FINANCIAL MANAGEMENT(LL)-TEXT

16th Edition

ISBN: 9781337902618

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 14P

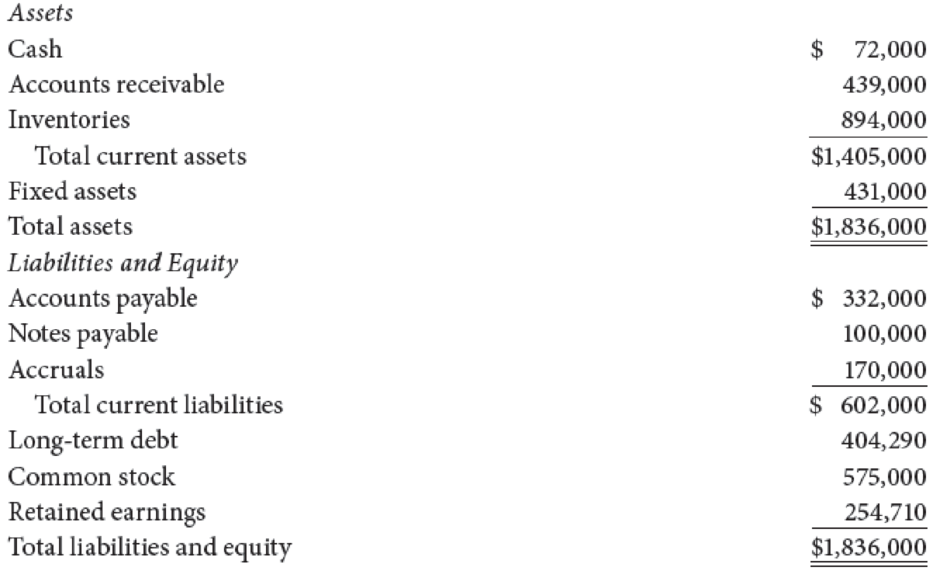

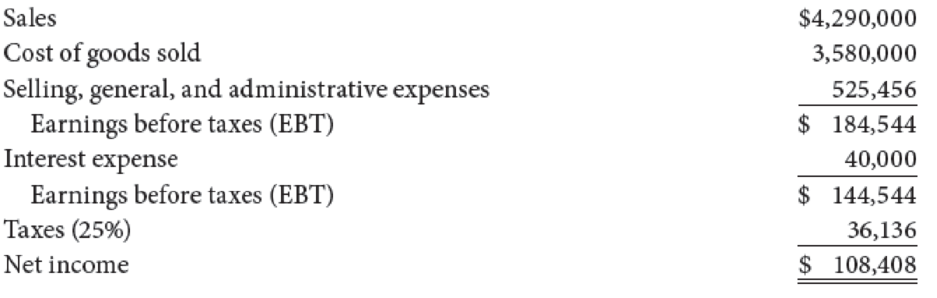

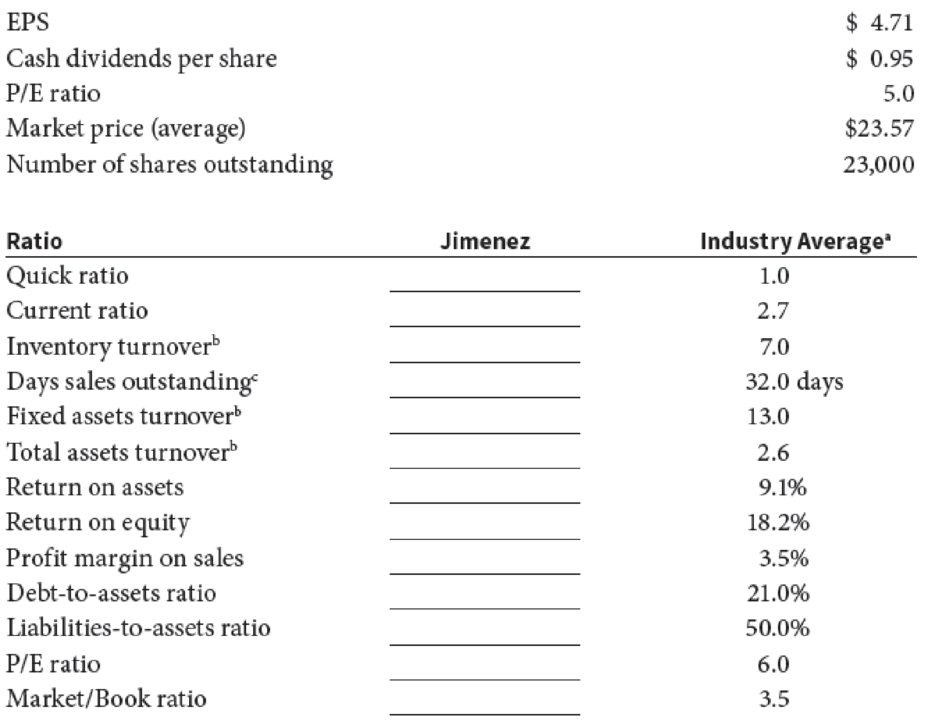

The Jimenez Corporation’s

Jimenez Corporation: Forecasted

Jimenez Corporation:

Jimenez Corporation: Per Share Data for 2020

Notes:

aIndustry average ratios have been stable for the past 4 years.

bBased on year-end balance sheet figures.

cCalculation is based on a 365-day year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Evaluate Aritzia’s profitability for 2022 compared with 2021. In your analysis, compute the following ratios and then comment on what those ratios indicate.

1. Return on sales

2. Asset turnover

3. Return on assets

4. Leverage ratio

5. Return on equity

6. Gross profit percentage

7. Earnings per share (show computation)

8. Book value per shareOperational and Financial Summary

A company has the following items for the fiscal year 2020:

Total Equity = 15 million

Total Assets = 30 million

EBIT = 4 million

Interest expense = 1 million

Calculate the company’s equity multiplier and interest coverage ratio

Write the formula for the following ratios and what each ratio measures:

Asset turnover

Inventory Turnover and Days Inventory

Receivable Collection Period

Write down the DuPont framework. How would you explain to your non-MBA non-Finance friend about the DuPont framework and why it is important?

A company has the following items for the fiscal year 2020:

Revenue = 10 million

EBIT = 4 million

Net income = 2 million

Total Equity = 15 million

Total Assets = 30 million

Calculate the company’s net profit margin, asset turnover, equity multiplier and ROE

Explain cash conversion cycle and why it is important to companies?

Is it possible that a company has a negative cash cycle? Is it a good thing or a bad thing?

A company has days of inventory 80…

Calculate the projected price/earnings ratio and market/book ratio. Explain whether these ratios indicate that investors will be expected to have a high or low opinion of the company.

Computron's Balance Sheets (Millions of Dollars)

2019

2020

Assets

Cash and equivalents

$ 60

$ 50

Short-term investments

100

10

Accounts receivable

400

520

Inventories

620

820

Total current assets

$ 1,180

$ 1,400

Gross fixed assets

$ 3,900

$ 4,820

Less: Accumulated depreciation

1,000

1,320

Net fixed assets

$ 2,900

$ 3,500

Total assets

$ 4,080

$ 4,900

Liabilities and equity

Accounts payable

$ 300

$ 400

Notes payable

50

250

Accruals

200

240

Total current liabilities

$ 550

$ 890

Long-term bonds

800

1,100

Total liabilities

$ 1,350

$ 1,990

Common stock

1,000

1,000

Retained earnings

1,730

1,910

Total equity

$ 2,730

$ 2,910

Total liabilities and equity

$ 4,080

$ 4,900…

Chapter 3 Solutions

FINANCIAL MANAGEMENT(LL)-TEXT

Ch. 3 - Define each of the following terms:

Liquidity...Ch. 3 - Financial ratio analysis is conducted by managers,...Ch. 3 - Over the past year, M. D. Ryngaert Co. has...Ch. 3 - Profit margins and turnover ratios vary from one...Ch. 3 - How might (a) seasonal factors and (b) different...Ch. 3 - Why is it sometimes misleading to compare a...Ch. 3 - Greene Sisters has a DSO of 20 days. The company’s...Ch. 3 - Vigo Vacations has $200 million in total assets,...Ch. 3 - Winston Watchs stock price is 75 per share....Ch. 3 - Reno Revolvers has an EPS of $1.50, a free cash...

Ch. 3 - Needham Pharmaceuticals has a profit margin of 3%...Ch. 3 - Gardial Son has an ROA of 12%, a 5% profit...Ch. 3 - Ace Industries has current assets equal to 3...Ch. 3 - Assume you are given the following relationships...Ch. 3 - Prob. 9PCh. 3 - The Morrit Corporation has $600,000 of debt...Ch. 3 - Complete the balance sheet and sales information...Ch. 3 - The Kretovich Company had a quick ratio of 1.4, a...Ch. 3 - Data for Lozano Chip Company and its industry...Ch. 3 - The Jimenez Corporation’s forecasted 2020...Ch. 3 - Why are ratios useful? What three groups use ratio...Ch. 3 - Calculate the projected profit margin, operating...Ch. 3 - Calculate the projected inventory turnover, days...Ch. 3 - Prob. 4MCCh. 3 - Calculate the projected debt ratio, debt-to-equity...Ch. 3 - Calculate the projected price/earnings ratio and...Ch. 3 - Prob. 7MCCh. 3 - Use the extended DuPont equation to provide a...Ch. 3 - What are some potential problems and limitations...Ch. 3 - What are some qualitative factors that analysts...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ratio Analysis Consider the following information taken from the stockholders equity section: How do you interpret the companys payout and profitability performance? Required: 1. Calculate the following for 2020. (Note. Round answers to two decimal places.) 2. CONCEPTUAL CONNECTION Assume 2019 ratios were: and the current year industry averages are: How do you interpret the companys payout and profitability performance?arrow_forwardFor the companies Lockheed-Martin (LMT) & Northrop-Grumman (NOC) Use Macrotrends data to calculate Return on Sales, Return on Assets, Debt Ratio, Inventory Turnover, Lead Time for each company Use Fintel to determine EPS forecasts for 2024-2027 for each company, and use those to calculate an average earnings growth rate for each - https://fintel.io/sfo/us/Imt https://fintel.io/sfo/us/noc Assuming MARR = WACC + 3%, calculate a fair market price for the stock of each company, assuming that earnings grow at the calculated rate for the next 50 years, with the following WACC LMT: NOC: 8.00% 8.25% Find the current stock price for each company Based on the above calculations, which company's stock would you buy, and provide your reasoning (If neither or both, explain reasoning)arrow_forwardCalculate the 2019 debt ratio, liabilities-to-assets ratio, times-interest-earned ratio, and EBITDA coverage ratios. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios?arrow_forward

- Debt Management Ratios Glow Corporation provides annual and quarterly financial data to the public. For the years of 2018 and 2019. Glows financial data included the following account balances: Required: Determine whether the debt to equity ratio is increasing or decreasing and whether Glow should be concerned.arrow_forwardData for Lozano Chip Company and its industry averages follow. Calculate the indicated ratios for Lozano. Construct the extended DuPont equation for both Lozano and the industry. Outline Lozano’s strengths and weaknesses as revealed by your analysis. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars)arrow_forwardEstimating Share Value Using the DCF Model Following are forecasts of Target Corporation's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2, 2019, which we label fiscal year 2018. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Reported Forecast Horizon Period $ millions 2018 Terminal 2019 2020 2021 2022 $79,124 $83,830 $87,234 $92,346 Period $93,428 4,767 Sales $76,106 NOPAT 3,269 NOA 23,770 4,152 3,572 4,501 3,939 24,197 26,157 26,677 28,761 28,571 Answer the following requirements with the following assumptions: Assumptions Terminal period growth rate 2% Discount rate (WACC) 7.63% Common shares outstanding 517.80 million Net nonoperating obligations (NNO) $12,473 million Estimate the value of a share of Target common stock using the discounted cash flow (DCF) model as of February 2, 2019. ($ millions) Increase in NOA…arrow_forward

- hello, I need help pleasearrow_forwardPlease use the attached images as well... Compute the following: 4. For fiscal 2020: Free Cash Flow to Equity 5. Market Capitalization, Market to Book Value and the Price-Earnings Ratio as of year-end 2020 Stock Prices in 2018 = $68.98 2019 = $84.15 2020 = $107.82arrow_forwardCalculate the following leverage ratios for 2020. Debt ratio- Debt-to-equity- Times interest earned ratio-arrow_forward

- Some parts of the balance sheet and income statement of PaintsWorld Enterprises is given below. You know that the effective tax rate is 23.0% and the interest rate the company pays on its long-term debt is 11.0%. You also know that the outstanding debt has been constant over the past few years. 1.Find the leverage ratio in 2022: 2. Find the asset turnover for 2022:arrow_forwardEstimating Share Value Using the DCF Model Following are forecasts of Target Corporation's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2, 2019, which we label fiscal year 2018. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Reported Forecast Horizon Period Terminal $ millions 2018 2019 Sales $75,356 NOPAT 3,269 NOA 23,020 2020 2021 Period $79,124 $83,080 $87,234 $91,596 $93,428 3,402 3,572 3,751 3,939 4,017 24,197 25,407 26,677 28,011 28,571 2022 Answer the following requirements with the following assumptions: Assumptions Terminal period growth rate 296 Discount rate (WACC) 7.63% Common shares outstanding 517.80 million Net nonoperating obligations (NNO) $11,723 million Estimate the value of a share of Target common stock using the discounted cash flow (DCF) model as of February 2, 2019. ($ millions) Increase in NOA…arrow_forwardhello, I need help pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License