Financial and Managerial Accounting

15th Edition

ISBN: 9780357297162

Author: Carl S. Warren; Jefferson P. Jones; William B. Tayler, Ph.D., CMA

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 24, Problem 4TIF

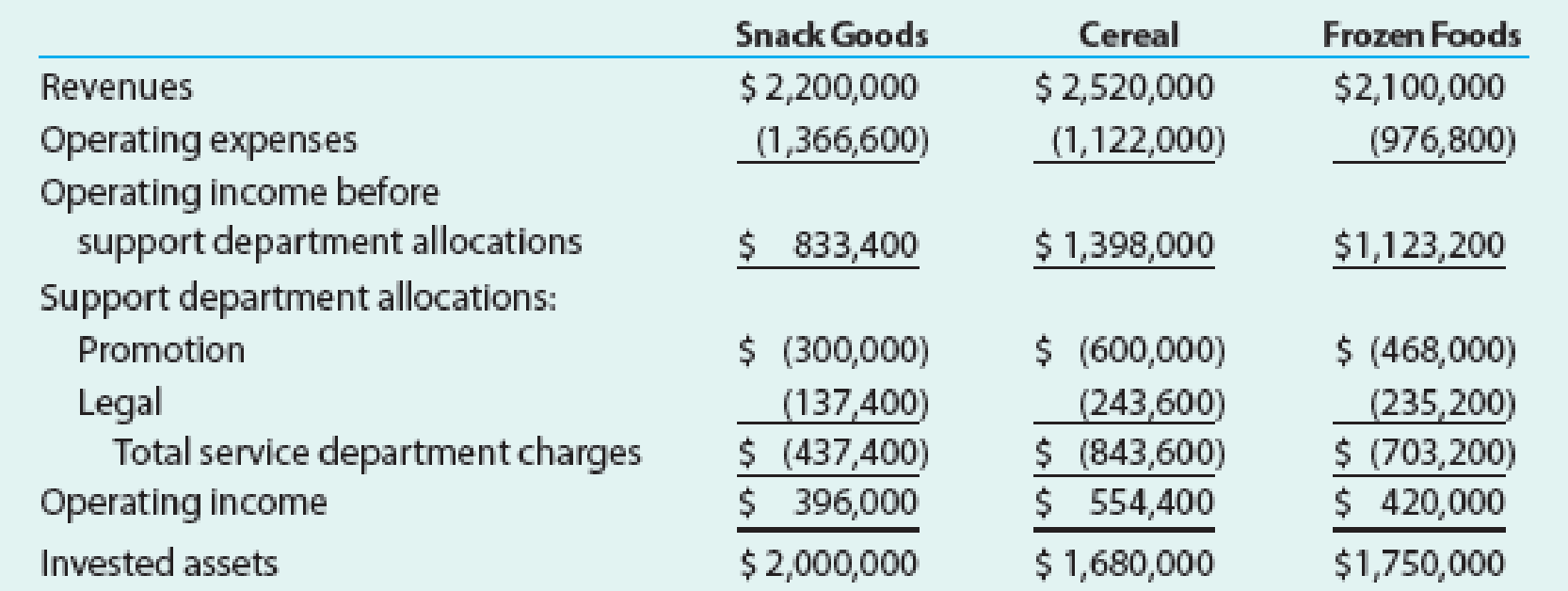

The three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year:

- a. Which division is making the best use of invested assets and should be given priority for future capital investments?

- b. b.

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain.

Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. - c. c.

Identify opportunities for improving the company’s financial performance.

Identify opportunities for improving the company’s financial performance.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please help me solve this general accounting question using the right accounting principles.

I am looking for help with this general accounting question using proper accounting standards.

Please provide the solution to this general accounting question with accurate financial calculations.

Chapter 24 Solutions

Financial and Managerial Accounting

Ch. 24 - Differentiate between centralized and...Ch. 24 - Differentiate between a profit center and an...Ch. 24 - Weyerhaeuser Co. (WY) developed a system that...Ch. 24 - What is the major shortcoming of using operating...Ch. 24 - In a decentralized company in which the divisions...Ch. 24 - Prob. 6DQCh. 24 - (a) Explain how return on investment might lead a...Ch. 24 - Prob. 8DQCh. 24 - When is the negotiated price approach preferred...Ch. 24 - Prob. 10DQ

Ch. 24 - Budgetary performance for cost center Vinton...Ch. 24 - Support department allocations The centralized...Ch. 24 - Prob. 3BECh. 24 - Profit margin, investment turnover, and ROI Briggs...Ch. 24 - Residual income Obj. The Commercial Division of...Ch. 24 - Transfer pricing The materials used by the...Ch. 24 - Budget performance reports for cost centers...Ch. 24 - The following data were summarized from the...Ch. 24 - Prob. 3ECh. 24 - Prob. 4ECh. 24 - Service department charges In divisional income...Ch. 24 - Varney Corporation, a manufacturer of electronics...Ch. 24 - Horton Technology has two divisions, Consumer and...Ch. 24 - Rocky Mountain Airlines Inc. has two divisions...Ch. 24 - Championship Sports Inc. operates two divisionsthe...Ch. 24 - The operating income and the amount of invested...Ch. 24 - The operating income and the amount of invested...Ch. 24 - Prob. 12ECh. 24 - The condensed income statement for the Consumer...Ch. 24 - Prob. 14ECh. 24 - Data are presented in the following table of...Ch. 24 - Prob. 16ECh. 24 - Materials used by the Instrument Division of...Ch. 24 - Prob. 18ECh. 24 - GHT Tech Inc. sells electronics over the Internet....Ch. 24 - Profit center responsibility reporting for a...Ch. 24 - Divisional income statements and return on...Ch. 24 - Effect of proposals on divisional performance A...Ch. 24 - Divisional performance analysis and evaluation The...Ch. 24 - Prob. 6PACh. 24 - Budget performance report for a cost center The...Ch. 24 - Profit center responsibility reporting for a...Ch. 24 - Divisional income statements and return on...Ch. 24 - Effect of proposals on divisional performance A...Ch. 24 - Prob. 5PBCh. 24 - Prob. 6PBCh. 24 - Kelly Kitchens operates both franchised and...Ch. 24 - Panera Bread Company (PNRA) operates over 2,000...Ch. 24 - Papa Johns International, Inc. (PZZA), operates...Ch. 24 - Panera Bread Company (PNRA) operates over 2,000...Ch. 24 - McDonalds Corporation (MCD) operates company-owned...Ch. 24 - Prob. 1TIFCh. 24 - Prob. 2TIFCh. 24 - Communication The Norse Division of Gridiron...Ch. 24 - The three divisions of Yummy Foods are Snack...Ch. 24 - Last Resort Industries Inc. is a privately held...Ch. 24 - Sara Bellows, manager of the telecommunication...Ch. 24 - Most firms allocate corporate and other support...Ch. 24 - Prob. 3CMACh. 24 - Prob. 4CMA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem using appropriate accountarrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

GE McKinsey Matrix for SBU Strategies; Author: Wolters World;https://www.youtube.com/watch?v=FffD1Ze76JQ;License: Standard Youtube License