Financial and Managerial Accounting

15th Edition

ISBN: 9780357297162

Author: Carl S. Warren; Jefferson P. Jones; William B. Tayler, Ph.D., CMA

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 24, Problem 2MAD

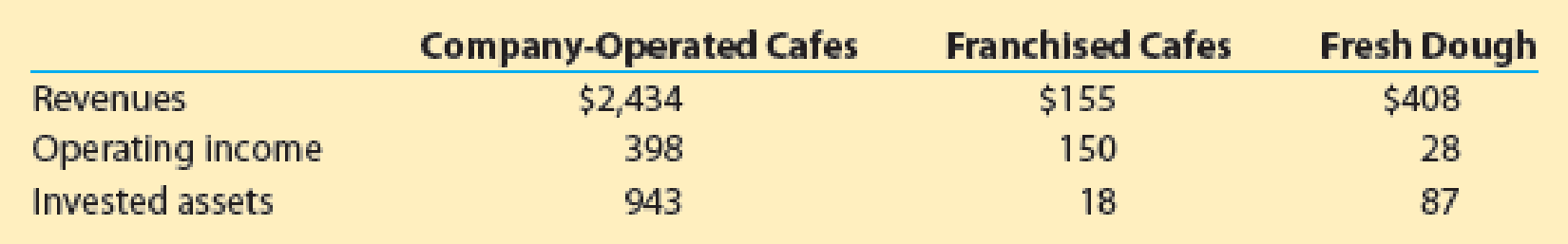

Panera Bread Company (PNRA) operates over 2,000 bakery-cafe locations throughout the United States and Canada and serves over 9 million customers per week. Panera’s operations are divided into the following segments:

- Company-Operated Bakery-Cafes

- Franchised Bakery-Cafes

- Fresh Dough and Other Products

The Fresh Dough and Other Products segment supplies fresh dough, produce, tuna, and other products to the company-operated and franchised cafes. Recent data (in millions) for each of these segments are as follows:

- a. Determine the profit margin for each segment. Round to one decimal place.

- b. Determine the investment turnover for each segment. Round to two decimal places.

- c. Use the DuPont formula to determine the

return on investment for each segment. Round to one decimal place. - d.

Which segment has the highest profit margin, investment turnover, and return on investment? Explain why.

Which segment has the highest profit margin, investment turnover, and return on investment? Explain why. - e.

If franchised cafes are more profitable, why would Panera operate company- owned cafes?

If franchised cafes are more profitable, why would Panera operate company- owned cafes?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting question

I am looking for the correct answer to this financial accounting question with appropriate explanations.

general accounting

Chapter 24 Solutions

Financial and Managerial Accounting

Ch. 24 - Differentiate between centralized and...Ch. 24 - Differentiate between a profit center and an...Ch. 24 - Weyerhaeuser Co. (WY) developed a system that...Ch. 24 - What is the major shortcoming of using operating...Ch. 24 - In a decentralized company in which the divisions...Ch. 24 - Prob. 6DQCh. 24 - (a) Explain how return on investment might lead a...Ch. 24 - Prob. 8DQCh. 24 - When is the negotiated price approach preferred...Ch. 24 - Prob. 10DQ

Ch. 24 - Budgetary performance for cost center Vinton...Ch. 24 - Support department allocations The centralized...Ch. 24 - Prob. 3BECh. 24 - Profit margin, investment turnover, and ROI Briggs...Ch. 24 - Residual income Obj. The Commercial Division of...Ch. 24 - Transfer pricing The materials used by the...Ch. 24 - Budget performance reports for cost centers...Ch. 24 - The following data were summarized from the...Ch. 24 - Prob. 3ECh. 24 - Prob. 4ECh. 24 - Service department charges In divisional income...Ch. 24 - Varney Corporation, a manufacturer of electronics...Ch. 24 - Horton Technology has two divisions, Consumer and...Ch. 24 - Rocky Mountain Airlines Inc. has two divisions...Ch. 24 - Championship Sports Inc. operates two divisionsthe...Ch. 24 - The operating income and the amount of invested...Ch. 24 - The operating income and the amount of invested...Ch. 24 - Prob. 12ECh. 24 - The condensed income statement for the Consumer...Ch. 24 - Prob. 14ECh. 24 - Data are presented in the following table of...Ch. 24 - Prob. 16ECh. 24 - Materials used by the Instrument Division of...Ch. 24 - Prob. 18ECh. 24 - GHT Tech Inc. sells electronics over the Internet....Ch. 24 - Profit center responsibility reporting for a...Ch. 24 - Divisional income statements and return on...Ch. 24 - Effect of proposals on divisional performance A...Ch. 24 - Divisional performance analysis and evaluation The...Ch. 24 - Prob. 6PACh. 24 - Budget performance report for a cost center The...Ch. 24 - Profit center responsibility reporting for a...Ch. 24 - Divisional income statements and return on...Ch. 24 - Effect of proposals on divisional performance A...Ch. 24 - Prob. 5PBCh. 24 - Prob. 6PBCh. 24 - Kelly Kitchens operates both franchised and...Ch. 24 - Panera Bread Company (PNRA) operates over 2,000...Ch. 24 - Papa Johns International, Inc. (PZZA), operates...Ch. 24 - Panera Bread Company (PNRA) operates over 2,000...Ch. 24 - McDonalds Corporation (MCD) operates company-owned...Ch. 24 - Prob. 1TIFCh. 24 - Prob. 2TIFCh. 24 - Communication The Norse Division of Gridiron...Ch. 24 - The three divisions of Yummy Foods are Snack...Ch. 24 - Last Resort Industries Inc. is a privately held...Ch. 24 - Sara Bellows, manager of the telecommunication...Ch. 24 - Most firms allocate corporate and other support...Ch. 24 - Prob. 3CMACh. 24 - Prob. 4CMA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardCan you explain the correct methodology to solve this financial accounting problem?arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forward

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

- I am searching for the right answer to this financial accounting question using proper techniques.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forwardCan you solve this financial accounting problem with appropriate steps and explanations?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License