Heavenly Dessert processes cocoa beans into cocoa powder at a

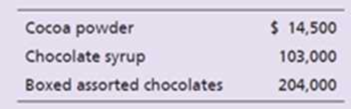

The cost of transforming the cocoa powder into chocolate syrup would be $72,000. Likewise, the company would incur a cost of $183,000 to transform the cocoa powder into boxed assorted chocolates. The company president has decided to make boxed assorted chocolates due to their high sales value and to the fact that the cocoa bean processing cost of $9,700 eats up most of the cocoa powder profits.

Has the president made the right or wrong decision? Explain your answer. Be sure to include the correct financial analysis in your response.

Want to see the full answer?

Check out a sample textbook solution

Chapter 25 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College