College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 25, Problem 1CP

CHALLENGE PROBLEM

This problem challenges you to apply your cumulative accounting knowledge to move a step beyond the material in the chapter.

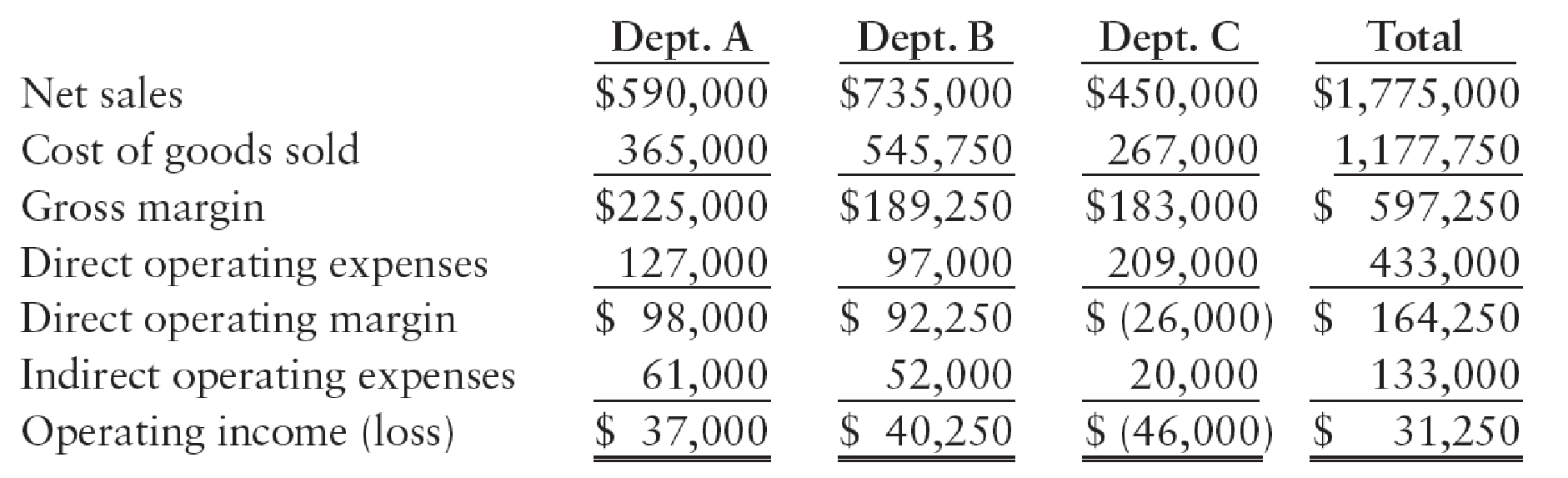

The results of the operating activities of Kobe Company for the current year are as follows:

Based on these results, Kobe is considering discontinuing department C and establishing a new department D. The estimated revenues and expenses of the new department are as follows:

In addition, the proposed change will cause total indirect operating expenses to increase by $22,000.

REQUIRED

Determine whether Kobe should discontinue department C and establish department D.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Financial accounting

Contribution margin is?

choose best answer

Chapter 25 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 25 - A department that incurs costs and generates...Ch. 25 - Departmental gross profit is the difference...Ch. 25 - Prob. 3TFCh. 25 - Direct expenses are operating expenses incurred...Ch. 25 - Departmental direct operating margin is the...Ch. 25 - Prob. 1MCCh. 25 - The difference between a departments net sales and...Ch. 25 - Prob. 3MCCh. 25 - The difference between a departments gross profit...Ch. 25 - The difference between a departments gross profit...

Ch. 25 - Prob. 1CECh. 25 - Prob. 2CECh. 25 - Prob. 3CECh. 25 - Prob. 1RQCh. 25 - Prob. 2RQCh. 25 - Prob. 3RQCh. 25 - Prob. 4RQCh. 25 - Prob. 5RQCh. 25 - Prob. 6RQCh. 25 - Prob. 7RQCh. 25 - Prob. 8RQCh. 25 - Distinguish between departmental gross profit,...Ch. 25 - Prob. 10RQCh. 25 - GROSS PROFIT SECTION OF DE PART MENT AL INCO ME ST...Ch. 25 - ALLOCATING OPERATING EXPENSESQUARE FEET Weaverling...Ch. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Mercado...Ch. 25 - COMPUTING OPERATING INCOME The sales, cost of...Ch. 25 - Prob. 6SEACh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - INCOME STATE MENT WITH DEPARTMENTAL OPERATING...Ch. 25 - INCOME STATEMENT WITH DEPART MENTAL DIRECT...Ch. 25 - Prob. 10SPACh. 25 - GROSS PROFIT SECTION OF DEPART MENTAL INCOME...Ch. 25 - Prob. 2SEBCh. 25 - ALLOCATING OPERATING EXPENSERELATIVE NET SALES...Ch. 25 - ALLOCATING OPERATING EXPENSEMILES DRIVEN Herbert...Ch. 25 - Prob. 5SEBCh. 25 - Prob. 6SEBCh. 25 - INCOME STATEMENT WITH DEPART MENTAL GROSS PROFIT...Ch. 25 - Prob. 8SPBCh. 25 - Prob. 9SPBCh. 25 - Prob. 10SPBCh. 25 - Prob. 1MYWCh. 25 - Prob. 1ECCh. 25 - MASTERY PROBLEM Bobs Acme Supermarket has been in...Ch. 25 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial accountingarrow_forwardOn August 1, 2022, Fletcher Corporation sells machinery for $180,000. The machinery originally cost $500,000, had an estimated 5-year life, and an expected salvage value of $50,000. The Accumulated Depreciation account had a balance of $325,000 on January 1, 2022, using the straight-line method. The gain or loss on disposal is__.arrow_forwardHello teacher please help me this question solutionarrow_forward

- How much is the gross profit margin?arrow_forwardAns ?arrow_forwardMint Corp. began operations on January 1, Year 1, and had the following items for the year: Sales revenue $6,680,000 Costs and expenses (excluding income taxes) 5,180,000 Dividends declared 160,000 Dividends payable 50,000 Mint's tax rate is 30%. In Mint's December 31, Year 1, balance sheet, what amount should be reported as total retained earnings? A. $890,000 B. $940,000 C. $1,050,000 D. $1,500,000 Explanation Retained earnings is the accumulated net income (loss) of an entity since its inception, less the accumulated declareddividends to shareholders (ie, the income/earnings still retained in the business). At the end of each accounting period, net income and dividends are closed into retained earnings to update the account for the financial statements. Mint's net income is $1,500,000 before taxes and $1,050,000 after taxes (Choices C and D): Sales revenues $6,680,000 Less: Costs and expenses (before…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License