Loose Leaf for Fundamental Accounting Principles

23rd Edition

ISBN: 9781259687709

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 4E

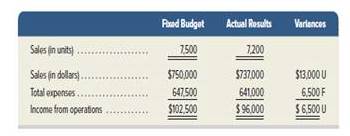

Exercise 23-4

Preparing a flexible budget performance report

P1

Bay City Company’s fixed budget performance report for July follows. The $647,500 budgeted total expenses include $487,00 variable expenses and $160,000 fixed expenses. Actual expenses include $158,000 fixed expenses. Prepare a flexible budget performance report that shows any variances between budgeted results and actual results. List fixed and variable expenses separately.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Can you solve this general accounting problem using appropriate accounting principles?

I need guidance with this general accounting problem using the right accounting principles.

Chapter 23 Solutions

Loose Leaf for Fundamental Accounting Principles

Ch. 23 - Prob. 1DQCh. 23 - Prob. 2DQCh. 23 - Prob. 3DQCh. 23 - Prob. 4DQCh. 23 - Prob. 5DQCh. 23 - Prob. 6DQCh. 23 - Prob. 7DQCh. 23 - Prob. 8DQCh. 23 - Prob. 9DQCh. 23 - Prob. 10DQ

Ch. 23 - Prob. 11DQCh. 23 - Prob. 12DQCh. 23 - Prob. 13DQCh. 23 - How can the manager of advertising sales at Google...Ch. 23 - Prob. 15DQCh. 23 - Prob. 16DQCh. 23 - Prob. 17DQCh. 23 - Prob. 18DQCh. 23 - Prob. 1QSCh. 23 - Prob. 2QSCh. 23 - Prob. 3QSCh. 23 - Prob. 4QSCh. 23 - Prob. 5QSCh. 23 - Prob. 6QSCh. 23 - Prob. 7QSCh. 23 - Prob. 8QSCh. 23 - Prob. 9QSCh. 23 - Prob. 10QSCh. 23 - Prob. 11QSCh. 23 - QS 23-12

Labor cost variances P2

Frontera...Ch. 23 - Prob. 13QSCh. 23 - Prob. 14QSCh. 23 - Volume variance P3 Refer to information in QS...Ch. 23 - Prob. 16QSCh. 23 - Preparing overhead entries P5 Refer to the...Ch. 23 - Prob. 18QSCh. 23 - Prob. 19QSCh. 23 - Prob. 20QSCh. 23 - Prob. 21QSCh. 23 - Prob. 22QSCh. 23 - Prob. 23QSCh. 23 - Prob. 1ECh. 23 - Prob. 2ECh. 23 - Prob. 3ECh. 23 - Exercise 23-4 Preparing a flexible budget...Ch. 23 - Prob. 5ECh. 23 - Prob. 6ECh. 23 - Exercise 23-7

Cost variances

C2

Presented below...Ch. 23 - Prob. 8ECh. 23 - Prob. 9ECh. 23 - Prob. 10ECh. 23 - Prob. 11ECh. 23 - Prob. 12ECh. 23 - Prob. 13ECh. 23 - Prob. 14ECh. 23 - Prob. 15ECh. 23 - Prob. 16ECh. 23 - Prob. 17ECh. 23 - Exercise 23-18A

Computation and interpretation...Ch. 23 - Prob. 19ECh. 23 - Prob. 20ECh. 23 - Prob. 21ECh. 23 - Prob. 22ECh. 23 - Prob. 23ECh. 23 - Prob. 1APSACh. 23 - Prob. 2APSACh. 23 - Prob. 3APSACh. 23 - Prob. 4APSACh. 23 - Prob. 5APSACh. 23 - Prob. 6APSACh. 23 - Prob. 1BPSBCh. 23 - Prob. 2BPSBCh. 23 - Problem 23-3B Flexible budget preparation;...Ch. 23 - Prob. 4BPSBCh. 23 - Prob. 5BPSBCh. 23 - Prob. 6BPSBCh. 23 - Prob. 23SPCh. 23 - Analysis of flexible budgets and standard costs...Ch. 23 - Prob. 2BTNCh. 23 - Selling materials, labor, and overhead standards...Ch. 23 - Prob. 4BTNCh. 23 - Prob. 5BTNCh. 23 - Prob. 6BTNCh. 23 - Prob. 7BTNCh. 23 - Prob. 8BTNCh. 23 - BIN 23-9 Access the annual report of Samsung (at...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forward

- Current Attempt in Progress The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1. 2. Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. 4. 5. 6. In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining…arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardgeneral accounting questionarrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY