Concept explainers

Profitability strategies

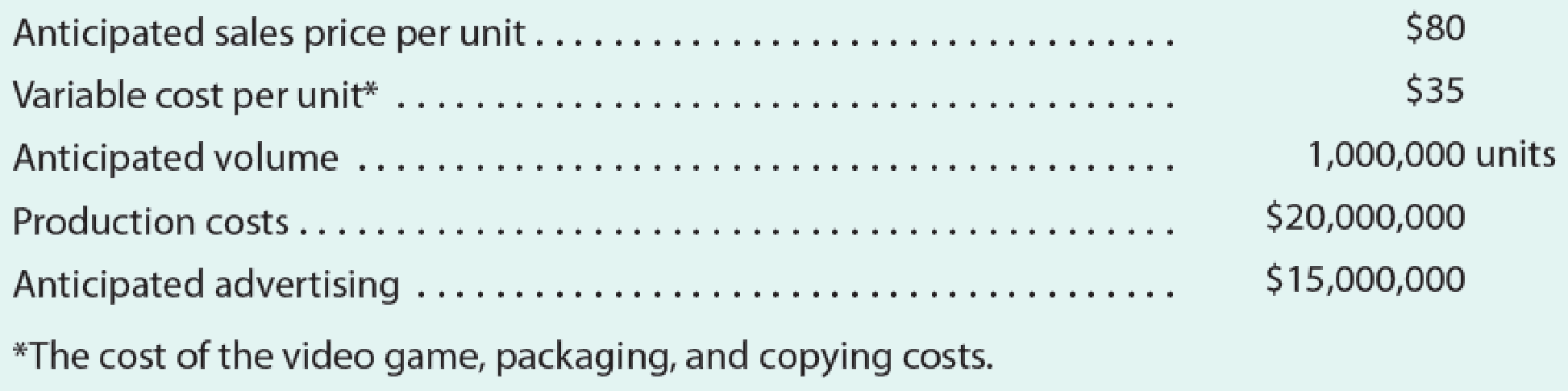

Somerset Inc. has finished a new video game, Snowboard Challenge. Management is now considering its marketing strategies. The following information is available:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

James: I think we need to think of some way to increase our profitability. Do you have any ideas?

Thomas: Well, I think the best strategy would be to become aggressive on price.

James: How aggressive?

Thomas: If we drop the price to $60 per unit and maintain our advertising budget at $15,000,000, I think we will generate total sales of 2,000,000 units.

James: I think that’s the wrong way to go. You’re giving up too much on price. Instead, I think we need to follow an aggressive advertising strategy.

Thomas: How aggressive?

James: If we increase our advertising to a total of $25,000,000, we should be able to increase sales volume to 1,400,000 units without any change in price.

Thomas: I don’t think that’s reasonable. We’ll never cover the increased advertising costs.

Which strategy is best: Keep the price and advertising budget as set, follow the advice of Thomas Seymour, or follow the advice of James Hamilton?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Financial And Managerial Accounting

- What does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forwardWhat is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forwardWhat are the three main financial statements in accounting?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning