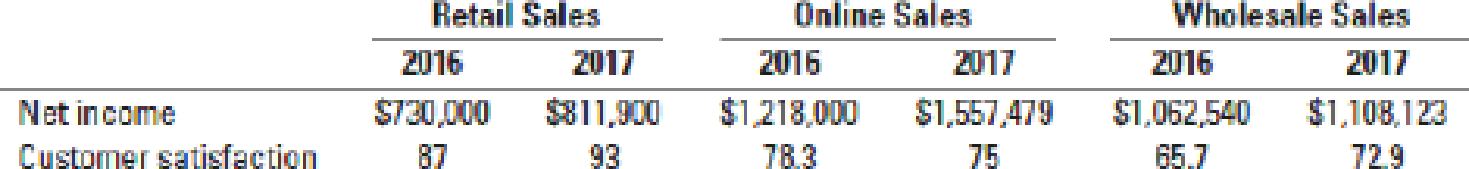

Executive compensation, balanced scorecard. Acme Company recently introduced a new bonus plan for its corporate executives. The company believes that current profitability and customer satisfaction levels are equally important to the company’s long-term success. As a result, the new plan awards a bonus equal to 0.5% of salary for each 1% increase in business unit net income or 1% increase in the business unit’s customer satisfaction index. For example, increasing net income from $1 million to $1.1 million (or 10% from its initial value) leads to a bonus of 5% of salary, while increasing the business unit’s customer satisfaction index from 50 to 60 (or 20% from its initial value) leads to a bonus of 10% of salary. There is no bonus penalty when net income or customer satisfaction declines. In 2016 and 2017, Acme’s three business units reported the following performance results:

- 1. Compute the bonus as a percent of salary earned by each business unit executive in 2017.

Required

- 2. What factors might explain the differences between improvement rates for net income and those for customer satisfaction in the three units? Are increases in customer satisfaction likely to result in increased net income right away?

- 3. Acme’s board of directors is concerned that the 2017 bonus awards may not accurately reflect the executives’ overall performance. In particular, the board is concerned that executives can earn large bonuses by doing well on one performance dimension but underperforming on the other. What changes can it make to the bonus plan to prevent this from happening in the future? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

- Dont use ai solution general Accounting questionarrow_forwardNeed correct answer general Accountingarrow_forwardYear 0123 Cash Flow -$ 19,000 11,300 10,200 6,700 a. What is the profitability index for the set of cash flows if the relevant discount rate is 11 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. b. What is the profitability index for the set of cash flows if the relevant discount rate is 16 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. c. What is the profitability index for the set of cash flows if the relevant discount rate is 23 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. a. Profitability index b. Profitability index c. Profitability indexarrow_forward

- Sol This question answerarrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What is the impact on Abercrombie & Fitch's financial statements from the write-down of its logo-adorned merchandise…arrow_forwardTherefore the final answerarrow_forward

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning