Cengagenowv2, 1 Term Printed Access Card For Bieg/toland's Payroll Accounting 2019, 29th

29th Edition

ISBN: 9781337619806

Author: Bernard J. Bieg, Judith Toland

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 10PB

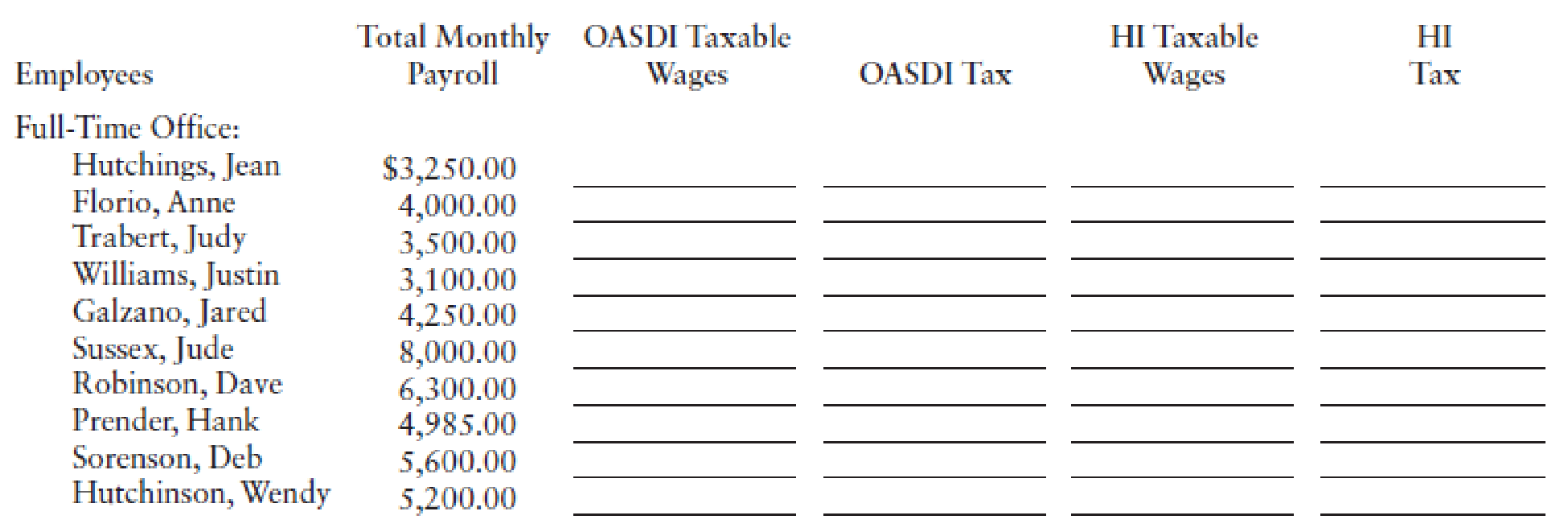

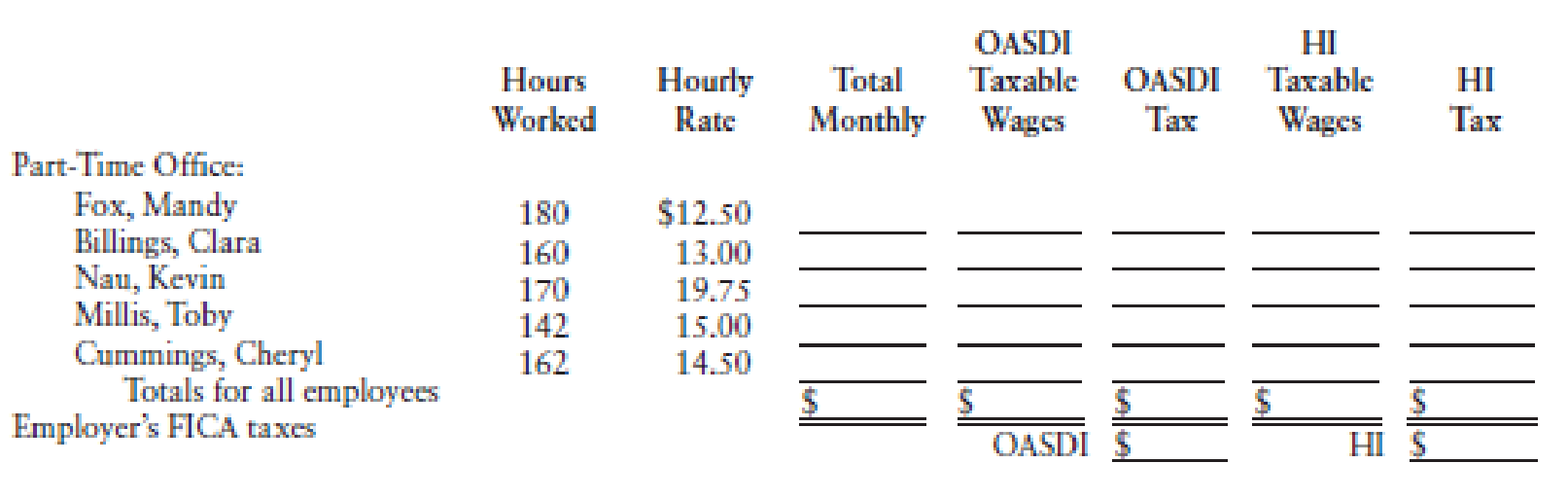

The monthly and hourly wage schedule for the employees of Quincy, Inc., follows. No employees are due overtime pay. Compute the following for the last monthly pay of the year:

- a. The total wages of each part-time employee for December 2019.

- b. The OASDI and HI taxable wages for each employee.

- c. The FICA taxes withheld from each employee’s wages for December.

- d. Totals of columns.

- e. The employer’s FICA taxes for the month.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Many experts using ai tools and giving incorrect solutions .

pls give correct answer when you 100% sure .

if you have problem with image comment i will write value

Step by step correct answer.

without using chatgpt.

answer should be co

Answer cor

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Bieg/toland's Payroll Accounting 2019, 29th

Ch. 3 - Which of the following are covered by FICA...Ch. 3 - Prob. 2SSQCh. 3 - Prob. 3SSQCh. 3 - Lori Kinmark works as a jeweler for a local...Ch. 3 - _____1. Johnson Industries, a semiweekly...Ch. 3 - _____1. Employees FICA tax rates A. Severance pay...Ch. 3 - For social security purposes, what conditions must...Ch. 3 - Prob. 2QRCh. 3 - Prob. 3QRCh. 3 - Prob. 4QR

Ch. 3 - What are an employers responsibilities for FICA...Ch. 3 - Prob. 6QRCh. 3 - Prob. 7QRCh. 3 - Prob. 8QRCh. 3 - Prob. 9QRCh. 3 - Prob. 10QRCh. 3 - Prob. 11QRCh. 3 - Prob. 12QRCh. 3 - Prob. 13QRCh. 3 - Prob. 14QRCh. 3 - Prob. 15QRCh. 3 - During the year, employee Sean Matthews earned...Ch. 3 - In order to improve the cash flow of the company,...Ch. 3 - Prob. 3QDCh. 3 - Prob. 4QDCh. 3 - The biweekly taxable wages for the employees of...Ch. 3 - During 2019, Rachael Parkins, president of...Ch. 3 - Prob. 3PACh. 3 - Ken Gorman is a maitre d at Carmel Dinner Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Audrey Martin and Beth James are partners in the...Ch. 3 - Prob. 7PACh. 3 - Ralph Henwood was paid a salary of 64,600 during...Ch. 3 - Empty Fields Company pays its salaried employees...Ch. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PACh. 3 - Prob. 12PACh. 3 - Prob. 13PACh. 3 - During the third calendar quarter of 20--, Bayview...Ch. 3 - Prob. 15PACh. 3 - Prob. 16PACh. 3 - Prob. 17PACh. 3 - Prob. 1PBCh. 3 - During 2019, Matti Conner, president of Maggert...Ch. 3 - Prob. 3PBCh. 3 - Moisa Evans is a maitre d at Red Rock Club. On...Ch. 3 - In 20-- the annual salaries paid each of the...Ch. 3 - Amanda Autry and Carley Wilson are partners in A ...Ch. 3 - Prob. 7PBCh. 3 - George Parker was paid a salary of 74,700 during...Ch. 3 - Prob. 9PBCh. 3 - The monthly and hourly wage schedule for the...Ch. 3 - Prob. 11PBCh. 3 - Prob. 12PBCh. 3 - Prob. 13PBCh. 3 - During the third calendar quarter of 20--, the...Ch. 3 - Prob. 15PBCh. 3 - Prob. 16PBCh. 3 - Prob. 17PBCh. 3 - Your assistant has just completed a rough draft of...Ch. 3 - Prob. 2CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financing Deficit Stevens Textile Corporation's 2019 financial statements are shown below: Just need the correct LOC? Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit 0 Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2019 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends (40%) $ 552 Addition to retained earnings $ 828 Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to…arrow_forwardWhen iuploading image then it get blurry Comment in comment section I will write data.arrow_forwardCorrect answer pleasearrow_forward

- In 2022, North Shore Community College had a total student body that was 5% more than in 2021, which was 5% more than in 2020. The enrollment in 2022 was 4,200. How many students attended the college in 2021? How many students attended the college in 2020?arrow_forwardWhen iam uploading it getting blurr comment i will write values. Don't answer with incorrect dataarrow_forwardSolve correctly if image is blurry comment..arrow_forward

- If data is not clear please commentarrow_forwardPlease don't use AI And give correct answer .arrow_forwardLouisa Pharmaceutical Company is a maker of drugs for high blood pressure and uses a process costing system. The following information pertains to the final department of Goodheart's blockbuster drug called Mintia. Beginning work-in-process (40% completed) 1,025 units Transferred-in 4,900 units Normal spoilage 445 units Abnormal spoilage 245 units Good units transferred out 4,500 units Ending work-in-process (1/3 completed) 735 units Conversion costs in beginning inventory $ 3,250 Current conversion costs $ 7,800 Louisa calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of Mintia that are spoiled are the result of defects not discovered before inspection of finished units. Materials are added at the beginning of the process. Using the weighted-average method, answer the following question: What are the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License