INTERM.ACCT.:REPORTING...-CENGAGENOWV2

3rd Edition

ISBN: 9781337909358

Author: WAHLEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 22, Problem 11P

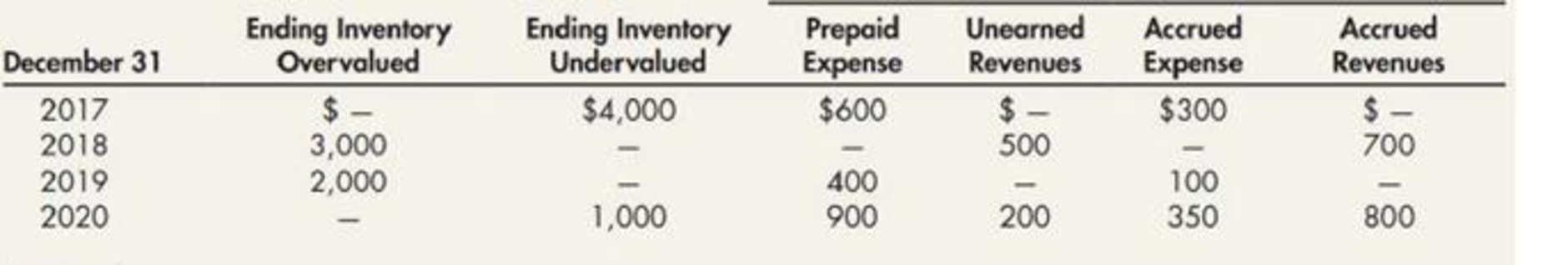

A review of Anderson Corporation’s books indicates that the errors and omissions pertaining to the

The net income per the books is: 2017, $10,000; 2018, $12,000; 2019, $15,000; and 2020, $20,000. No dividends were declared during these years and no adjustments were made to

Omissions

Required:

Determine the correct net income for the years 2017, 2018, 2019, and 2020, and the adjusted balance sheet accounts as of December 31, 2020. Ignore possible income tax effects.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Solve this financial accounting problem

Need answer the financial accounting question not use ai and chatgpt

What is the material price variance?

Chapter 22 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

Ch. 22 - Prob. 1GICh. 22 - Prob. 2GICh. 22 - Prob. 3GICh. 22 - What steps are necessary to apply the...Ch. 22 - Prob. 5GICh. 22 - Prob. 6GICh. 22 - Prob. 7GICh. 22 - Prob. 8GICh. 22 - Define a change in estimate. What is the proper...Ch. 22 - Prob. 10GI

Ch. 22 - How is a change in depreciation method accounted...Ch. 22 - Describe a change in a reporting entity. How does...Ch. 22 - Prob. 13GICh. 22 - Prob. 14GICh. 22 - Prob. 15GICh. 22 - Prob. 16GICh. 22 - Prob. 17GICh. 22 - Prob. 18GICh. 22 - Prob. 19GICh. 22 - Prob. 20GICh. 22 - The cumulative effect of an accounting change...Ch. 22 - When a change in accounting principle is made...Ch. 22 - Prob. 3MCCh. 22 - A change in the expected service life of an asset...Ch. 22 - During 2019, White Company determined that...Ch. 22 - Generally, how should a change in accounting...Ch. 22 - On January 2, 2017, Garr Company acquired...Ch. 22 - A company has included in its consolidated...Ch. 22 - Shannon Corporation began operations on January 1,...Ch. 22 - Shannon Corporation began operations on January 1,...Ch. 22 - Prob. 1RECh. 22 - Heller Company began operations in 2019 and used...Ch. 22 - Refer to RE22-2. Assume the pretax cumulative...Ch. 22 - Refer to RE22-2. Assume Heller Company had sales...Ch. 22 - Bloom Company had beginning unadjusted retained...Ch. 22 - Suppose that Blake Companys total pretax...Ch. 22 - Bliss Company owns an asset with an estimated life...Ch. 22 - At the end of 2019, Framber Company received 8,000...Ch. 22 - At the end of 2019, Cortex Company failed to...Ch. 22 - At the end of 2019, Jayrad Company paid 6,000 for...Ch. 22 - At the end of 2019, Manny Company recorded its...Ch. 22 - Abrat Company failed to accrue an allowance for...Ch. 22 - The following are independent events: a. Changed...Ch. 22 - Prob. 2ECh. 22 - The following are independent events: a. A...Ch. 22 - Change in Inventory Cost Flow Assumption At the...Ch. 22 - Fava Company began operations in 2018 and used the...Ch. 22 - Berg Company began operations on January 1, 2019,...Ch. 22 - Prob. 7ECh. 22 - In 2020, Frost Company, which began operations in...Ch. 22 - Gundrum Company purchased equipment on January 1,...Ch. 22 - Prob. 10ECh. 22 - On January 1, 2014, Klinefelter Company purchased...Ch. 22 - The following are independent errors made by a...Ch. 22 - The following are independent errors made by a...Ch. 22 - Refer to the information in E22-13. Required:...Ch. 22 - The following are independent errors: a. In...Ch. 22 - Dudley Company failed to recognize the following...Ch. 22 - Prob. 1PCh. 22 - Prob. 2PCh. 22 - Koopman Company began operations on January 1,...Ch. 22 - Schmidt Company began operations on January 1,...Ch. 22 - Prob. 5PCh. 22 - Kraft Manufacturing Company manufactures two...Ch. 22 - Jackson Company has decided to issue common stock...Ch. 22 - At the beginning of 2020, Holden Companys...Ch. 22 - At the end of 2020, while auditing Sandlin...Ch. 22 - At the beginning of 2020, Tanham Company...Ch. 22 - A review of Anderson Corporations books indicates...Ch. 22 - Prob. 12PCh. 22 - Gray Companys financial statements showed income...Ch. 22 - Prob. 14PCh. 22 - There are three types of accounting changes:...Ch. 22 - Prob. 2CCh. 22 - Berkeley Company, a manufacturer of many different...Ch. 22 - When the FASB issues a new generally accepted...Ch. 22 - It is important in accounting theory to be able to...Ch. 22 - Prob. 6CCh. 22 - Prob. 7CCh. 22 - Prob. 8CCh. 22 - Prob. 9CCh. 22 - Sometimes a business entity may change its method...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello experts please answer the financial accounting questionarrow_forwardhello tutor please help mearrow_forwardWalker Manufacturing uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs. Last year, the company's estimated manufacturing overhead was $1,800,000, and its estimated level of activity was 60,000 direct labor-hours. The company's direct labor wage rate is $15 per hour. Actual manufacturing overhead amounted to $1,720,000, with actual direct labor cost of $930,000. For the year, manufacturing overhead was_.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License