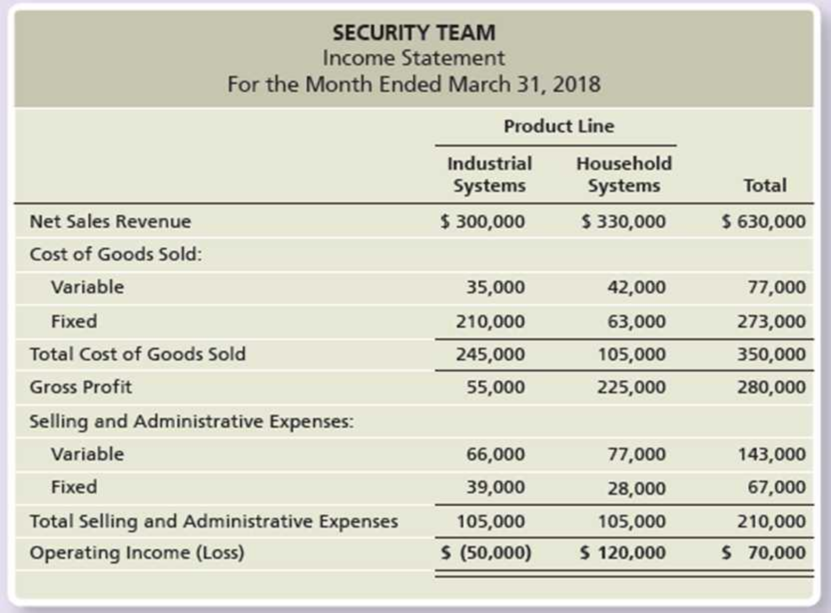

Members of the board of directors of Security Team have received the following operating income data for the year ended March 31, 2018:

Members of the board are surprised that the industrial systems product line is losing money. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $81,000 and decrease fixed selling and administrative expenses by $15,000.

Requirements

- 1. Prepare a differential analysis to show whether Security Team should drop the industrial systems product line.

- 2. Prepare contribution margin income statements to show Security Team’s total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives’ income numbers to your answer to Requirement 1.

- 3. What have you learned from this comparison in Requirement 2?

Want to see the full answer?

Check out a sample textbook solution

Chapter 25 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Marketing: An Introduction (13th Edition)

Principles of Microeconomics (MindTap Course List)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Amherst City provides a defined benefit pension plan for employees of the city electric utility, an enterprise fund. Assume that the projected level of earnings on plan investments is $199,000, the service cost component is $257,500, and interest on the pension liability is $164,500 for the year. The City is amortizing a deferred outflow resulting from a change in plan assumptions from a prior year in the amount of $7,650 per year. Requried: Prepare journal entries to record annual pension expenses for the enterprise fund.arrow_forwardGeneral accountingarrow_forwardAmherst City provides a defined benefit pension plan for employees of the city electric utility, an enterprise fund. Assume that the projected level of earnings on plan investments is $165,000, the service cost component is $260,000, and interest on the pension liability is $99,000 for the year. The City is amortizing a deferred outflow resulting from a change in plan assumptions from a prior year in the amount of $5,500 per year. Requried: Prepare journal entries to record annual pension expenses for the enterprise fund.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning