The current price of Estelle Corporation stock is $25. In each of the next two years, this stock price will either go up by 20% or go down by 20%. The stock pays no dividends. The one-year risk-free interest rate is 6% and will remain constant. Using the Binomial Model, calculate the price of a one-year call option on Estelle stock with a strike price of $25.

To determine: The price of a one year call option on ET stock.

Introduction: A binomial model portrays the development of irregular variables over a progression of time steps, relegating specified probabilities to increase or decrease in the variable. The binomial option pricing model makes the improving supposition that, toward the finish of every period, the price of stocks has just two conceivable values.

Answer to Problem 1P

Explanation of Solution

Determine the increase or decrease in the stock price.

Therefore, the stock price either increases to $30 or decreases to $20

Here

S – Denotes the current stock price

K – Denotes the strike price

C – Denotes the call price

B – Denotes the risk-free investment or initial investment in the portfolio

Su – Denotes the probability of increase in stock price (the price to go up)

Sd – Denotes the probability of decrease in stock price next period (the price to go down)

rf – Denotes the risk-free rate

Cu – Denotes the price of the call option if the stock price increases (the price to go up)

Cd – Denotes the price of the call option if the stock price decreases (the price to go down)

Δ – Denotes the shares of stock in the portfolio or the sensitivity of option price to stock price

Determine the option payoff:

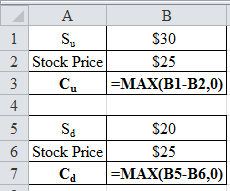

Using Excel function =MAX, the option payoff is determined as follows:

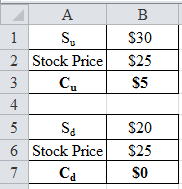

Excel spreadsheet:

Excel workings:

Therefore, the option payoff either increases to $5 or decreases to $0.

Determine the shares of stock in the replicating portfolio:

Therefore, the share of stock in the replicating portfolio is 0.5.

Determine the risk-free investment or initial investment in the portfolio:

Therefore, the risk-free investment or initial investment in the portfolio is -9.4340.

Determine the price of a one year call option on ET stock:

Therefore, the price of a one year call option on ET stock is $3.07.

Want to see more full solutions like this?

Chapter 21 Solutions

Corporate Finance Plus MyLab Finance with Pearson eText -- Access Card Package (4th Edition) (Berk, DeMarzo & Harford, The Corporate Finance Series)

Additional Business Textbook Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Foundations Of Finance

Marketing: An Introduction (13th Edition)

Financial Accounting, Student Value Edition (4th Edition)

- The current price of Natasha Corporation stock is $6.39. In each of the next two years, this stock price can either go up by $2.50 or go down by $2.00. The stock pays no dividends. The one-year risk-free interest rate is 3.4% and will remain constant. Using the Binomial Model, calculate the price of a two-year call option on Natasha stock with a strike price of $7.00.arrow_forwardThe current price of MMX Corporation stock is $10. In each of the next two years, this stock price can either go up by $3.00 or go down by $2.00. MMX stock pays no dividends. The one-year risk-free interest rate is 5% and will remain constant. Using the binomial pricing model, calculate the price of a two-year call option on MMX stock with a strike price of $9. PLease answer with solutionarrow_forwardThe current price of Natasha Corporation stock is $5.68. In each of the next two years, this stock price can either go up by $2.50 or go down by $2.00. The stock pays no dividends. The one-year risk-free interest rate is 3.8% and will remain constant. Using the Binomial Model, calculate the price of a two-year put option on Natasha stock with a strike price of $7.00. The price of the two-year put is $ (Round to the nearest cent.)arrow_forward

- The current price of XL Corporation stock is $40. In each of the next two years, this stock price can either go up by $15.00 or go down by $15.00. XL stock pays no dividends. The one-year risk-free interest rate is 15% and will remain constant. Using the binomial pricing model, calculate the price of a two-year American straddle option on XL stock with a strike price of $40.arrow_forwardThe current price of KD Industries stock is $20. In the next year the stock price will either go up by 20% or go down by 20%. KD pays no dividends. The one-year risk-free rate is 5% and will remain constant. Using the binomial pricing model, the calculated price of a one-year put option on KD stock with a strike price of $20 is closest to:arrow_forwardThe current price of a stock is $22, and at the end of one year its price will be either $29 or $15. The annual risk-free rate is 3%, based on daily compounding. A 1-year call option on the stock, with an exercise price of $22, is available. Based on the binominal model, what is the option's value?arrow_forward

- In excel, please solve the following problem... The current price of Natasha Corporation stock is $ 5.92. In each of the next two years, this stock price can either go up by $2.50 or go down by $ 2.00. The stock pays no dividends. The one-year risk - free interest rate is 3.7% and will remain constant. Using the Binomial Model, calculate the price of a two-year call option on Natasha stock with a strike price of $7.00. What is the price of the two year call option?arrow_forwardThe current price of a stock is $20, and at the end of one year its price will be either $22 or $18. The annual risk-free rate is 2.0% (use daily compounding with 365 days/year), based on daily compounding. A 1-year call option on the stock, with an exercise price of $19, is available. Based on the binominal model, what is the option's value?(Please Show Work)arrow_forwardThe stock price of Trollhätan Corporation is $90. It has a volatility of 40% per year. The one- year risk-free interest rate is 5% and will remain constant in the future, a) Using a three (3) step binomial tree, apply the risk-neutral valuation approach to calculate the price of a one -year call option on the stock of Trollhätan Corporation with a strike price of $70.arrow_forward

- The current price of a stock is $21. In 1 year, the price will be either $26 or $16. The annual risk-free rate is 5%. Find the price of a call option on the stock that has a strike price of $22 and that expires in 1 year. (Hint: Use daily compounding.) Assume a 365-day year. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardDo it correctly step by step.arrow_forwardThe current price of a stock is $20. In 1 year, the price will be either $26 or$16. The annual risk-free rate is 5%. Find the price of a call option on thestock that has a strike price of $21 and that expires in 1 year. (Hint: Use dailycompounding.)arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT