a.

To determine: The net operating working capital for 2018 and 2019.

Statement of Cash Flow: It is a part of financial statements that are included in the annual report of a company. It reports the cash generated or used by the business in a specified period.

Cash Flow from Operating Activities: The cash generated over and above required business operations is called and reported as cash flow from operating activities. Statement of cash flow reports the net cash flow generated or consumed by the business.

a.

Answer to Problem 14P

The net operating working capital for 2018 is $42,000 and 2019 is $50,220.

Explanation of Solution

Determine the net operating working capital for 2018:

Therefore the net operating working capital for 2018 is $42,000.

Determine the net operating working capital for 2019:

Therefore the net operating working capital for 2019 is $50,220.

b.

To determine: The

b.

Answer to Problem 14P

The free cash flow in 2019 for Company A is $22,780.

Explanation of Solution

Determine the free cash flow in 2019 for Company A:

Therefore, the free cash flow in 2019 for Company A is $22,780.

c.

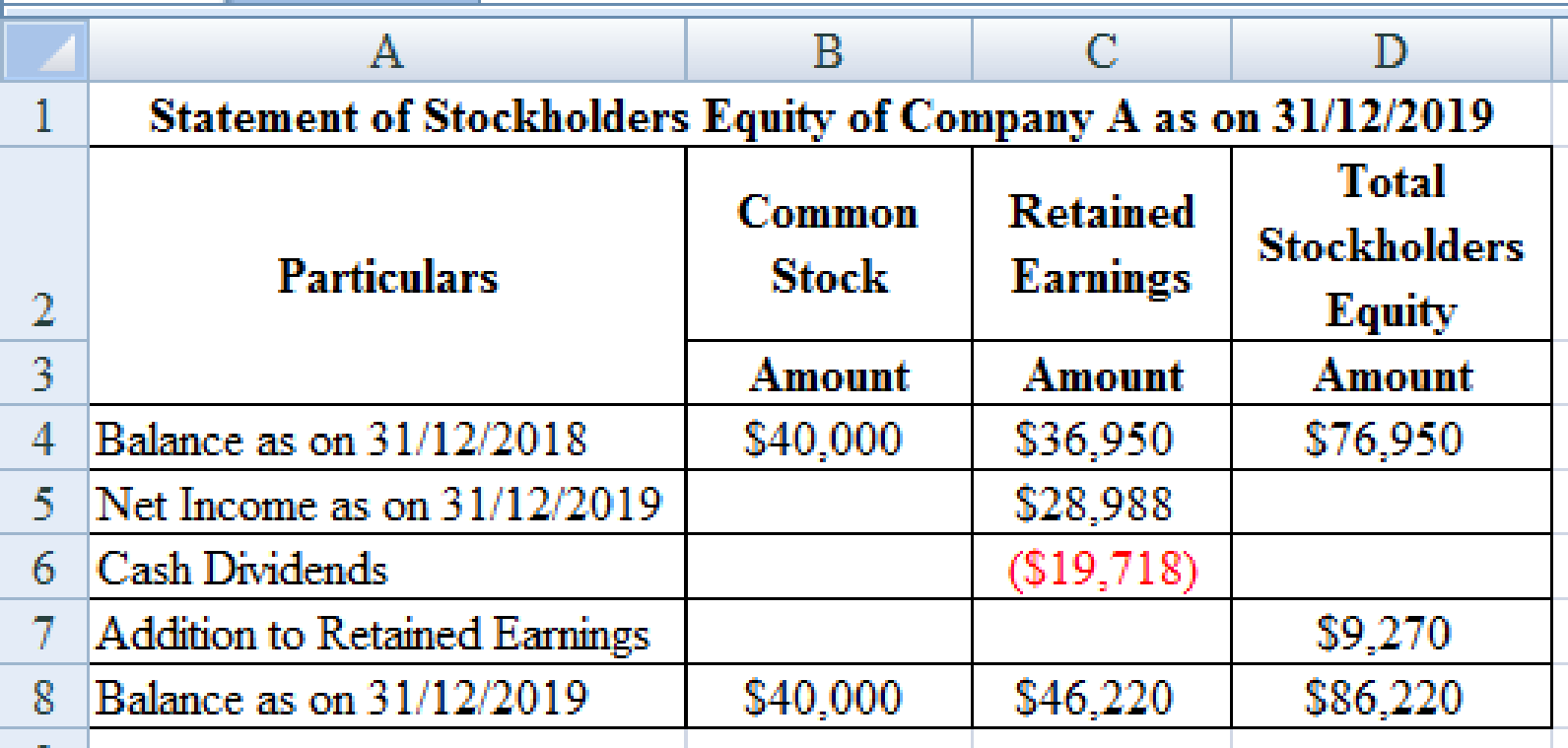

To determine: The statement of

c.

Explanation of Solution

The statement of stockholders equity for Company as on 2019 is as follows:

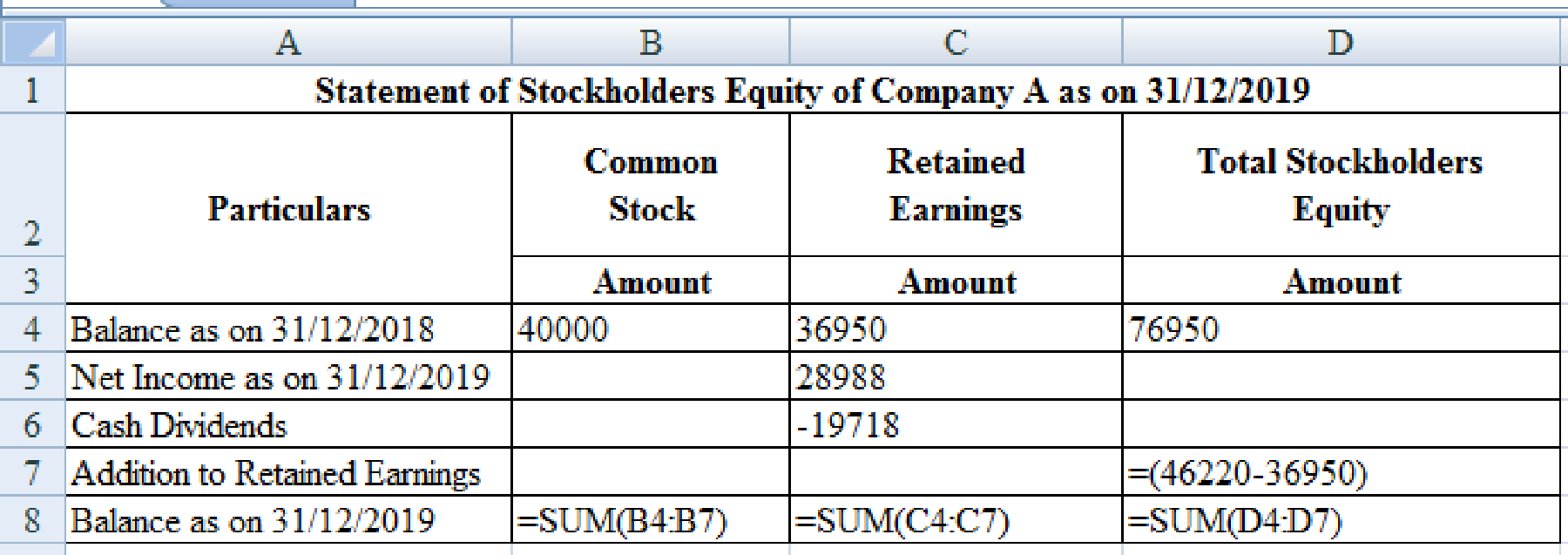

Excel Spreadsheet:

Excel Spreadsheet Workings:

d.

To determine: The EVA of Company A for 2019.

d.

Answer to Problem 14P

The EVA of Company A for 2019 is $21,678.

Explanation of Solution

Determine the EVA of Company A for 2019:

Therefore, the EVA of Company A for 2019 is $21,678.

e.

To determine: The MVA of Company A for 2019.

e.

Answer to Problem 14P

The MVA of Company A for 2019 is $13,780.

Explanation of Solution

Determine the MVA of Company A for 2019:

Therefore, the MVA of Company A for 2019 is $13,780.

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- finance subjectarrow_forwardCould you help explain, what is the complete salary survey analysis, and ensuring the data is relevant and up-to-date? What is the job evaluation and compensation plan? How to ensure the final report is comprehensive, clearly structured, and aligned with the company vision?arrow_forwardThe maturity value of an $35,000 non-interest-bearing, simple discount 4%, 120-day note is:arrow_forward

- Carl Sonntag wanted to compare what proceeds he would receive with a simple interest note versus a simple discount note. Both had the same terms: $18,905 at 10% for 4 years. Use ordinary interest as needed. Calculate the simple interest note proceeds. Calculate the simple discount note proceeds.arrow_forwardWhat you're solving for Solving for maturity value, discount period, bank discount, and proceeds of a note. What's given in the problem Face value: $55300 Rate of interest: 10% Length of note: 95 days Date of note: August 23rd Date note discounted: September 18th Bank discount rate:9 percentarrow_forwardAll tutor giving incorrect solnarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning