Concept explainers

EXPANDED STATEMENT OF

Additional information:

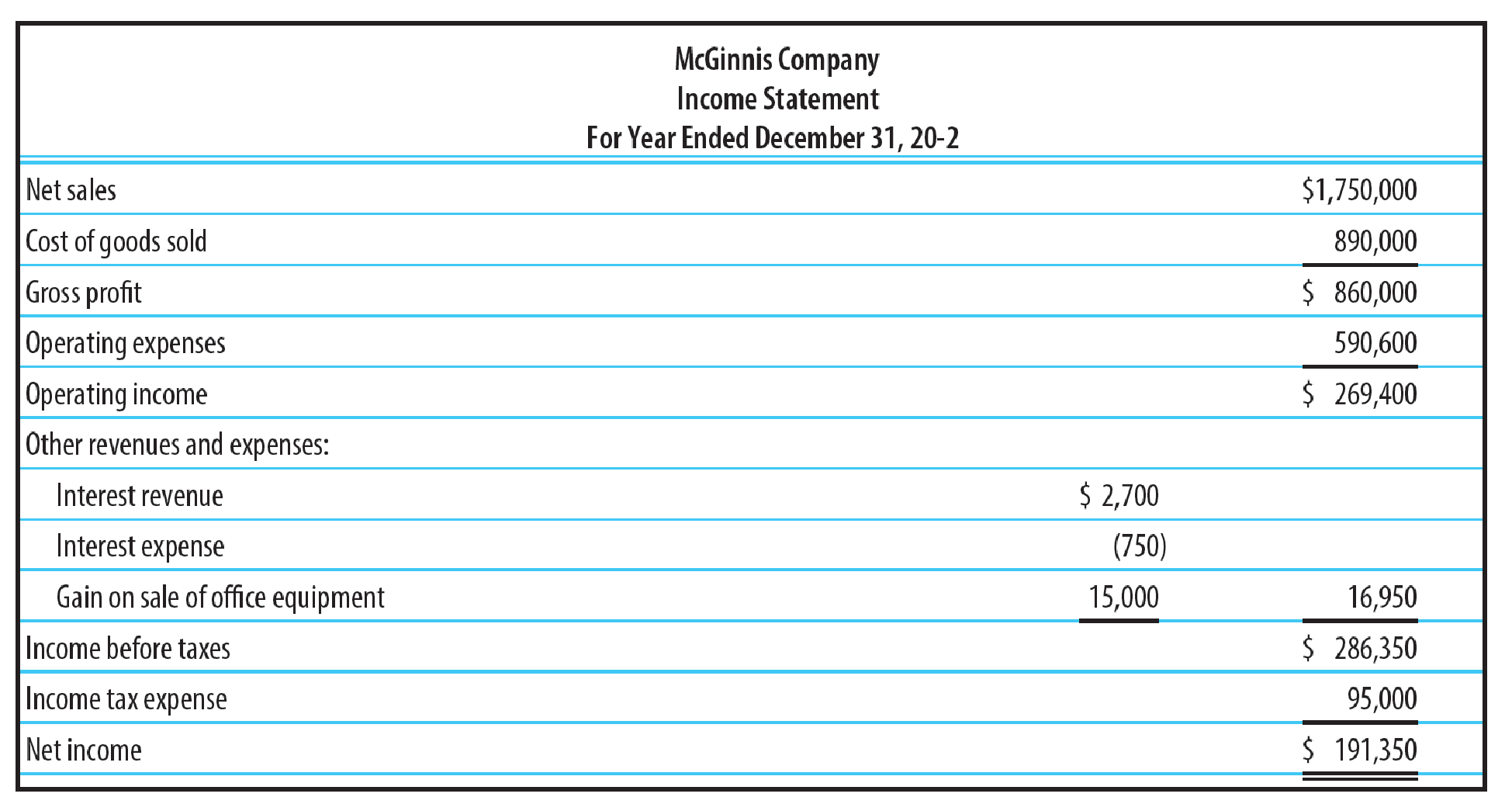

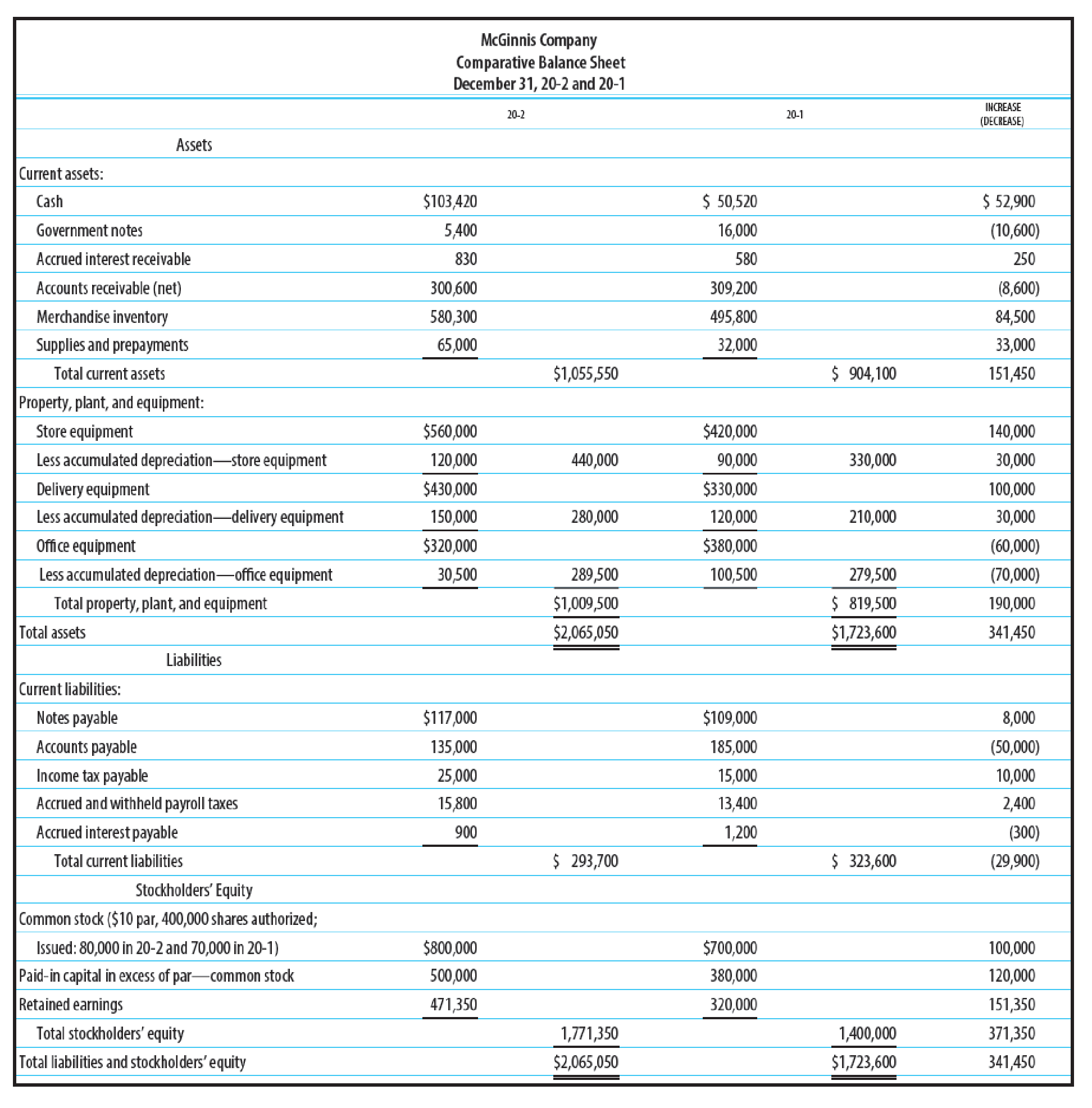

1. Office equipment was sold in 20-2 for $35,000. Additional information on the office equipment sold is provided below.

2.

3. The following purchases were made for cash:

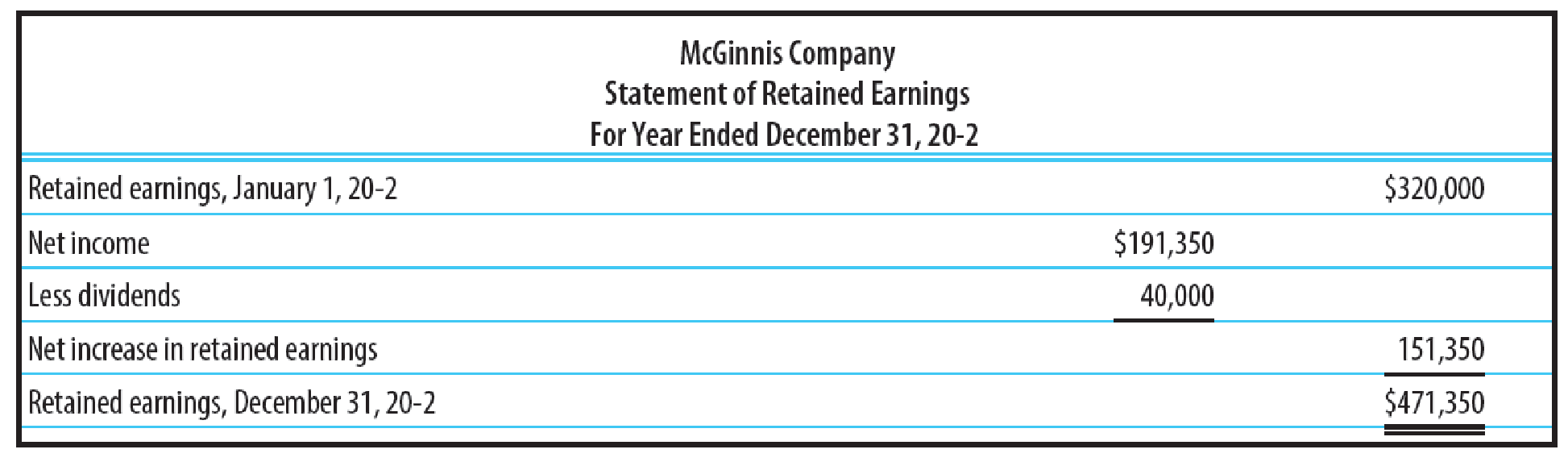

4. Declared and paid cash dividends of $40,000.

5. Issued 10,000 shares of $10 par common stock for $22 per share.

6. Acquired additional office equipment by issuing a note payable for $8,000.

REQUIRED

Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2.

STATEMENT OF CASH FLOWS UNDER THE DIRECT METHOD Using the information provided in Problem 23-12B for McGinnis Company, prepare the following:

1. A schedule for the calculation of cash generated from operating activities for McGinnis Company for the year ended December 31, 20-2.

2. A statement of cash flows for McGinnis Company prepared under the direct method for the year ended December 31, 20-2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23A Solutions

College Accounting, Chapters 1-27

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning