Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 13P

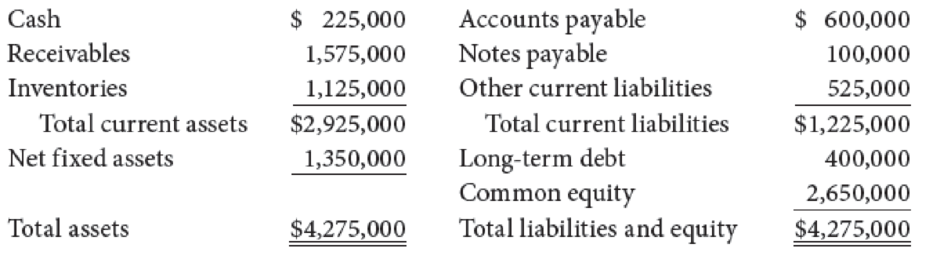

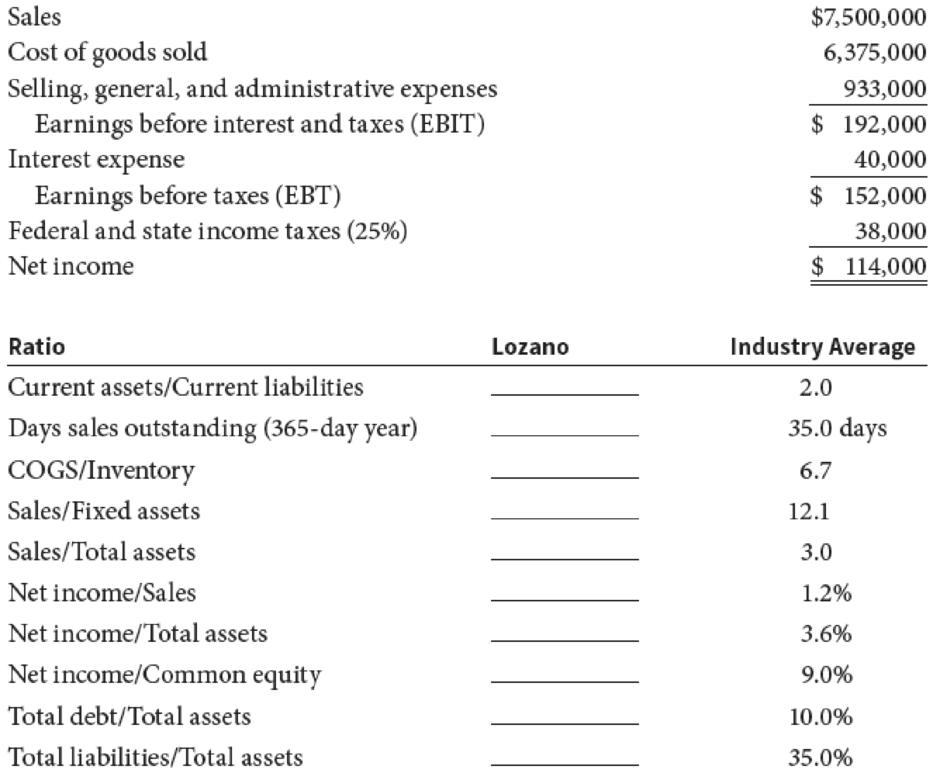

Data for Lozano Chip Company and its industry averages follow.

- a. Calculate the indicated ratios for Lozano.

- b. Construct the extended DuPont equation for both Lozano and the industry.

- c. Outline Lozano’s strengths and weaknesses as revealed by your analysis.

Lozano Chip Company:

Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

You plan to save $X per year for 6 years, with your first savings contribution in 1 year. You and your heirs then plan to withdraw

$43,246 per year forever, with your first withdrawal expected in 7 years. What is X if the expected return per year is 18.15 percent per

year?

Input instructions: Round your answer to the nearest dollar.

59

$

Are there assets for which a value might be considered to be hard to determine?

You plan to save $X per year for 7 years, with your first savings contribution in 1 year. You and your heirs then plan to make annual

withdrawals forever, with your first withdrawal expected in 8 years. The first withdrawal is expected to be $43,596 and all subsequent

withdrawals are expected to increase annually by 1.84 percent forever. What is X if the expected return per year is 11.34 percent per

year?

Input instructions: Round your answer to the nearest dollar.

$

Chapter 3 Solutions

Financial Management: Theory & Practice

Ch. 3 - Define each of the following terms:

Liquidity...Ch. 3 - Financial ratio analysis is conducted by managers,...Ch. 3 - Over the past year, M. D. Ryngaert Co. has...Ch. 3 - Profit margins and turnover ratios vary from one...Ch. 3 - How might (a) seasonal factors and (b) different...Ch. 3 - Why is it sometimes misleading to compare a...Ch. 3 - Greene Sisters has a DSO of 20 days. The company’s...Ch. 3 - Vigo Vacations has $200 million in total assets,...Ch. 3 - Winston Watchs stock price is 75 per share....Ch. 3 - Reno Revolvers has an EPS of $1.50, a free cash...

Ch. 3 - Needham Pharmaceuticals has a profit margin of 3%...Ch. 3 - Gardial Son has an ROA of 12%, a 5% profit...Ch. 3 - Ace Industries has current assets equal to 3...Ch. 3 - Assume you are given the following relationships...Ch. 3 - Prob. 9PCh. 3 - The Morrit Corporation has $600,000 of debt...Ch. 3 - Complete the balance sheet and sales information...Ch. 3 - The Kretovich Company had a quick ratio of 1.4, a...Ch. 3 - Data for Lozano Chip Company and its industry...Ch. 3 - The Jimenez Corporation’s forecasted 2020...Ch. 3 - Why are ratios useful? What three groups use ratio...Ch. 3 - Calculate the projected profit margin, operating...Ch. 3 - Calculate the projected inventory turnover, days...Ch. 3 - Prob. 4MCCh. 3 - Calculate the projected debt ratio, debt-to-equity...Ch. 3 - Calculate the projected price/earnings ratio and...Ch. 3 - Prob. 7MCCh. 3 - Use the extended DuPont equation to provide a...Ch. 3 - What are some potential problems and limitations...Ch. 3 - What are some qualitative factors that analysts...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to save $41,274 per year for 4 years, with your first savings contribution later today. You then plan to make X withdrawals of $41,502 per year, with your first withdrawal expected in 4 years. What is X if the expected return per year is 8.28 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to save $X per year for 10 years, with your first savings contribution in 1 year. You then plan to withdraw $58,052 per year for 9 years, with your first withdrawal expected in 10 years. What is X if the expected return is 7.41 percent per year? Input instructions: Round your answer to the nearest dollar. 69 $arrow_forwardYou plan to save $X per year for 7 years, with your first savings contribution later today. You then plan to withdraw $30,818 per year for 5 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 6.64 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forward

- You plan to save $24,629 per year for 8 years, with your first savings contribution in 1 year. You then plan to withdraw $X per year for 7 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 5.70 percent per year? Input instructions: Round your answer to the nearest dollar. $ SAarrow_forwardYou plan to save $15,268 per year for 7 years, with your first savings contribution later today. You then plan to withdraw $X per year for 9 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 10.66 percent per year? Input instructions: Round your answer to the nearest dollar. GA $arrow_forwardYou plan to save $19,051 per year for 5 years, with your first savings contribution in 1 year. You then plan to make X withdrawals of $30,608 per year, with your first withdrawal expected in 5 years. What is X if the expected return per year is 14.61 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- What is the value of a building that is expected to generate no cash flows for several years and then generate annual cash flows forever if the first cash flow is expected in 10 years, the first cash flow is expected to be $49,900, all subsequent cash flows are expected to be 3.42 percent higher than the previous cash flow, and the cost of capital is 15.90 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou plan to save $X per year for 8 years, with your first savings contribution later today. You and your heirs then plan to make annual withdrawals forever, with your first withdrawal expected in 9 years. The first withdrawal is expected to be $29,401 and all subsequent withdrawals are expected to increase annually by 3.08 percent forever. What is X if the expected return per year is 9.08 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou own investment A and 10 bonds of bond B. The total value of your holdings is $12,185.28. Bond B has a coupon rate of 18.82 percent, par value of $1000, YTM of 15.36 percent, 7 years until maturity, and semi-annual coupons with the next coupon expected in 6 months. Investment A is expected to pay $X per year for 12 years, has an expected return of 19.64 percent, and is expected to make its first payment later today. What is X? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forward

- You plan to save $X per year for 8 years, with your first savings contribution later today. You then plan to withdraw $43,128 per year for 6 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 13.14 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou plan to save $X per year for 6 years, with your first savings contribution in 1 year. You then plan to withdraw $20,975 per year for 8 years, with your first withdrawal expected in 7 years. What is X if the expected return is 13.29 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou plan to save $X per year for 7 years, with your first savings contribution later today. You and your heirs then plan to withdraw $31,430 per year forever, with your first withdrawal expected in 8 years. What is X if the expected return per year is 14.95 percent per year per year? Input instructions: Round your answer to the nearest dollar. 6A $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License