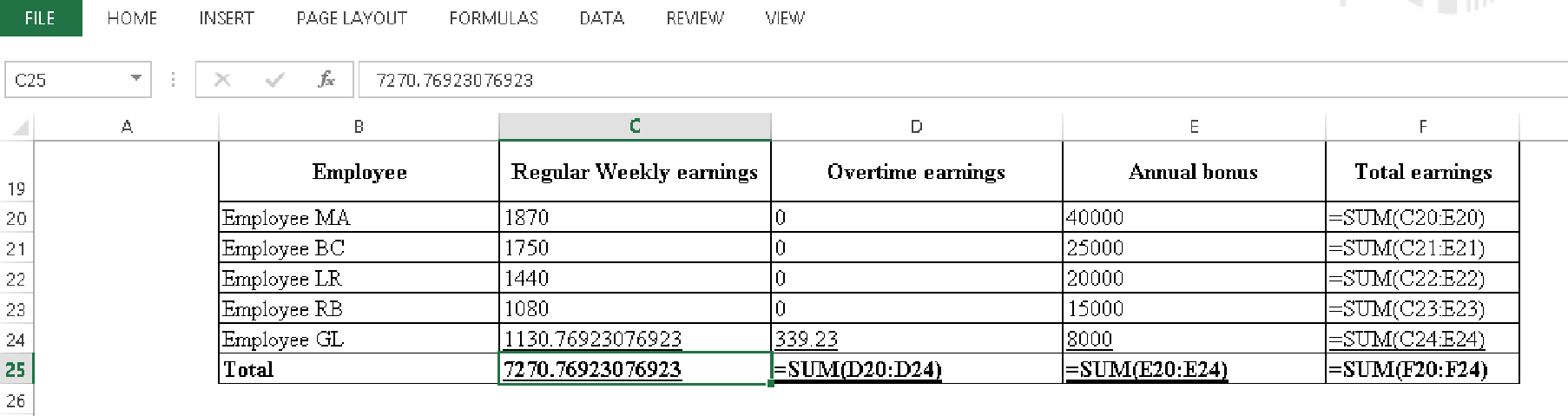

Calculate the total regular, overtime earnings and bonus.

| Employee | Regular Weekly earnings | Overtime earnings | Annual bonus | Total earnings |

| Employee MA | $1,870.00 | $0.00 | $40,000 | $41,870.00 |

| Employee BC | $1,750.00 | $0.00 | $25,000 | $26,750.00 |

| Employee LR | $1,440.00 | $0.00 | $20,000 | $21,440.00 |

| Employee RB | $1,080.00 | $0.00 | $15,000 | $16,080.00 |

| Employee GL | $1,130.77 | $339.23 | $8,000 | $9,470.00 |

| Total | $7,270.77 | $339.23 | $108,000 | $115,610.00 |

Table (4)

Calculation for total regular, overtime earnings and bonus is as follows.

Table (5)

4 and 5.

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

4 and 5.

Explanation of Solution

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

| Cumulative earnings as of Last Pay Period | FICA Taxable Wages This Pay Period | FICA Taxes to be Withheld | Employees | ||

| OASDI (A) | HI (B) | OASDI | HI | ||

| $91,630 | $36,770.00 | $41,870 | $2,279.74 | $607.12 | Employee MA |

| $85,750 | $26,750.00 | $26,750 | $1,658.50 | $387.88 | Employee BC |

| $70,560 | $21,440.00 | $21,440 | $1,329.28 | $310.88 | Employee LR |

| $52,920 | $16,080.00 | $16,080 | $996.96 | $233.16 | Employee RB |

| $34,890 | $9,470.00 | $9,470 | $587.14 | $137.32 | Employee GL |

| $110,510.00 | $115,610.00 | $6,851.62 | $1,676.35 | Totals | |

Table (6)

Note: Employee MA’s earnings is exceeding the taxable wage limit of $128,400. Thus, the $5,100

Step 3: Calculate the employer’s portion of the FICA taxes for the week ended.

Calculate the OASDI taxes.

Calculate the HI taxes.

Calculate the total FICA taxes.

Want to see more full solutions like this?

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Bieg/toland's Payroll Accounting 2019, 29th

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning