Concept explainers

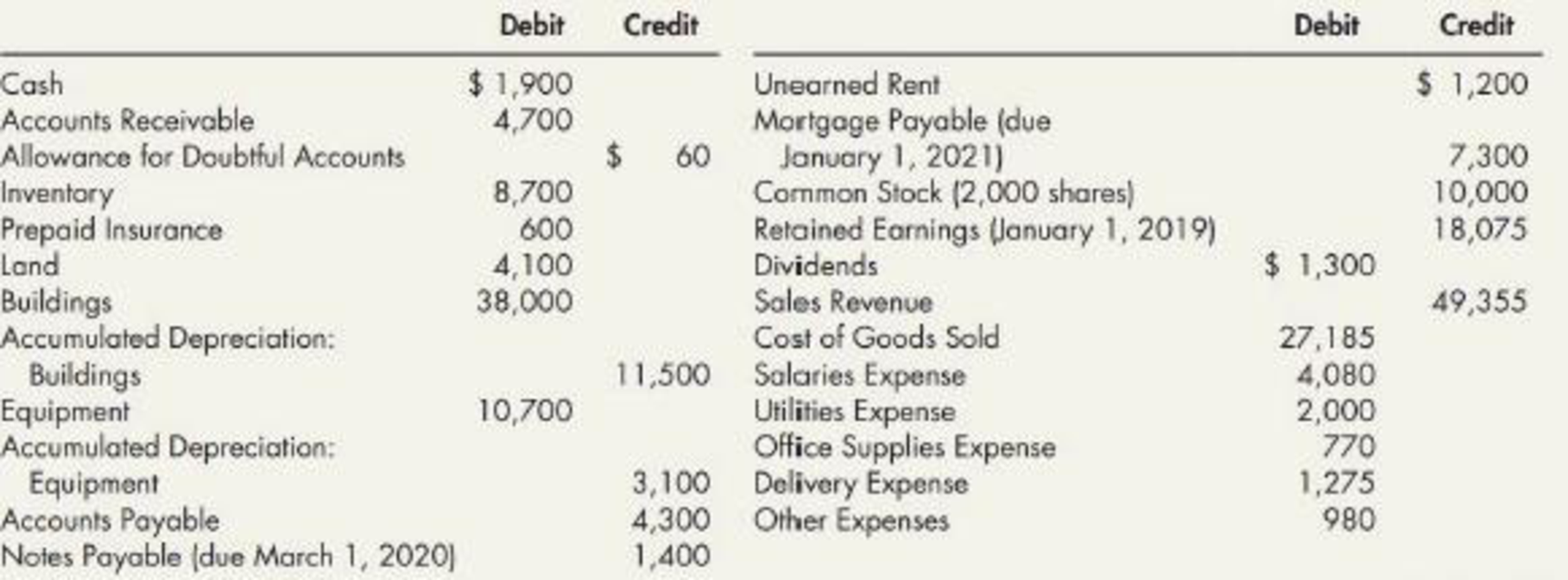

Worksheet Victoria Company has the following account balances on December 31, 2019, prior to any adjustments:

Additional adjustment information: (a)

Required:

- 1. Transfer the account balances to a 10-column worksheet and prepare a

trial balance . - 2. Prepare the

adjusting entries in the general journal and complete the worksheet. - 3. Prepare the company’s income statement,

retained earnings statement, andbalance sheet . - 4. Prepare closing entries in the general journal.

1 and 2

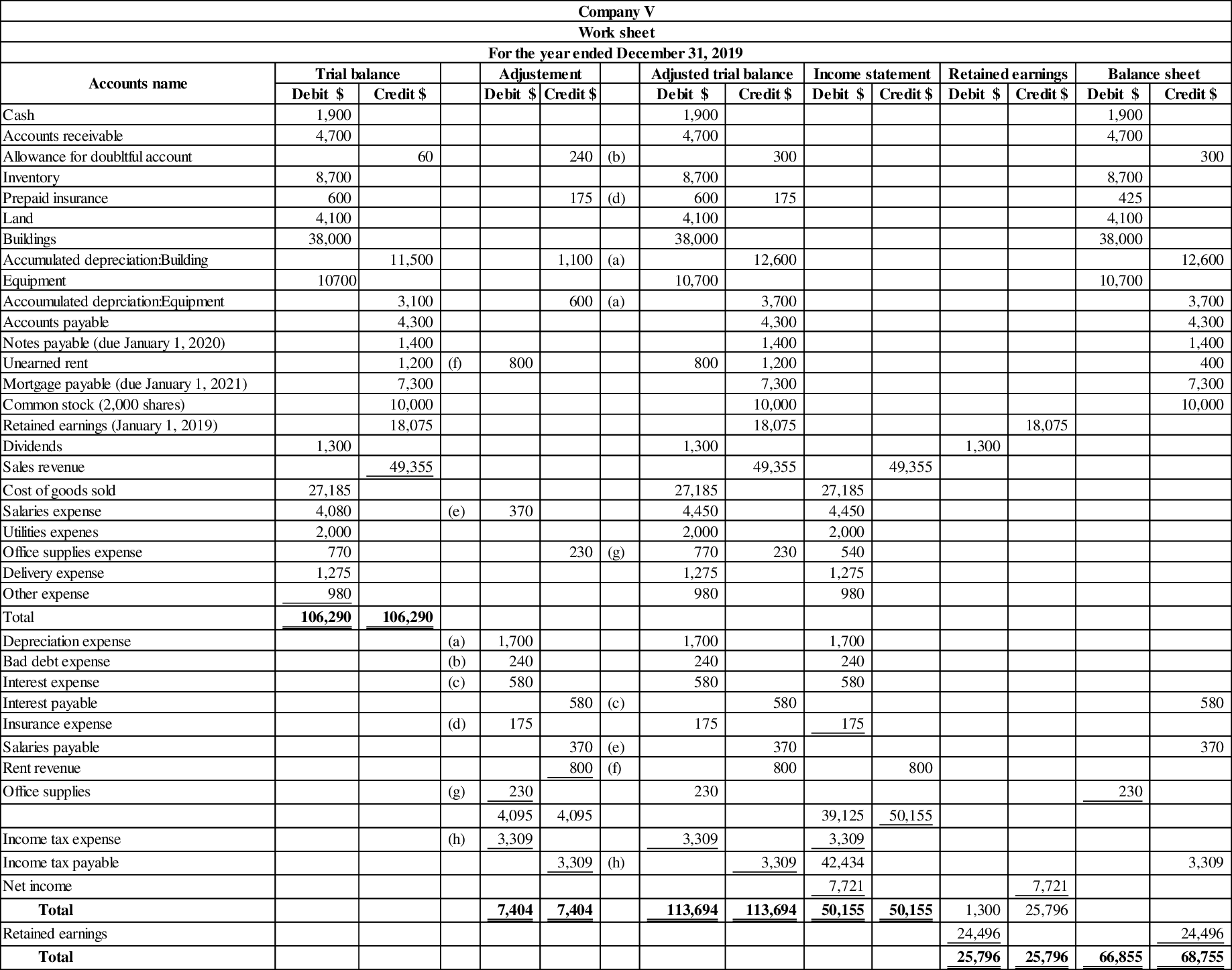

Prepare a 10 column worksheet for the given account balances, and prepare the adjusting entries of Company V.

Explanation of Solution

Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the ledger postings and helps preparing the final accounts.

Worksheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare 10 column worksheet for the given account balances, and trial balance as follows:

Figure (1)

Adjusting entry:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| December 31, 2019 | Depreciation expense | 1,700 | |

| Accumulated depreciation - Buildings | 1,100 | ||

| Accumulated depreciation - Equipment | 600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| December 31, 2019 | Bad debts expense | 240 | |

| Allowance for doubtful accounts | 240 | ||

| (To record the bad debts expense estimated at the end of the accounting year) | |||

| December 31, 2019 | Interest expense | 580 | |

| Interest payable | 580 | ||

| (To record the interest expense incurred at the end of the accounting year) | |||

| December 31, 2019 | Insurance expense | 175 | |

| Prepaid insurance | 175 | ||

| (To record the insurance expense incurred at the end of the accounting year) | |||

| December 31, 2019 | Salaries expense | 370 | |

| Salaries payable | 370 | ||

| (To record the salaries expense accrued at the end of the accounting year) | |||

| December 31, 2019 | Unearned rent | 800 | |

| Rent revenue | 800 | ||

| (To record the rent revenue recognized) | |||

| December 31, 2019 | Office supplies expense | 230 | |

| Office supplies | 230 | ||

| (To record the supplies used during the year) | |||

| December 31, 2019 | Income tax expense (1) | 3,309 | |

| Income tax payable | 3,309 | ||

| (To record the income tax expense incurred at the end of the accounting year) |

Table (1)

Working note (1):

Calculate the value of income tax expense.

3.

Prepare income statement, retained earnings, and balance sheet of Company V.

Explanation of Solution

Financial statements: Financial statements are condensed summary of transactions communicated in the form of reports for the purpose of decision making. The financial statements are balance sheet, income statement, statement of retained earnings, and the cash flow statement.

Prepare income statement, retained earnings, and balance sheet of Company V as follows:

| Company V | ||

| Income statement | ||

| For the year ended December 31, 2019 | ||

| Particulars | Amount($) | Amount ($) |

| Service revenue | 49,355 | |

| Less: Cost of goods sold | (27,185) | |

| Gross profit | 22,170 | |

| Less: Operating expense | ||

| Salaries expense | 4,450 | |

| Utilities expense | 2,000 | |

| Office supplies expense | 540 | |

| Delivery expense | 1,275 | |

| Depreciation expense | 1,700 | |

| Bad debt expense | 240 | |

| Insurance expense | 175 | |

| Other expense | 980 | |

| Total operating expense | 11,360 | |

| Income from operations | 10,810 | |

| Other items: | ||

| Rent revenue | 800 | |

| Interest expense | (580) | 220 |

| Income before income taxes | 11,030 | |

| Income tax expense | (3,309) | |

| Net income (A) | 14,339 | |

| Number of shares (B) | 2,000 shares | |

| Earnings per share | $3.86 | |

Table (2)

| Company V | |

| Statement of retained earnings | |

| For the year end December 31, 2019 | |

| Particulars | Amount ($) |

| Retained earnings on January 1, 2019 | 18,075 |

| Add: Net income | 7,721 |

| 25,796 | |

| Less: Dividend for 2019 | (1,300) |

| Retained earnings on December 31, 2019 | 24,496 |

Table (3)

| Company V | ||

| Balance sheet | ||

| As at December 31, 2019 | ||

| Assets | Amount ($) | Amount ($) |

| Current assets: | ||

| Cash | 1,900 | |

| Accounts receivable | 4,700 | |

| Less: Allowance for doubtful accounts | (300) | 4,400 |

| Inventory | 8,700 | |

| Prepaid insurance | 425 | |

| Office supplies | 230 | |

| Total current assets (C) | 15,655 | |

| Property, plant and equipment: | ||

| Land | 4,100 | |

| Buildings | 38,000 | |

| Less: Accumulated depreciation | (12,600) | 25,400 |

| Equipment | 10,700 | |

| Less: Accumulated depreciation | (3,700) | 7,000 |

| Total property, plant and equipment (D) | 36,500 | |

| Total assets | 52,155 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | 4,300 | |

| Notes payable | 1,400 | |

| Interest payable | 580 | |

| Salaries payable | 370 | |

| Unearned rent | 400 | |

| Income tax payable | 3,309 | |

| Total current liabilities | 10,359 | |

| Long-term liabilities: | ||

| Mortgage payable | 7,300 | |

| Total liabilities | 17,659 | |

| Shareholders' equity | ||

| Contributed capital: | ||

| Common stock | 10,000 | |

| Retained earnings | 24,496 | 34,496 |

| Total shareholder's equity | 52,155 | |

Table (4)

4.

Prepare closing entries of Company V for the current year.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries of Company V for the current year as follows:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| December 31, 2019 | Sales revenue | 49,355 | |

| Rent revenue | 800 | ||

| Income summary | 50,155 | ||

| (To close the sales revenue and rent revenue account) | |||

| December 31, 2019 | Income summary | 42,434 | |

| Cost of goods sold | 27,185 | ||

| Salaries expense | 4,450 | ||

| Utilities expense | 2,000 | ||

| Office supplies expense | 540 | ||

| Delivery expense | 1,275 | ||

| Other expense | 980 | ||

| Depreciation expense | 1,700 | ||

| Bad debt expense | 240 | ||

| Interest expense | 580 | ||

| Insurance expense | 175 | ||

| Income tax expense | 3,309 | ||

| (To close all expenses account) | |||

| December 31, 2019 | Income summary | 7,721 | |

| Retained earnings (2) | 7,721 | ||

| (To close the income summary account) | |||

| December 31, 2019 | Retained Earnings | 1,300 | |

| Dividends | 1,300 | ||

| (To close the dividends account.) |

Table (5)

Closing entry for revenue account:

In this closing entry, the sales revenue and rent revenue account is closed by transferring the amount of revenue to the income summary account in order to bring the revenue accounts balance to zero. Hence, debit all revenue account for $50,155, and credit the income summary account for $50,155.

Closing entry for expenses account:

In this closing entry, cost of goods sold, operating expense, and income tax expense are closed by transferring the amount of all expenses to the income summary account in order to bring all the expense accounts balance to zero. Hence, debit the income summary account for $42,434, and credit all the expenses account for $42,434.

Closing entry for income summary account:

In this closing entry, the income summary account is closed by transferring the amount of net income to the retained earnings account in order to bring the income summary balance to zero. Hence, debit the income summary account for $7,721, and credit the retained earnings for $7,721.

Closing entry for dividends account:

The dividends are paid to the shareholders out of the retained earnings. Thus, retained earnings are debited since the earnings are decreased on payment of dividend. Dividends are a component of shareholders’ equity account. It is credited because dividends are transferred to retained earnings account.

Working note (2):

Calculate the value of retained earnings.

Want to see more full solutions like this?

Chapter 3 Solutions

Intermediate Accounting: Reporting And Analysis

- Given the following information how much raw material was transferred to work in progress on January 31? Inventory on January 1 is $350,000, raw materials purchased in January are $860,000, and raw materials inventory on January 31 is $240,000. A: $880,000 B: $970,000 C: $650,000 D: $780,000arrow_forwardOn October 1, 2022, Vyom Industries purchased a machine for $180,000. The estimated service life is 8 years with a $20,000 residual value. Vyom records partial-year depreciation based on the number of months in service. Depreciation for 2022, using the double-declining-balance method, would be _. Solve thisarrow_forwardcesi Required information [The following information applies to the questions displayed below] On July 23 of the current year, Dakota Mining Company pays $8,595,840 for land estimated to contain 9,768,000 tons of recoverable ore. It installs and pays for machinery costing $1,074,480 on July 25. The company removes and sells 502,500 tons of ore during its first five months of operations ending on December 31. Depreciation of the machinery is in proportion to the mine's depletion as the machinery will be abandoned after the ore is mined. Required: Prepare entries to record the following. (a) The purchase of the land. (b) The cost and installation of machinery. (c) The first five months' depletion assuming the land has a net salvage value of zero after the ore is mined. (d) The first five months' depreciation on the machinery. Complete this question by entering your answers in the tabs below. Required A Required B Required C1 Required C2 Required D1 Required D2arrow_forward

- During October, the first month of the fiscal year, sales totaled $750,000, and the cost of merchandise available for sale totaled $680,000. Estimate the cost of the merchandise inventory as of October 31, based on an estimated gross profit rate of 35%. Answerarrow_forwardgeneral accountingarrow_forwardcan you please solve thisarrow_forward

- How much should be recorded on December 31 for the gain or loss?arrow_forwardWhat is the gross income for the year?arrow_forwardAt the beginning of the recent period there were 1,080 units of product in a department, one-third completed. These units were finished and an additional 5,620 units were started and completed during the period. 960 units were still in process at the end of the period. One-fourth completed. Using the weighted-average valuation method the equivalent units produced by the department were____Units.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College