Concept explainers

Karen Johnson, CFO for Raucous Roasters (RR), a specialty coffee manufacturer, is rethinking her company’s working capital policy in light of a recent scare she faced when RR’s corporate banker, citing a nationwide credit crunch, balked at renewing RR’s line of credit. Had the line of credit not been renewed, RR would not have been able to make payroll, potentially forcing the company out of business. Although the line of credit was ultimately renewed, the scare has forced Johnson to examine carefully each component of RR’s working capital to make sure it is needed, with the goal of determining whether the line of credit can be eliminated entirely. In addition to (possibly) freeing RR from the need for a line of credit, Johnson is well aware that reducing working capital will improve

Historically, RR has done little to examine working capital, mainly because of poor communication among business functions. In the past, the production manager resisted Johnson’s efforts to question his holdings of raw materials, the marketing manager resisted questions about finished goods, the sales staff resisted questions about credit policy (which affects accounts receivable), and the treasurer did not want to talk about the cash and securities balances. However, with the recent credit scare, this resistance has become unacceptable and Johnson has undertaken a company-wide examination of cash, marketable securities, inventory, and accounts receivable levels.

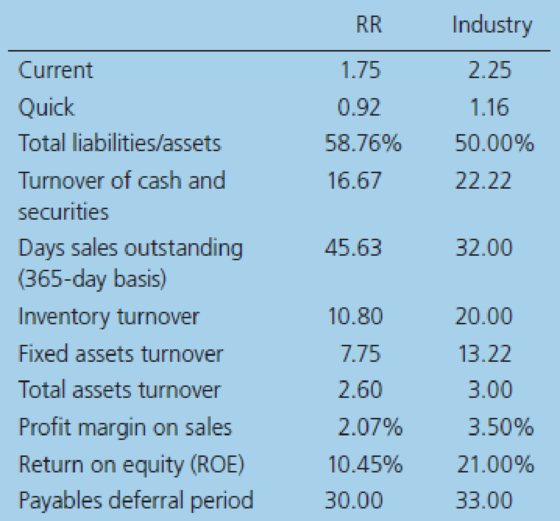

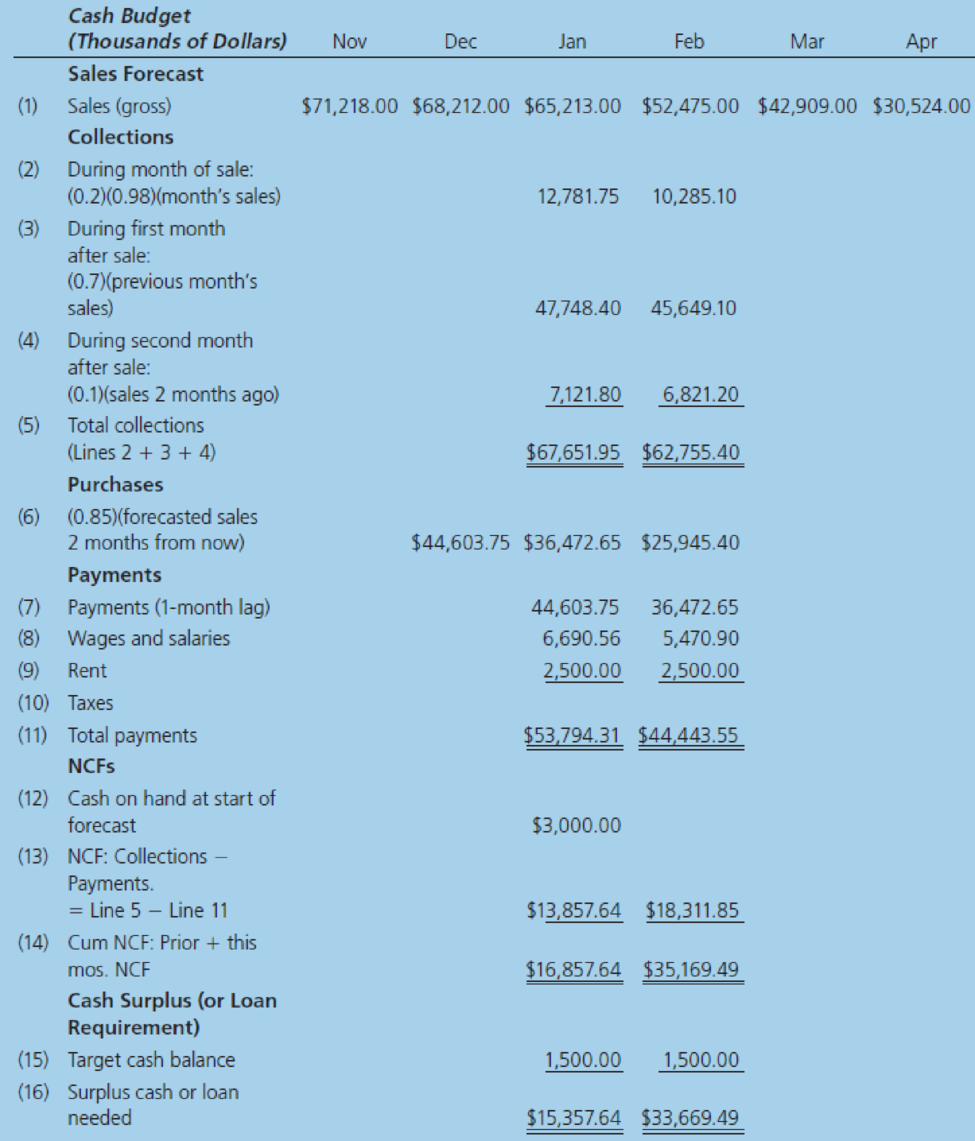

Johnson also knows that decisions about working capital cannot be made in a vacuum. For example, if inventories could be lowered without adversely affecting operations, then less capital would be required, and free cash flow would increase. However, lower raw materials inventories might lead to production slowdowns and higher costs, and lower finished goods inventories might lead to stockouts and loss of sales. So, before inventories are changed, it will be necessary to study operating as well as financial effects. The situation is the same with regard to cash and receivables. Johnson has begun her investigation by collecting the ratios shown here. (The partial cash budget shown after the ratios is used later in this mini case.)

Johnson plans to use the preceding ratios as the starting point for discussions with RR’s operating team. Based on the data, does RR seem to be following a relaxed, moderate, or restricted current asset usage policy?

Trending nowThis is a popular solution!

Chapter 21 Solutions

Intermediate Financial Management (MindTap Course List)

- Answer should be match in options. Many experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer.arrow_forwardplease select correct option of option will not match please skip dont give wrong answe Answer should be match in options. Many experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forwardThe YTMs on benchmark one-year, two-year, and three-year annual pay bonds that are priced at par are listed in the table below. Bond Yield 1-year 2.39 2-year 3.11 3-year 3.52 What is the three-year spot rate for no-arbitrage pricing? Enter answer in percents.arrow_forward

- Answers for all the questionsarrow_forwardHello experts Answer should be match in options. Many experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forward3. Owen expects to receive $20,000 at the beginning of next year from a trust fund. If a bank loans money at an interest rate of 7.5%, how much money can he borrow from the bank based on this information? A. $12879.45 B. $12749.67 C. $15567.54 D. $174537.34arrow_forward

- TASK DESCRIPTION Children educatio Personali Cross- n ty cultural Spouse's willingne allowanc ss to travel Spouseoverseas job assistanc compete Prior ncies internati onal experienc Age Host country housing assistanc Income tax equalisati on policy Overseas health care plan Length of the foreign assignme Career nt and repatriati Receptivity to Internation al Careers Family status Gender Marital status Educatio n Destinati Opportun on on Company ities for country planning culture career support (Tarique et al., 2015) Tarique et al. (2015) developed the receptivity to international careers framework. Reflecting on generational differences in contemporary organisations, you are required to evaluate this model critically by addressing the following: 1. Identify the factors that are more important to Gen X, Gen Y, and Gen Z in their receptivity to international assignments. (1,500 words) 2. Critically discusses how factors such as culture, personality and skills/experience may impact…arrow_forwardListen Answer should be match in options. Many experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forwardPlease Answer should be match in options. Many experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forward

- Answer should be match in options. Many experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forwardToodles Inc. had sales of $1,840,000. administrative and selling expenses, and depreciation expenses were Cost of goods sold, $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.) Arrange the financial information for Toodles Inc. in statement and compute its OCF? an incomearrow_forwardFootfall Manufacturing Ltd. reports information at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on 2 net sales) Inventory turnover ratio 1.25 Fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% Gross profit margin 25% Return on investment 2% the following financial Use the given information to fill out the templates for income statement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year ending December 31, 20XX (in $) Sales 100,000 Cost of goods sold Gross profit Other expenses Earnings before Lax Tax @50% Earnings tax afterarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning