Introduction:

Net

The difference between the

Payback Period:

The time required to cover the cost of investment refers to payback period. The company prefers shorter payback period that has less risks compared to longer payback period.

Requirement-1:

To compute:

The annual expected net cash flows of Project A and Project B of Aikman Company that indicates the financial stability of the company.

Answer to Problem 2BPSB

Solution:

Net cash flows for Project A:

Net cash flows for Project B:

Explanation of Solution

The annual expected cash flows is computed by using the below formula:

Therefore the annual net cash flow of each project is calculated as below:

Project A:

Net income:

Net Cash Flow

Depreciation for Project A:

Given,

Cost of Machinery/Investment:

Useful life of an Asset:

Annual Depreciation=

Project B:

Net income:

Depreciation Expense:

Net Cash Flow

Depreciation for Project B:

Given,

Cost of Machinery/Investment:

Useful life of an Asset:

Annual Depreciation=

Depreciation expense is calculated by using the formula:

Hence the net cash flow for Project A is $99,900 and Project B is $105,900. Project B has the higher net cash flows compared to Project A that indicates Project B is financially sound than Project B. However Project A also has equally good cash flows.

Requirement-2:

To determine:

The payback period of Project A and Project B of Aikman Company to determine the investment risk of projects.

Answer to Problem 2BPSB

Solution:

Payback period of Project A: 2.4 years

Payback period of Project B: 2.3 years

Explanation of Solution

The payback period is derived using the formula:

Calculation of Payback Period for Project A:

Given,

Cost of Investment:

Net Cash Flow (As calculated):

Payback period

Calculation of Payback Period for Project B:

Given,

Cost of Investment:

Net Cash Flow (As calculated):

Payback period

The shortest payback period has less risk and longer payback period has high risk. Hence from the computation of payback period of both the projects, Project B has shorter period compared to Project A. However there is no much difference in the payback periods of both the projects that indicates both has less risk of investment.

Requirement-3:

To compute:

The accounting

Answer to Problem 2BPSB

Solution:

The accounting rate of return for Project A is 33.3%

The accounting rate of return for Project B is 21.6%

Explanation of Solution

Explanation:

The accounting rate of return is calculated using the formula:

Project A:

Given,

Net income:

Average investment:

Accounting rate of return= $39,900/$120,000*100=33.3%

Project B:

Given,

Net income:

Average investment:

Accounting rate of return=

From the computation of accounting rate of return Project A has higher accounting rate of return compared to Project B. Hence the company can proceed with investment in Project A.

Requirement-4:

To determine:

The

Answer to Problem 2BPSB

Solution:

The net present value at discounted rate of 8% of Project A is .

The net present value at discounted rate of 8% of Project B is .

Explanation of Solution

The present value of net cash flows at discounted rate is calculated by using the formula:

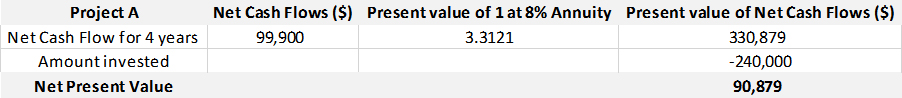

Project A:

Net cash flow as calculated for Project A is $99,900

Cost of investment is $240,000

Present value of 1 at 8% Annuity for 4 years is 3.3121 (Taken from the Annuity table)

The below table shows the calculation of net present value for Project A:

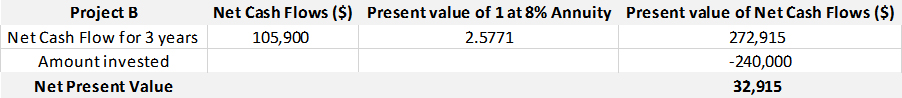

Project B:

Net cash flow as calculated for Project A is $105,900

Cost of investment is $240,000

Present value of 1 at 8% Annuity for 3 years is 2.5771(Taken from the Annuity table)

The below table shows the calculation of net present value for Project B:

From the computation of net present value of cash flows, Project A has the higher present value of $90,879 compared to Project B that indicates Project A is highly profitable.

Requirement-5:

To discuss:

The project that would be recommended to the management and the explanation for the recommendation.

Answer to Problem 2BPSB

Solution:

Project A is recommended to the management.

Explanation of Solution

Project A has higher present value of cash flows of $90,879 and accounting rate of return

of 33.3% when compared to Project B.

Hence comparing the net present value and accounting rate of return of both the projects, the Project A is highly profitable to proceed with.

Want to see more full solutions like this?

Chapter 25 Solutions

Fundamental Accounting Principles -Hardcover

- The increase in the company's plan assets during the year isarrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Echo Corporation had accounts receivable of $95,000 at January 1, 2023. At December 31, 2023, accounts receivable was $75,000. Sales for 2023 totaled $650,000. Compute Echo Corporation's 2023 cash receipts from customers.arrow_forwardProvide answerarrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- Nonearrow_forwardO'Keeffe Corporation's trial balance shows Accounts Receivable with a debit balance of $350,000. The company estimates that 3% of receivables will be uncollectible. If the Allowance for Doubtful Accounts has a credit balance of $4,200 before adjustment, what is the required adjusting entry for bad debt expense?arrow_forwardAziz Industries has forecasted sales of $6,200 in April, $7,800 in May, and $9,400 in June. All sales are on credit. The company collects 35% of sales in the month of the sale and the remaining 65% in the following month. What will be the balance in accounts receivable at the beginning of July?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education