Loose Leaf for Fundamentals of Accounting Principles and Connect Access Card

22nd Edition

ISBN: 9781259542169

Author: John J Wild

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 24, Problem 4APSA

Problem 24-4A

Departmental contribution to income

P3

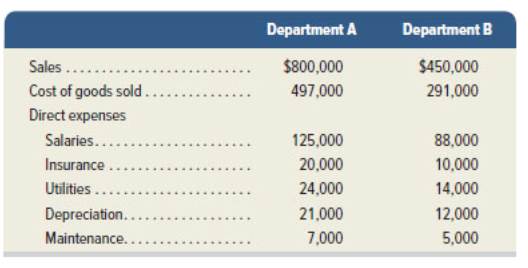

Vortex Company operates a retail Store with two departments. Information about those departments follows.

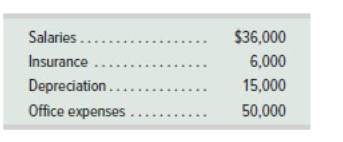

The company also incurred the following indirect costs.

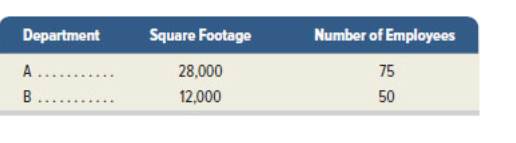

Indirect costs are allocated as follows: salaries on the basis of sales; insurance and

Required

1. For each department, determine the departmental contribution to

2. Should Department B be eliminated? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Overhead application to costs is a critical issue for the costing of your products. We are studying several ways to handle this situation.

Describe overhead and the overhead application process.

What would cause an overhead to be overapplied, or underapplied.

Discuss the results to your decision making and the financial statements for each of those two situations.

Describe how the over or under application of overhead should be corrected in the accounting records.

Don't use ai to answer I will report you answer

i need this question answer General accounting question

Chapter 24 Solutions

Loose Leaf for Fundamentals of Accounting Principles and Connect Access Card

Ch. 24 - Prob. 1DQCh. 24 - What is the difference between operating...Ch. 24 - What are controllable costs?Ch. 24 - Prob. 4DQCh. 24 - Prob. 5DQCh. 24 - Prob. 6DQCh. 24 - Prob. 7DQCh. 24 - What is the difference between direct and indirect...Ch. 24 - Prob. 9DQCh. 24 - Prob. 10DQ

Ch. 24 - Prob. 11DQCh. 24 - Prob. 12DQCh. 24 - Prob. 13DQCh. 24 - Prob. 14DQCh. 24 - Prob. 15DQCh. 24 - Prob. 16DQCh. 24 - Prob. 17DQCh. 24 - Prob. 18DQCh. 24 - Prob. 19DQCh. 24 - Prob. 20DQCh. 24 - Prob. 1QSCh. 24 - Prob. 2QSCh. 24 - Prob. 3QSCh. 24 - Allocation and measurement terms C1 In each blank...Ch. 24 - Basis for cost allocation C1 For each of the...Ch. 24 - Prob. 6QSCh. 24 - Prob. 7QSCh. 24 - Prob. 8QSCh. 24 - Prob. 9QSCh. 24 - Prob. 10QSCh. 24 - Prob. 11QSCh. 24 - Prob. 12QSCh. 24 - Prob. 13QSCh. 24 - Prob. 14QSCh. 24 - Prob. 15QSCh. 24 - Prob. 16QSCh. 24 - Prob. 17QSCh. 24 - Prob. 18QSCh. 24 - Prob. 19QSCh. 24 - Prob. 1ECh. 24 - Prob. 2ECh. 24 - Exercise 24-3 Service department expenses...Ch. 24 - Prob. 4ECh. 24 - Prob. 5ECh. 24 - Prob. 6ECh. 24 - Prob. 7ECh. 24 - Prob. 8ECh. 24 - Prob. 9ECh. 24 - Prob. 10ECh. 24 - Prob. 11ECh. 24 - Prob. 12ECh. 24 - Prob. 13ECh. 24 - Prob. 14ECh. 24 - Prob. 15ECh. 24 - Prob. 16ECh. 24 - Prob. 17ECh. 24 - Prob. 18ECh. 24 - Prob. 19ECh. 24 - Prob. 20ECh. 24 - Prob. 21ECh. 24 - Problem WA

Responsibility according perfortmance...Ch. 24 - Prob. 2APSACh. 24 - Prob. 3APSACh. 24 - Problem 24-4A Departmental contribution to income...Ch. 24 - Prob. 5APSACh. 24 - Prob. 1BPSBCh. 24 - Prob. 2BPSBCh. 24 - Prob. 3BPSBCh. 24 - Prob. 4BPSBCh. 24 - Prob. 5BPSBCh. 24 - Prob. 24SPCh. 24 - Prob. 1BTNCh. 24 - Prob. 2BTNCh. 24 - Prob. 3BTNCh. 24 - Prob. 4BTNCh. 24 - Prob. 5BTNCh. 24 - Prob. 6BTNCh. 24 - Prob. 7BTNCh. 24 - Prob. 8BTNCh. 24 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License