Concept explainers

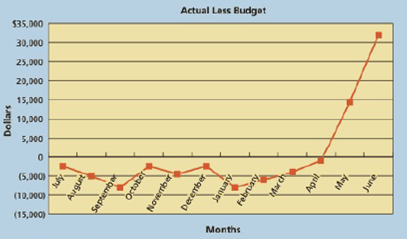

Communication

The city of .Milton has an annual budget cycle that begins on July 1 and ends on June 30. At the beginning of each budget year, an annual budget is established for each derailment. The annual budget is divided equally among the 12 months to provide a constant monthly italic budget. On June 30, all unspent budgeted monies for the budget year from the various city departments must be "returned" to the General Fund. Thus, if department heads tail to use the It budget by year-end, they will lose it. A budget analyst prepared a chart of the difference between the monthly actual and budgeted amounts for all departments in a recent fiscal year. The chart wav as follows:

Write a memo to Stacy Poindexter, the city manager, interpreting the chart and suggesting improvements to the budgeting system.

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

CengageNOWv2, 2 terms Printed Access Card for Warren/Reeve/Duchac’s Financial & Managerial Accounting, 14th

- Marvin Company is a subsidiary of Hughes Corp. The controller believes that the yearly allowance for doubtful accounts for Marvin should be 8% of gross accounts receivable. Given the recession and the high interest rate environment, the president, nervous that the parent company might expect the subsidiary company to sustain its 10% growth rate, suggests that the controller increase the allowance for doubtful accounts to 9%. The president thinks that the lower net income, which reflects a 6% growth rate, will be a more sustainable rate for Marvin Company. On the basis of the case above: In a recessionary environment with tight credit and high interest rates, What steps Marvin Company might consider to improve the accounts receivable situation? Evaluate each step identified in terms of the risks and costs involved. Should the controller be concerned with Marvin Company's growth rate in estimating the allowance? Does the president's request pose an ethical dilemma for the controller?…arrow_forwardPlease provide answer this financial accounting questionarrow_forwardFinancial Accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning