Concept explainers

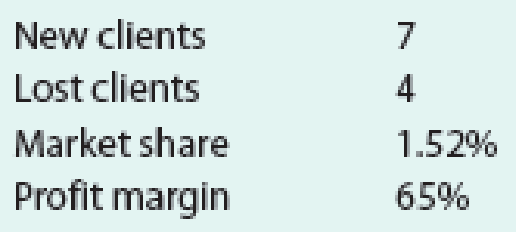

Blake & McKenzie Tax Services is a company serving 72 clients (as of the beginning of last month) that is working on reorganizing its balanced scorecard. Currently, the company has the following performance metrics: online client satisfaction rating, client growth percentage (the number of total clients at the beginning of the current month compared to the number of total clients at the beginning of the prior month), market share, and profit margin. The company tracks these metrics from month to month. The company’s target client growth percentage is 4% per month. Its target average online client satisfaction rating is 4.8 stars. Last month, the company noted the following data related to these metrics:

- a. Working together in teams, create strategic objectives that each of the company’s four performance metrics might represent.

- b. Determine whether the company achieved its client growth percentage target last month.

- c. Suppose that last month, the company received 55 five-star reviews, 10 four-star reviews, 3 three-star reviews, 1 two-star review, and 1 one-star review (some clients did not submit a review). Determine whether the company met its average online client satisfaction rating target.

- d. Come up with at least one strategic initiative for the strategic objective of any performance metric target that you know the company did not meet last month.

Trending nowThis is a popular solution!

Chapter 28 Solutions

Financial and Managerial Accounting - Workingpapers

- What is cat enterprises net loss for the year?arrow_forwardNeed answerarrow_forwardRetirement Portfolio Mutual Fund Type Net Asset Value Shares Total Value Fidelity Capital Appreciation Large Cap $25.14 1225 $30,796.50 Fidelity Contrafund Large Cap $55.32 1500 $82,980.00 Fidelity Equity Income Large Cap $51.00 1400 $71,400.00 Fidelity Export & Multinational Large Cap $19.11 600 $11,466.00 Fidelity Strategic Large Cap Value Large Cap $12.68 1800 $22,824.00 Fidelity Mid Cap Stock Mid Cap $22.38 600 $13,428.00 Fidelity Value Mid Cap $69.92 850 $59,432.00 Fidelity Small Cap Independence Small Cap $19.02 1000 $19,020.00 Fidelity Low Priced Stock Small Cap $39.54 400 $15,816.00 Fidelity Puritan Blended $19.87 1500 $29,805.00 Fidelity Fidelity Fund Blended $30.44 675 $20,547.00 Fidelity Mortgage Securities Bond $11.23 700 $7,861.00 Fidelity Strategic Income Bond $10.59 400 $4,236.00 ######### construct an appropriate chart to show the relative value of funds in each indvestment category in the excel filearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning