Concept explainers

Problem 23-3B

Flexible budget preparation; computation of materials, labor, and

P1P2P3

Suncoast Company set the following standard costs for one unit of its product.

Direct materials (6 lbs. @ $5 per lb.) …………………. $ 27

Direct labor (2 hrs. @ $17 per hr.) ……………………... 18

Overhead (2 hrs. @ $ 18.50 per hr.) ……………………. 24

Total

The predetermined overhead rate ($ 16.00 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level.

Overhead Budget (75% Capacity)

Variable overhead costs

Indirect materials ……………………………………… $ 22,000

Indirect labor …………………………………………… 90,000

Power …………………………………………………… 22,500

Repairs and maintenance ……………………………….. 45,000

Total variable overhead costs …………………………… $180,000

Fixed overhead costs

Depreciation- Machinery ………………………………… 72,000

Taxes and insurance ……………………………………… 18,000

Supervision ………………………………………………... 66,000

Total fixed overhead costs …………………………………180,000

Total overhead costs ………………………………………………$ 360,000

The company incurred the following actual costs when it operated at 75% of capacity in October.

Direct materials (91,000 lbs. @ $5.10 per lb) …………………… $ 420,900

Direct labor (30,500 hrs. @ $ 17.25 per hr.) ……………………… 280,440

Overhead costs

Indirect materials …………………………………………. $ 21,600

Indirect labor ………………………………………………. 82,260

Power ………………………………………………………. 23,100

Repairs and maintenance …………………………………… 46,800

Depreciation-Building ……………………………………… 24,000

Depreciation-Machinery …………………………………….. 75,000

Taxes and insurance …………………………………………. 16,500

Supervision …………………………………………………… 66,000

355,260

Total costs ……………………………………………………………_____

$1,056,600 _______

Required

- Examine the monthly overhead budget to (a) determine the costs per unit for each variable overhead item and its total per unit costs and (b) identity the total fixed costs per month.

- Prepare flexible overhead budgets (as in Exhibit 23.12) for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels.

- Compute the direct materials cost variance, including its price and quantity variances.

- Compute the direct labor cost variance, including its rate and efficiency variances.

- Prepare a detailed overhead variance report (as in Exhibit 23.16) that shows the variances for individual items of overhead.

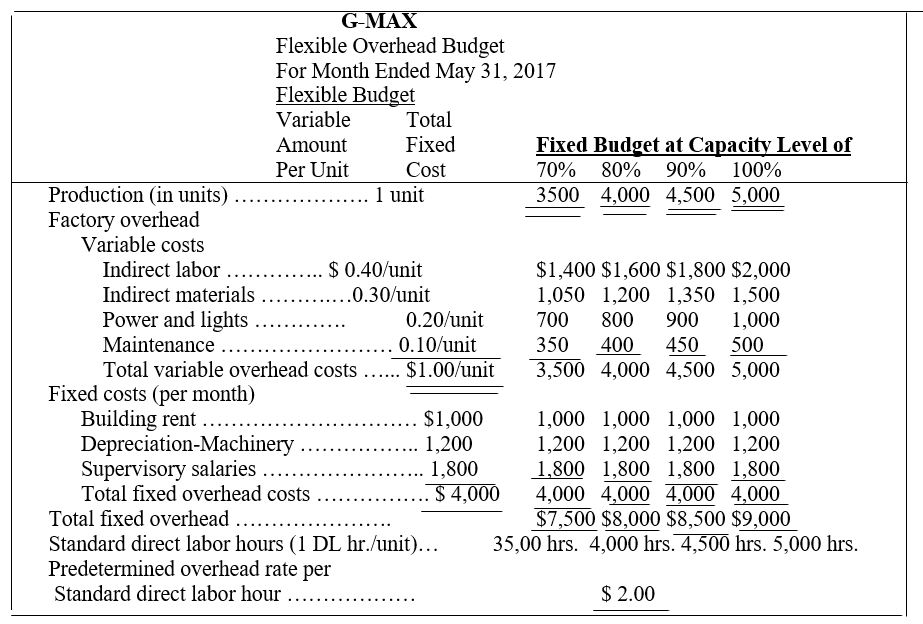

EXHIBIT 23.12 Flexible Overhead Budgets

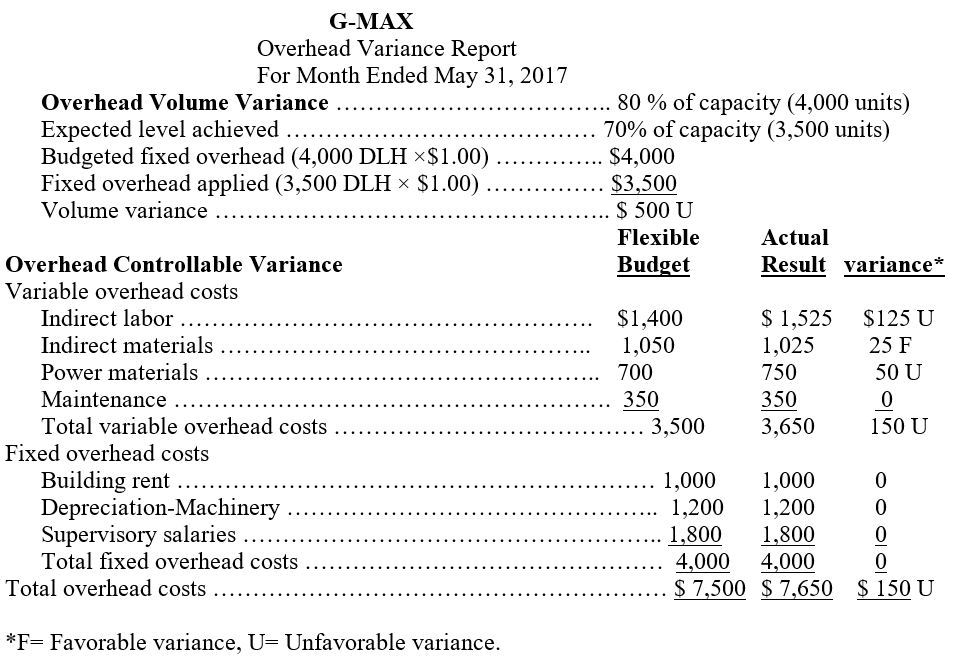

EXHIBIT 23.16 Overhead Variance Report

Flexible Budget:

A flexible budget is prepared for more than one level of production and it is flexible in nature. Flexible budget can vary according to the actual level of production. It eliminates the volume variance between the budgeted values and actual result of production.

Material Price Variance:

At the actual quantity, the difference between the actual cost and standard cost is known as material price variance.

Material Quantity Variance:

The material quantity variance measures the efficiency of a production in terms of material utilization. It is computed by determining the difference between the standard quantity to used and actual quantity of material used in the production at the standard rate.

Labor Rate Variance:

At the actual direct labor hours, the variance between the actual direct labor cost based on actual rate incurred and the budgeted direct labor cost based on standard rate is called direct labor cost variance.

Direct Labor Efficiency Variance:

Direct labor efficiency variance measures the efficiency in utilization of direct labor costs by determining the difference between the actual labor hours and the direct labor hours allowed at the standard rate.

To determine:

1. Determine the cost per unit of each variable overhead item and its total per unit costs and identify the total fixed costs per month.

2. Preparing flexible budgets showing the amounts of each variable and fixed cost at the 65%, 75% and 85% capacity levels.

3. Computation of direct materials cost variance, showing price and quantity variances.

4. Computation of direct labor cost variance, showing rate and efficiency variances.

5. Preparation of overhead variance report that shows the variances for individual items of overhead.

Explanation of Solution

Explanation:

1. The total per unit costs is $12 and the total fixed cost per month is $180,000.

2. The total overhead cost at 65%, 75%, and 85% is $336,000, $360,000, and $384,000 respectively.

3. The direct material cost variance is $15,900 (U) with unfavorable price variance of $6,900 and quantity variance of $9,000.

4. Direct labor cost variance is $10,440 (U) with unfavorable rate variance of $6,840 and efficiency variance of $3,600.

5. Suncoast Company has favorable overhead volume variance of $48,000 and unfavorable controllable variance of $4,740.

1.

| Overhead items | Variable cost per unit | Fixed cost per month |

| Variable overhead costs | ||

| Indirect materials | $1.50 | |

| Indirect labor | $6.00 | |

| Power | $1.50 | |

| Repairs and maintenance | $3.00 | |

| Total variable overhead costs | $12.00 | |

| Fixed overhead costs | ||

| Depreciation – Building | $24,000 | |

| Depreciation – Machinery | $72,000 | |

| Taxes and insurance | $18,000 | |

| Supervision | $66,000 | |

| Total fixed overhead costs | $180,000 |

2.

| SUNCOAST COMPANY Flexible Overhead Budgets For the Month Ended December 31. |

|||||

| Flexible Budget | Flexible Budget at Capacity Level of | ||||

| Variable cost per unit | Fixed cost per month | 65% | 75% | 85% | |

| Production (in units) | 1 unit | 13,000 | 15,000 | 17,000 | |

| Variable overhead costs | |||||

| Indirect materials | $1.50 | $19,500 | $22,500 | $25,500 | |

| Indirect labor | $6.00 | $78,000 | $90,000 | $102,000 | |

| Power | $1.50 | $19,500 | $22,500 | $25,500 | |

| Repairs and maintenance | $3.00 | $39,000 | $45,000 | $51,000 | |

| Total variable overhead costs | $12.00 | $156,000 | $180,000 | $204,000 | |

| Fixed overhead costs | |||||

| Depreciation – Building | $24,000 | $24,000 | $24,000 | $24,000 | |

| Depreciation – Machinery | $72,000 | $72,000 | $72,000 | $72,000 | |

| Taxes and insurance | $18,000 | $18,000 | $18,000 | $18,000 | |

| Supervision | $66,000 | $66,000 | $66,000 | $66,000 | |

| Total fixed overhead costs | $180,000 | $180,000 | $180,000 | $180,000 | |

| Total Overhead Costs | $336,000 | $360,000 | $384,000 | ||

| Predetermined overhead rate per standard direct labor hour | $16.00 | ||||

3.

Computation of direct materials cost variance, including its price and quantity variances

4.

Computation of direct labor cost variance, including its rate and efficiency variances

5.

| SUNCOAST COMPANY Overhead Variance Report For the Month Ended December 31. |

||||

| Overhead Volume Variance | ||||

| Expected production level | 75% of capacity 15,000 units | |||

| Production level achieved | 85% of capacity 17,000 units | |||

| Budgeted fixed overhead (22,500 hrs. X $16.00) | $360,000 | |||

| Fixed overhead applied (25,500 hrs. X $16.00) | $408,000 | |||

| Volume Variance | $48,000 F | |||

| Overhead Controllable Variance | Flexible Budget | Actual Results |

Variances | |

| Variable overhead costs | ||||

| Indirect materials | $22,500 | $21,600 | $900 F | |

| Indirect labor | $90,000 | $82,260 | $7,740 F | |

| Power | $22,500 | $23,100 | $600 U | |

| Repairs and maintenance | $45,000 | $46,800 | $1,800 U | |

| Total variable overhead costs | $180,000 | $173,760 | $6,240 F | |

| Fixed overhead costs | ||||

| Depreciation – Building | $24,000 | $24,000 | 0 | |

| Depreciation – Machinery | $72,000 | $75,000 | $3,000 U | |

| Taxes and insurance | $18,000 | $16,500 | $1,500 F | |

| Supervision | $66,000 | $66,000 | 0 | |

| Total fixed overhead costs | $180,000 | $181,500 | $1,500 U | |

| Total Overhead costs | $360,000 | $355,260 | $4,740 U | |

Conclusion:

The direct material pro=ice variance is $6,900 Unfavorable

The direct material quantity variance is $9,000 Unfavorable

The direct material cost variance is $15,900 Unfavorable

Want to see more full solutions like this?

Chapter 23 Solutions

Fundamental Accounting Principles

- Give me answer general accounting questionarrow_forward1: Armand Giroux (single; 0 federal withholding allowances) earned weekly gross pay of $1,500. For each period, he makes a 401(k) retirement plan contribution of 8% of gross pay. The city in which he works (he lives elsewhere) levies a tax of 1% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 0.60% of an employee's taxable pay on nonresidents. Federal income tax withholding = $ State income tax withholding = $ Local income tax withholding = $ 144.10 69.00 8.28 2: Peter Quigley (married; 8 federal withholding allowances) earned weekly gross pay of $2,350. He contributed $100 to a flexible spending account during the period. The city in which he lives and works levies a tax of 2.7% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 1.9% of an employee's taxable pay on nonresidents. Federal income tax withholding = $ State income tax withholding = $ Local income tax…arrow_forwardCheck my work mode: This sh so hat is correct or incorrect for the work you have compl it does not indicate completion. Return to questi 1.5 9 points You've collected the following information about Fender, Incorporated: Sales Net income Dividends Total debt Total equity $ 170,000 $ 12,800 $ 8,400 $ 68,000 $ 56,000 a. What is the sustainable growth rate for the company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. If it does grow at this rate, how much new borrowing will take place in the coming year, assuming a constant debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What growth rate could be supported with no outside financing at all? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. × Answer is complete but not entirely correct. a. Sustainable growth rate b.…arrow_forward

- On December 31, 2018, Blackpink Company, a financing institution lent ₱15,000,000 to YG Corp. due 3 years after. The loan is supported by an 12% note receivable. Based on the company’s initial estimates the present value of the 12 months expected credit loss (ECL) discounted at 10% is at 2,000,000. The probability of default (PD) is at 7%. Blackpink Company was able to collect interest as it became due at the end of 2019. There was no evidence of significant increase in credit risk by the end 2019 and that the receivable is determined to have “low credit risk”. There were no changes in its initial estimate of the 12 months expected credit loss either. By the end of 2020, Blackpink Company was able to collect interest as it became due. Based on available forward-looking information (determinable without undue cost or effort), however, there is evidence that there was a significant increase in credit risk by the end of 2020. Blackpink Company therefore had to change its basis…arrow_forwardOn December 31, 2018, Blackpink Company, a financing institution lent ₱15,000,000 to YG Corp. due 3 years after. The loan is supported by an 12% note receivable. Based on the company’s initial estimates the present value of the 12 months expected credit loss (ECL) discounted at 10% is at 2,000,000. The probability of default (PD) is at 7%. Blackpink Company was able to collect interest as it became due at the end of 2019. There was no evidence of significant increase in credit risk by the end 2019 and that the receivable is determined to have “low credit risk”. There were no changes in its initial estimate of the 12 months expected credit loss either. By the end of 2020, Blackpink Company was able to collect interest as it became due. Based on available forward-looking information (determinable without undue cost or effort), however, there is evidence that there was a significant increase in credit risk by the end of 2020. Blackpink Company therefore had to change its basis…arrow_forwardNeed correct answer general accounting questionarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,