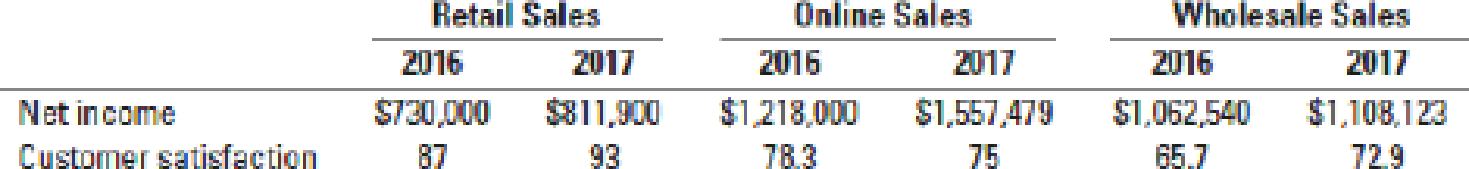

Executive compensation, balanced scorecard. Acme Company recently introduced a new bonus plan for its corporate executives. The company believes that current profitability and customer satisfaction levels are equally important to the company’s long-term success. As a result, the new plan awards a bonus equal to 0.5% of salary for each 1% increase in business unit net income or 1% increase in the business unit’s customer satisfaction index. For example, increasing net income from $1 million to $1.1 million (or 10% from its initial value) leads to a bonus of 5% of salary, while increasing the business unit’s customer satisfaction index from 50 to 60 (or 20% from its initial value) leads to a bonus of 10% of salary. There is no bonus penalty when net income or customer satisfaction declines. In 2016 and 2017, Acme’s three business units reported the following performance results:

- 1. Compute the bonus as a percent of salary earned by each business unit executive in 2017.

Required

- 2. What factors might explain the differences between improvement rates for net income and those for customer satisfaction in the three units? Are increases in customer satisfaction likely to result in increased net income right away?

- 3. Acme’s board of directors is concerned that the 2017 bonus awards may not accurately reflect the executives’ overall performance. In particular, the board is concerned that executives can earn large bonuses by doing well on one performance dimension but underperforming on the other. What changes can it make to the bonus plan to prevent this from happening in the future? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

COST ACCOUNTING

- (a) “We believe that it is important for director’s reward to be performance -related. Moreover, we expect excellent performance in both short and the long term. So we calculate bonuses on the annual profits then we have a parallel 3-year scheme which rewards directors if EPS grows by 30% over that period” Comment on above phrase. What is the challenge faced by a company in determining directors’ remuneration. b) Mr. Daniel has been a director for Air Hitam Berhad for 5 years. He has not hold any directorship in any other company. He is now 50 years old. Recently, he was charged with corporate fraud. His case is still in the court hearing and yet to be verdicted. However, due to the case, the substantial shareholders of the company which is Valiguard investment group has passed the resolution to remove him from the board of directors. Is the decision valid? Justify your argument.arrow_forwardAlternative Compensation Plans ADM Inc., an electronics manufacturer, uses growth in earnings per share (EPS) as a guideline for evaluating executive performance. ADM executives receive abonus of $5,000 for every penny increase in EPS for the year. This bonus is paid in addition to fixedsalaries ranging from $500,000 to $900,000 annually. Cygnus Corporation, a computer componentsmanufacturer, also uses EPS as an evaluation tool. Its executives receive a bonus equal to 40% oftheir salary for the year if the firm’s EPS is in the top third of a list ranking the EPS for Cygnus andits 12 competitors.Required1. Why are companies such as ADM and Cygnus switching from stock option incentives to programs morelike the ones described? What does the use of these plans by the two firms say about each firm’s competitive strategy?2. What are the weaknesses of incentive plans based on EPS?arrow_forward1. Calculate the profit margin and gross profit margin. 2. The vice-president of marketing and director of human resources have proposed that the company change its compensation of the sales force to a commission basis rather than paying a fixed salary. Given the extra incentive, they expect sales to increase by 15%. They estimate that gross profit will increase by $27,000, operating expenses by $13,500, and income tax expense by $2,700. Non-operating expense is not expected to change. Calculate the expected new gross profit and net income amounts. 3. Calculate the revised gross profit margin and profit margin.arrow_forward

- Assume that you are the president of your company and paid a year-end bonus according to the amount of net income earned during the year. When prices are rising, would you choose a FIFO or weighted average cost flow assumption? Explain, using an example to support your answer. Would your choice be the same if prices were falling? I need an example with net income for weighted averagearrow_forwardPlease show the solution.arrow_forwardAssume that you are the president of your company and paid a year-end bonus according to the amount of net income earned during the year. When prices are rising, would you choose a FIFO or weighted average cost flow assumption? Explain, using an example to support your answer. Would your choice be the same if prices were falling?arrow_forward

- The financial manager for "ERR" industrial Company would extend the credit terms from "net 30" to "net 45" in order to stimulate credit sales. 'ERR' Company also benefits from relaxing of terms from its suppliers from "net 30" to "net 35". The manager is wondering how to estimate the financial impact of these alternatives would have on the shareholder's wealth. The financial manager estimates that the daily sales increase at a growth rate equals 10% following the extension of DSO. You gathered the following information:Purchase amount = 40% of sales amount Annual sales amount = $31,025,000 The annual cost of capital = 10% Inventory turnover =18.25 1- Calculate the daily NPV of the current terms. 2- Calculate the daily NPV of the proposed terms. 3- Based on your own calculations, what is your recommendation? Why? 4- Calculate the NPVCCP of the present terms. Interpret. 5- Calculate the ANPVCCP-aggregate of the Company. Interpret.arrow_forwardAs we review our people management practices, it's essential to evaluate the return on the money we spend. Last year we spent $1100 on training and development per employee. From our internal research, these expenditures were tied to an increase of 3.3% in employee productivity, with every 1% productivity gain resulting in a profit per employee increase of $650. What's the return on our investment in last year's training and development investments? Rich Rich Carter Board Member, Human Resources | Andrews Corporation 95.0% 21.4% 104.5% -40.9% Respondarrow_forwarde) Briefly discuss the consequences and meaning of the Jump at Point A and the cap at Point B in the graph below. A Typical Executive Compensation Plan* Salary & Bonus B Сар Hurdle Salary 80% 120% Performance Measure = Target * Adapted from Jensen's graphic, p. 97. When hurdle A is reached the manager receives a bonus. The bonus increases until it hits the cap B, but the kinks in the line create incentives to game the system. Adapted from: Jensen's graphic, p.97.arrow_forward

- The managers of the XYZ clubs, who have the authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's X Club reported the following results for the past year: Sales Net operating income Average operating assets $ 730,000 $ 13, 140 $ 100,000 The following questions are to be considered independently. 2. Assume that the manager of the club is able to increase sales by $73,000 and that, as a result, net operating income increases by $5,329. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) %arrow_forwardPlease help with this question.arrow_forwardZNet Co. is a web-based retail company. The company reports the following for the past year. The company’s CEO believes that sales for next year will increase by 20% and both profit margin (%) and the level of average invested assets will be the same as for the past year. 1. Compute return on investment for the past year. 2. Compute profit margin for the past year. 3. If the CEO’s forecast is correct, what will return on investment equal for next year? 4. If the CEO’s forecast is correct, what will investment turnover equal for next year? Sales . $5,000,000 Operating income . $1,000,000 Average invested assets . $12,500,000arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,