Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 24, Problem 22PS

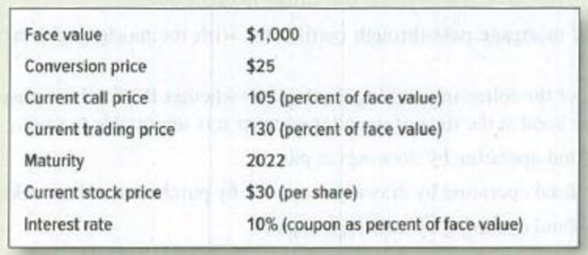

Convertible bonds The Surplus Value Company had $10 million (face value) of convertible bonds outstanding in 2015. Each bond has the following features.

- a. What is the bond’s conversion value?

- b. Can you explain why the bond is selling above conversion value?

- c. Should Surplus call? What will happen if it does so?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray

Media would let you make quarterly payments of $14,000 for 6 years at an interest rate of 1.50 percent per quarter. Your first payment

to Gray Media would be in 3 months. Island Media would let you make monthly payments of $X for 4 years at an interest rate of

1.35 percent per month. Your first payment to Island Media would be today. What is X?

Input instructions: Round your answer to the nearest dollar.

SA

$

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray

Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to

Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per

month. Your first payment to River Media would be in 1 month. What is X?

Input instructions: Round your answer to the nearest dollar.

$

You just borrowed $203,584. You plan to repay this loan by making regular quarterly payments of X for 69 quarters and a special

payment of $56,000 in 7 quarters. The interest rate on the loan is 1.94 percent per quarter and your first regular payment will be made

today. What is X?

Input instructions: Round your answer to the nearest dollar.

59

Chapter 24 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 24 - Bond terms Select the most appropriate term from...Ch. 24 - Sinking funds For each of the following sinking...Ch. 24 - Security and seniority a. As a senior bondholder,...Ch. 24 - Prob. 4PSCh. 24 - Prob. 5PSCh. 24 - Private placements Explain the three principal...Ch. 24 - Prob. 7PSCh. 24 - Prob. 8PSCh. 24 - Convertible bonds True or false? a. Convertible...Ch. 24 - Prob. 10PS

Ch. 24 - Bond terms Bond prices can fall either because of...Ch. 24 - Prob. 13PSCh. 24 - Prob. 14PSCh. 24 - Security and seniority a. Residential mortgages...Ch. 24 - Prob. 16PSCh. 24 - Prob. 17PSCh. 24 - Call provisions a. If interest rates rise, will...Ch. 24 - Prob. 19PSCh. 24 - Covenants Alpha Corp. is prohibited from issuing...Ch. 24 - Prob. 21PSCh. 24 - Convertible bonds The Surplus Value Company had 10...Ch. 24 - Prob. 23PSCh. 24 - Convertible bonds Iota Microsystems 10%...Ch. 24 - Prob. 25PSCh. 24 - Convertible bonds Zenco Inc. is financed by 3...Ch. 24 - Tax benefits Dorlcote Milling has outstanding a 1...Ch. 24 - Convertible bonds This question illustrates that...Ch. 24 - Prob. 29PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to retire in 4 years with $698,670. You plan to withdraw $X per year for 17 years. The expected return is 17.95 percent per year and the first regular withdrawal is expected in 5 years. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou just borrowed $111,682. You plan to repay this loan by making X regular annual payments of $15,500 and a special payment of $44,900 in 10 years. The interest rate on the loan is 13.33 percent per year and your first regular payment will be made in 1 year. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou just borrowed $174,984. You plan to repay this loan by making regular annual payments of X for 12 years and a special payment of $11,400 in 12 years. The interest rate on the loan is 9.37 percent per year and your first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. $arrow_forward

- You plan to retire in 7 years with $X. You plan to withdraw $54,100 per year for 15 years. The expected return is 13.19 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardYou plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. 99 $arrow_forwardYou have an investment worth $56,618 that is expected to make regular monthly payments of $1,579 for 25 months and a special payment of $X in 8 months. The expected return for the investment is 0.76 percent per month and the first regular payment will be made today What is X? Note: X is a positive number. Input instructions: Round your answer to the nearest dollar. $arrow_forward

- You plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. $ EAarrow_forwardYou have an investment worth $38,658 that is expected to make regular monthly payments of $1,130 for 16 months and a special payment of $X in 11 months. The expected return for the investment is 1.46 percent per month and the first regular payment will be made in 1 month. What is X? Note: X is a positive number. Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou just borrowed $373,641. You plan to repay this loan by making regular annual payments of X for 18 years and a special payment of $56,400 in 18 years. The interest rate on the loan is 12.90 percent per year and your first regular payment will be made in 1 year. What is X? Input instructions: Round your answer to the nearest dollar. EA $arrow_forward

- How much do you need in your account today if you expect to make quarterly withdrawals of $6,300 for 7 years and also make a special withdrawal of $25,700 in 7 years. The expected return for the account is 4.56 percent per quarter and the first regular withdrawal will be made today. Input instructions: Round your answer to the nearest dollar. $ 69arrow_forwardYou just bought a new car for $X. To pay for it, you took out a loan that requires regular monthly payments of $2,200 for 10 months and a special payment of $24,100 in 6 months. The interest rate on the loan is 1.07 percent per month and the first regular payment will be made today. What is X? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forward3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798? Input instructions: Round your answer to at least 2 decimal places. 1.62 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

What happens to my bond when interest rates rise?; Author: The Financial Pipeline;https://www.youtube.com/watch?v=6uaXlI4CLOs;License: Standard Youtube License