Loose Leaf for Fundamental Accounting Principles

23rd Edition

ISBN: 9781259687709

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 21, Problem 4E

Exercise 21-4

Measurement of cost behavior using a scatter diagram

P1

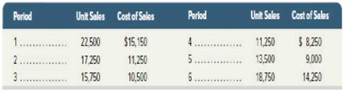

A company reports the Mowing information about its unit sales and its cost of sales. Each unit sells for $500. Use these data to prepare a scatter diagram.

Draw an estimated line of cost behavior and determine whether the cost appears to be variable, fixed, or mixed.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you explain this general accounting question using accurate calculation methods?

I need help finding the accurate solution to this general accounting problem with valid methods.

I am looking for help with this general accounting question using proper accounting standards.

Chapter 21 Solutions

Loose Leaf for Fundamental Accounting Principles

Ch. 21 - Prob. 1DQCh. 21 - Prob. 2DQCh. 21 - When output volume increases, do fixed costs per...Ch. 21 - Prob. 4DQCh. 21 - Prob. 5DQCh. 21 - Describe the contribution margin ratio in...Ch. 21 - Prob. 7DQCh. 21 - Prob. 8DQCh. 21 - Prob. 9DQCh. 21 - Prob. 10DQ

Ch. 21 - How does assuming that operating activity occurs...Ch. 21 - Prob. 12DQCh. 21 - Prob. 13DQCh. 21 - Prob. 14DQCh. 21 - Prob. 15DQCh. 21 - Prob. 16DQCh. 21 - Prob. 17DQCh. 21 - Prob. 18DQCh. 21 - Prob. 19DQCh. 21 - Prob. 20DQCh. 21 - Prob. 21DQCh. 21 - Prob. 22DQCh. 21 - Prob. 1QSCh. 21 - Prob. 2QSCh. 21 - Prob. 3QSCh. 21 - Prob. 4QSCh. 21 - Prob. 5QSCh. 21 - Prob. 6QSCh. 21 - Prob. 7QSCh. 21 - Prob. 8QSCh. 21 - Prob. 9QSCh. 21 - Prob. 10QSCh. 21 - Prob. 11QSCh. 21 - Prob. 12QSCh. 21 - Prob. 13QSCh. 21 - Prob. 14QSCh. 21 - Prob. 15QSCh. 21 - Prob. 16QSCh. 21 - Prob. 17QSCh. 21 - Prob. 18QSCh. 21 - Prob. 19QSCh. 21 - Prob. 20QSCh. 21 - Prob. 21QSCh. 21 - Prob. 1ECh. 21 - Prob. 2ECh. 21 - Prob. 3ECh. 21 - Exercise 21-4 Measurement of cost behavior using a...Ch. 21 - Prob. 5ECh. 21 - Prob. 6ECh. 21 - Prob. 7ECh. 21 - Prob. 8ECh. 21 - Prob. 9ECh. 21 - Prob. 10ECh. 21 - Prob. 11ECh. 21 - Prob. 12ECh. 21 - Prob. 13ECh. 21 - Prob. 14ECh. 21 - Prob. 15ECh. 21 - Prob. 16ECh. 21 - Prob. 17ECh. 21 - Prob. 18ECh. 21 - Prob. 19ECh. 21 - Prob. 20ECh. 21 - Prob. 21ECh. 21 - Prob. 22ECh. 21 - Prob. 23ECh. 21 - Prob. 24ECh. 21 - Prob. 25ECh. 21 - Prob. 26ECh. 21 - Prob. 27ECh. 21 - Prob. 1APSACh. 21 - Prob. 2APSACh. 21 - Prob. 3APSACh. 21 - Prob. 4APSACh. 21 - Prob. 5APSACh. 21 - Prob. 6APSACh. 21 - Prob. 7APSACh. 21 - Prob. 1BPSBCh. 21 - Prob. 2BPSBCh. 21 - Prob. 3BPSBCh. 21 - Prob. 4BPSBCh. 21 - Prob. 5BPSBCh. 21 - Prob. 6BPSBCh. 21 - Prob. 7BPSBCh. 21 - Prob. 21SPCh. 21 - Prob. 1BTNCh. 21 - Prob. 2BTNCh. 21 - Prob. 3BTNCh. 21 - Prob. 4BTNCh. 21 - Prob. 5BTNCh. 21 - Prob. 6BTNCh. 21 - Prob. 7BTNCh. 21 - Prob. 8BTNCh. 21 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting Information Systems

Finance

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Markup and Markdown; Author: GreggU;https://www.youtube.com/watch?v=EFtodgI46UM;License: Standard Youtube License