Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 25, Problem 20E

Product decisions under bottlenecked operations

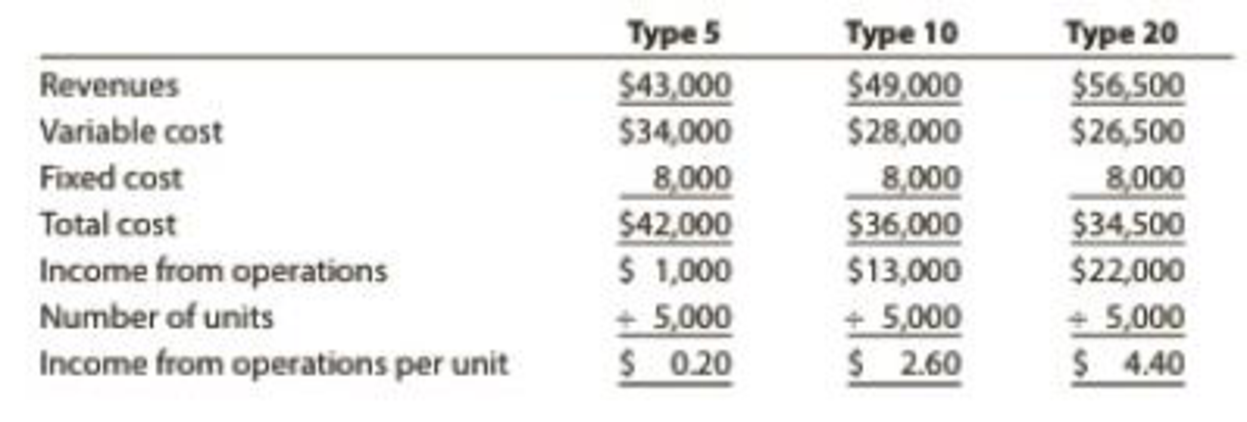

Mill Metals Inc. has three grades of metal product, Type 5, Type 10, and Type 20. Financial data for the three grades are as follows:

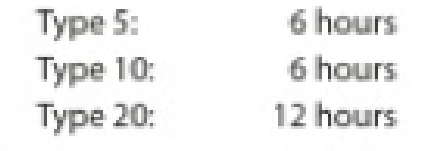

Mill’s operations require all three grades to be melted in a furnace before being formed. The furnace runs 24 hours a day, 7 days a week, and is a production bottleneck. The furnace hours required per unit of each product are as follows:

The Marketing Department is considering a new marketing and sales campaign.

Which product should be emphasized in the marketing and sales campaign in order to maximize profitability?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Product Decisions Under Bottlenecked Operations

Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $176,000 for the company as a whole. In addition, the following information is available about the three products:

Line Item Description

Large

Medium

Small

Unit selling price

$254

$143

$266

Unit variable cost

(200)

(117)

(234)

Unit contribution margin

$ 54

$ 26

$ 32

Autoclave hours per unit

6

2

4

Total process hours per unit

12

4

12

Budgeted units of production

3,500

3,500

3,500

a. Determine the contribution margin by glass type and the total company operating income for the budgeted units of production.

Line Item Description

Large…

Product Decisions Under Bottlenecked Operations

Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $296,000 for the company as a whole. In addition, the following information is available about the three products:

Large

Medium

Small

Unit selling price

$324

$286

$158

Unit variable cost

255

234

139

Unit contribution margin

$ 69

$ 52

$ 19

Autoclave hours per unit

6

4

2

Total process hours per unit

18

8

6

Budgeted units of production

4,700

4,700

4,700

a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production.

Large

Medium

Small

Total

Units…

Product Decisions Under Bottlenecked Operations

Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $270,000 for the company as a whole. In addition, the following information is available about the three products:

Large

Medium

Small

Unit selling price

$122

$347

$448

Unit variable cost

96

284

394

Unit contribution margin

$ 26

$ 63

$ 54

Autoclave hours per unit

2

6

4

Total process hours per unit

4

12

12

Budgeted units of production

4,200

4,200

4,200

a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production.

Large

Medium…

Chapter 25 Solutions

Financial And Managerial Accounting

Ch. 25 - Explain the meaning of (A) differential revenue,...Ch. 25 - A company could sell a building for 250,000 or...Ch. 25 - A chemical company has a commodity-grade and...Ch. 25 - A company accepts incremental business at a...Ch. 25 - A company fabricates a component at a cost of...Ch. 25 - Prob. 6DQCh. 25 - In the long run, the normal selling price must be...Ch. 25 - Although the cost-plus approach to product pricing...Ch. 25 - How does the target cost method differ from...Ch. 25 - Prob. 10DQ

Ch. 25 - Lease or sell Plymouth Company owns equipment with...Ch. 25 - Prob. 2BECh. 25 - Make or buy A company manufactures various-sized...Ch. 25 - Replace equipment A machine with a book value of...Ch. 25 - Process or sell Product J19 is produced for 11 per...Ch. 25 - Prob. 6BECh. 25 - Product cost markup percentage Green Thumb Garden...Ch. 25 - Prob. 8BECh. 25 - Differential analysis for a lease or sell decision...Ch. 25 - Prob. 2ECh. 25 - Differential analysis for a discontinued product A...Ch. 25 - Differential analysis for a discontinued product...Ch. 25 - Prob. 5ECh. 25 - Decision to discontinue a product On the basis of...Ch. 25 - Make-or-buy decision Somerset Computer Company has...Ch. 25 - Make-or-buy decision for a service company The...Ch. 25 - Machine replacement decision A company is...Ch. 25 - Differential analysis for machine replacement...Ch. 25 - Sell or process further Calgary Lumber Company...Ch. 25 - Sell or process further Dakota Coffee Company...Ch. 25 - Decision on accepting additional business...Ch. 25 - Accepting business at a special price Box Elder...Ch. 25 - Prob. 15ECh. 25 - Product cost method of product pricing La Femme...Ch. 25 - Product cost method of product costing Smart...Ch. 25 - Target costing Toyota Motor Corporation (TM) uses...Ch. 25 - Target costing Instant Image Inc. manufactures...Ch. 25 - Product decisions under bottlenecked operations...Ch. 25 - Prob. 21ECh. 25 - Total cost method of product pricing Based on the...Ch. 25 - Variable cost method of product pricing Based on...Ch. 25 - Differential analysis involving opportunity costs...Ch. 25 - Differential analysis for machine replacement...Ch. 25 - Differential analysis for sales promotion proposal...Ch. 25 - Prob. 4PACh. 25 - Prob. 5PACh. 25 - Product pricing using the cost-plus approach...Ch. 25 - Differential analysis involving opportunity costs...Ch. 25 - Differential analysis for machine replacement...Ch. 25 - Differential analysis for sales promotion proposal...Ch. 25 - Differential analysis for further processing The...Ch. 25 - Prob. 5PBCh. 25 - Product pricing using the cost-plus approach...Ch. 25 - Analyze Pacific Airways Pacific Airways provides...Ch. 25 - Service yield pricing and differential equations...Ch. 25 - Prob. 3MADCh. 25 - Service yield pricing and differential analysis...Ch. 25 - Aaron McKinney is a cost accountant for Majik...Ch. 25 - Prob. 3TIFCh. 25 - Prob. 4TIFCh. 25 - Accepting service business at a special price If...Ch. 25 - Prob. 6TIFCh. 25 - In differential cost analysis, which one of the...Ch. 25 - Prob. 2CMACh. 25 - Prob. 3CMACh. 25 - Oakes Inc. manufactured 40,000 gallons of Mononate...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Product Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $91,000 for the company as a whole. In addition, the following information is available about the three products: Unit selling price Unit variable cost Unit contribution margin Autoclave hours per unit Total process hours per unit Budgeted units of production Large Medium Small $240 $94 $199 (189) (77) (175) $ 51 $ 17 $ 24 6 2 4 18 4 8 2,200 2,200 2,200 a. Determine the contribution margin by glass type and the total company operating income for the budgeted units of production. Large Medium Small Units produced Revenues Variable costs Contribution margin Fixed costs…arrow_forwardProduct Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $177,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $353 $99 $282 Unit variable cost 278 81 248 Unit contribution margin $ 75 $ 18 $ 34 Autoclave hours per unit 6 2 4 Total process hours per unit 18 6 8 Budgeted units of production 3,100 3,100 3,100 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Large Medium Small Total Units…arrow_forwardProduct Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $154,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $6 $413 $448 Unit variable cost (52) (338) (394) Unit contribution margin $ 14 $ 75 $ 54 Autoclave hours per unit 2 6 4 Total process hours per unit 6 12 8 Budgeted units of production 2,400 2,400 2,400 a. Determine the contribution margin by glass type and the total company operating income for the budgeted units of production. Large Medium Small Total Units produced Revenues $4 Variable costs Contribution margin %4 Fixed…arrow_forward

- Product Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $148,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $226 $165 $208 Unit variable cost 178 135 183 Unit contribution margin $ 48 $ 30 $ 25 Autoclave hours per unit 6 4 2 Total process hours per unit 18 8 6 Budgeted units of production 3,200 3,200 3,200 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Large Medium…arrow_forwardProduct Decisions Under Bottlenecked Operations Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $339,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $216 $116 $647 Unit variable cost (170) (95) (569) Unit contribution margin $ 46 $ 21 $ 78 Autoclave hours per unit 4 2 6 Total process hours per unit 12 4 12 Budgeted units of production 5,200 5,200 5,200arrow_forwardSoft Cushion Company is highly decentralized. Each division is empowered to make its own sales decisions. The Assembly Division can purchase stuffing, a key component, from the Production Division or from external suppliers. The Production Division has been the major supplier of stuffing in recent years. The Assembly Division has announced that two external suppliers will be used to purchase the stuffing at $26per pound for the next year. The Production Division recently increased its unit price to $54.The manager of the Production Division presented the following information — variable cost $38 and fixed cost $14 — to top management in order to attempt to force the Assembly Division to purchase the stuffing internally. The Assembly Division purchases 21,000 pounds of stuffing per month. What would be the monthly operating advantage (disadvantage) of purchasing the goods internally, assuming the external supplier increased its price to $88 per pound and the Production Division…arrow_forward

- Scottsdale Manufacturing is organized into two divisions: Fabrication and Assembly. Components transferred between the two divisions are recorded at a predetermined transfer price. Standard variable manufacturing cost per unit in the Fabrication Division is $350. At the present time, this division is working to capacity. Fabrication estimates that the units it produces could be sold on the external market for $580. The product under consideration is viewed as a commodity-type product, with no differentiating features or characteristics. Required: 2. Based on the general transfer pricing rule presented in the chapter, what is the minimum transfer price between units when the Fabrication Division is working to capacity? 3. What if the Fabrication Division had excess capacity? How would this change the minimum transfer price as determined by the application of the general transfer pricing rule?arrow_forwardThe Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years. The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the Personnel Department. The first, called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the employee’s…arrow_forwardThe Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years. The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the Personnel Department. The first, called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the…arrow_forward

- The Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years. The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the Personnel Department. The first, which is called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the…arrow_forwardThe Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years. The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the Personnel Department. The first, called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the…arrow_forwardThe Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years. The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions. There are two basic activities in the Personnel Department. The first, called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

HR Basics: Compensation; Author: HR Basics: Compensation;https://www.youtube.com/watch?v=wZoRId6ADuo;License: Standard Youtube License