1.

Construct a cost-volume-profit chart indicating the break-even sales for last year, and verify the answer using the break-even equation.

1.

Explanation of Solution

Cost-Volume-Profit Analysis: It is a method followed to analyze the relationship between the sales, costs, and the related profit or loss at various levels of units sold. In other words, it shows the effect of the changes in the cost and the sales volume on the operating income of the company.

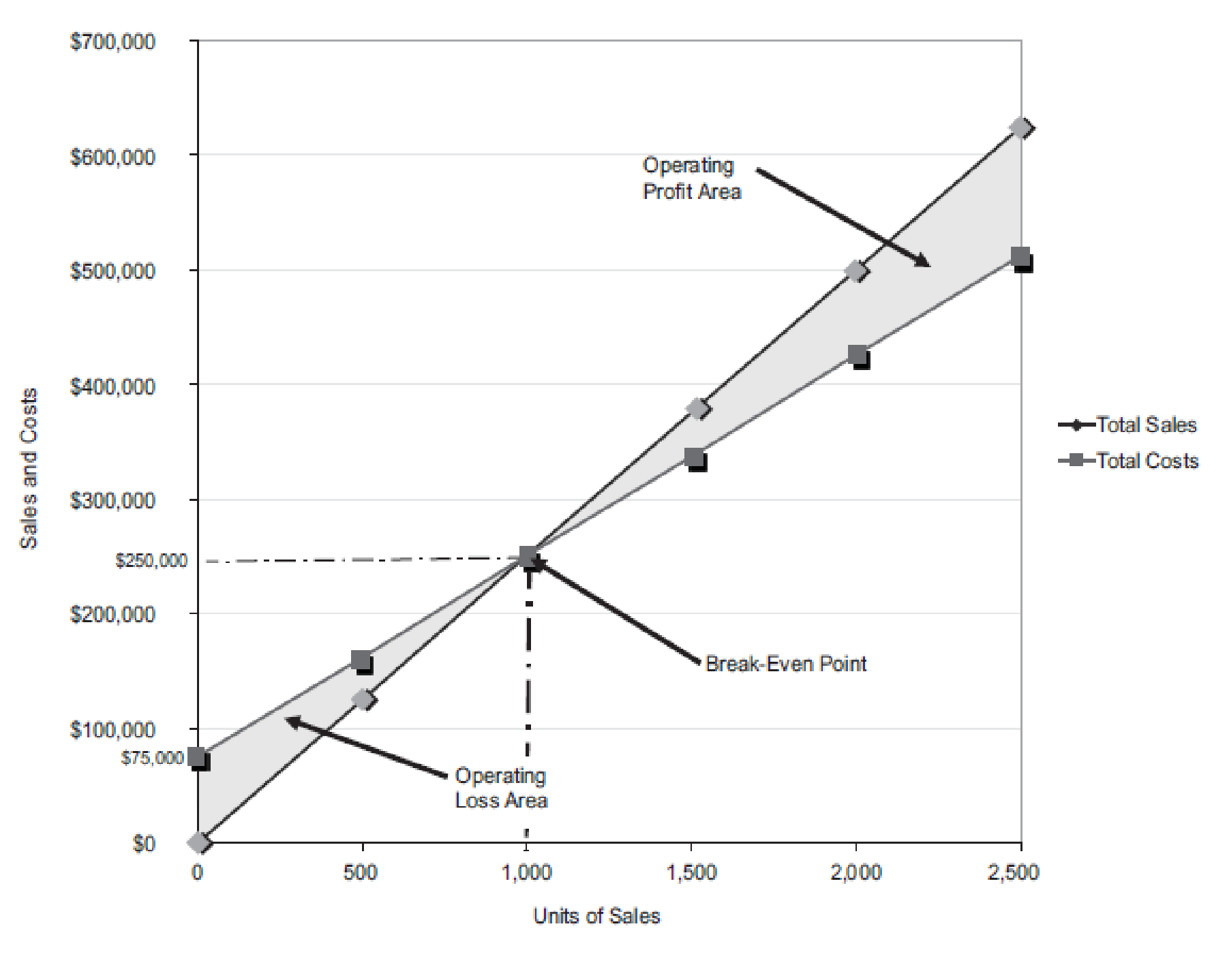

Construct a cost-volume-profit chart indicating the break-even sales for last year.

Figure (1)

The volume in units of sales is shown on the horizontal axis. The maximum relevant range is 2,500 units. The sales and the total costs (fixed cost and variable cost) in dollars is shown on the vertical axis. The maximum relevant range of sales and total costs is $700,000.

The total sales line is drawn right upward by connecting the first point at $0 to the second point at $625,000

The total cost line is drawn right upward by connecting the first point at $75,000 (fixed cost) on the vertical axis to the second point at $512,500

The break-even point is the intersection point where the total sales line and total cost line meet. The vertical dotted line drawn downward from the intersection point reaches at 1,000 units. It indicates the break-even sales (units). The horizontal line drawn to the left towards the vertical axis reaches at $250,000. It indicates the break-even sales (dollars).

The operating profit area is the area where the total sales line exceeds the total cost line. However, the operating loss area is the area where the total cost exceeds the total sales line.

Verify the answer using the break-even equation as follows:

Determine the break-even sales in units.

Fixed cost =$75,000

Contribution margin per unit =$75 per unit (1)

Determine the break-even sales in dollars.

Fixed cost =$75,000

Contribution margin ratio =30% (2)

Working note (1):

Compute the contribution margin per unit.

Selling price per unit =$250 per unit

Variable cost per unit =$175 per unit

Working note (2):

Determine the contribution margin ratio.

Contribution margin =$75 per unit (1)

Selling price per unit =$250 per unit

2(A)

Compute the income from operations for last year.

2(A)

Explanation of Solution

Compute the income from operations for last year as follows:

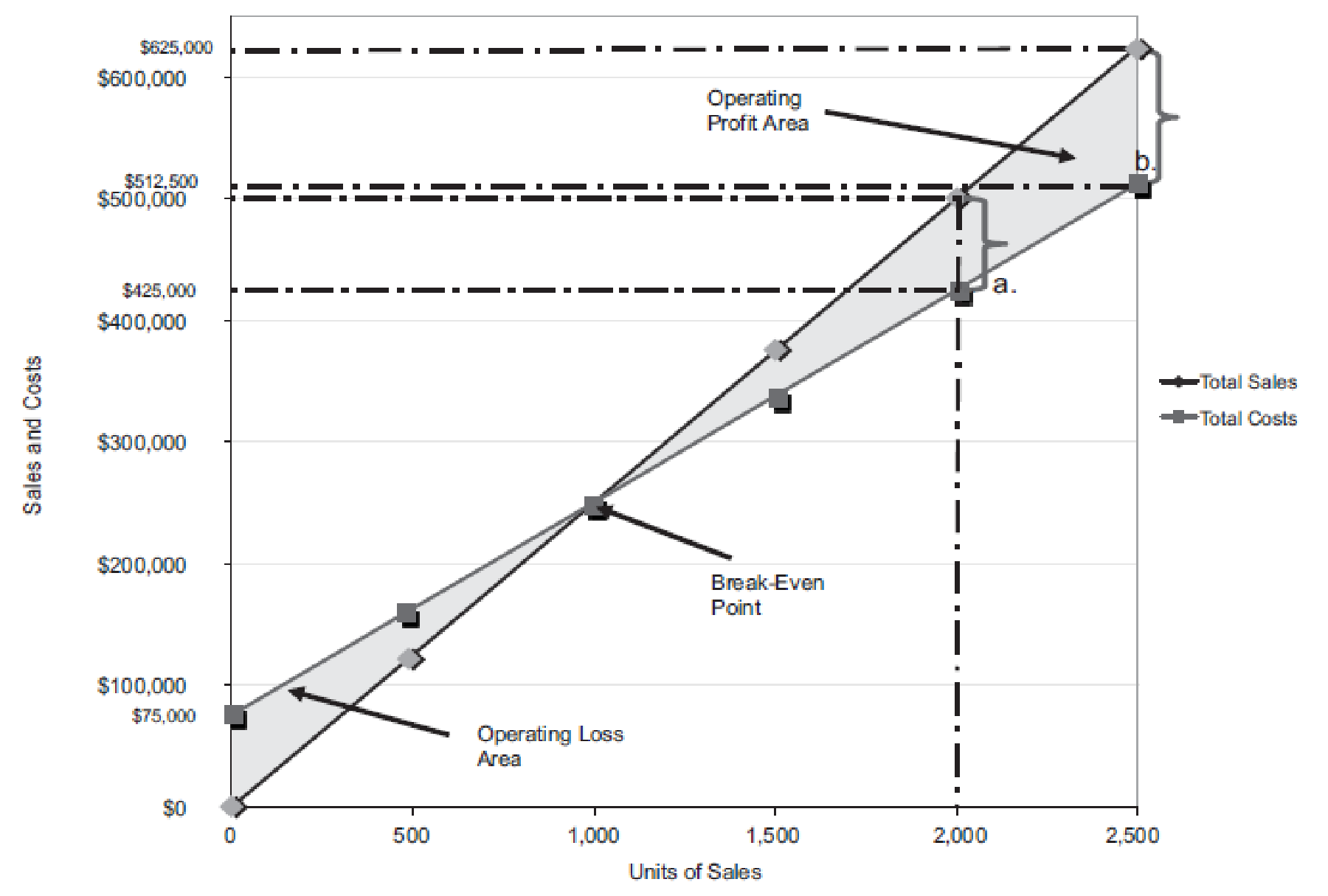

Figure (2)

Last year, the number of units sold is 2,000 units (3). The total sales is $500,000. The total cost is

Similarly, a dotted line is drawn from the total cost at $425,000 on the vertical axis towards the right and a dotted line is drawn upward for the 2,000 units sold from the horizontal axis. The two dotted line meet at a point which indicates the point of total cost at 2,000 units.

The dotted line from sales is above the dotted line for total cost. This indicates the income from operations. Thus, the area in between the two dotted lines is the income from operations of

Verify the answers using the mathematical approach to cost-volume-profit analysis.

Determine the income from operations for the last year.

| Determine the income from operations for 2,000 units | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 500,000 | |

| Less: Fixed costs | 75,000 | |

| Variable costs | 350,000 | (425,000) |

| Income from operations | 75,000 | |

Table (1)

Working note (3):

Determine the number of units sold.

Sales =$500,000

Selling price per unit =$250 per unit

2(B)

Compute the maximum income from operations realized during the year.

2(B)

Explanation of Solution

The maximum relevant range for number of units to be sold is 2,500 units. Thus, the total sale is

Similarly, a dotted line is drawn from the total cost at $512,500 on the vertical axis towards the right and a dotted line is drawn upward for the 2,500 units sold from the horizontal axis. The two dotted line meet at a point which indicates the point of total cost at 2,500 units.

The dotted line from sales is above the dotted line for total cost. This indicates the income from operations. Thus, the area in between the two dotted lines is the income from operations of

Determine the maximum income from operations that could have been realized during the year.

| Determine the income from operations for 2,500 units | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 625,000 | |

| Less: Fixed costs | 75,000 | |

| Variable costs | 437,500 | (512,500) |

| Income from operations | 112,500 | |

Table (2)

3.

Construct a cost-volume-profit chart indicating the break-even sales for the current year, and verify the answer using the break-even equation.

3.

Explanation of Solution

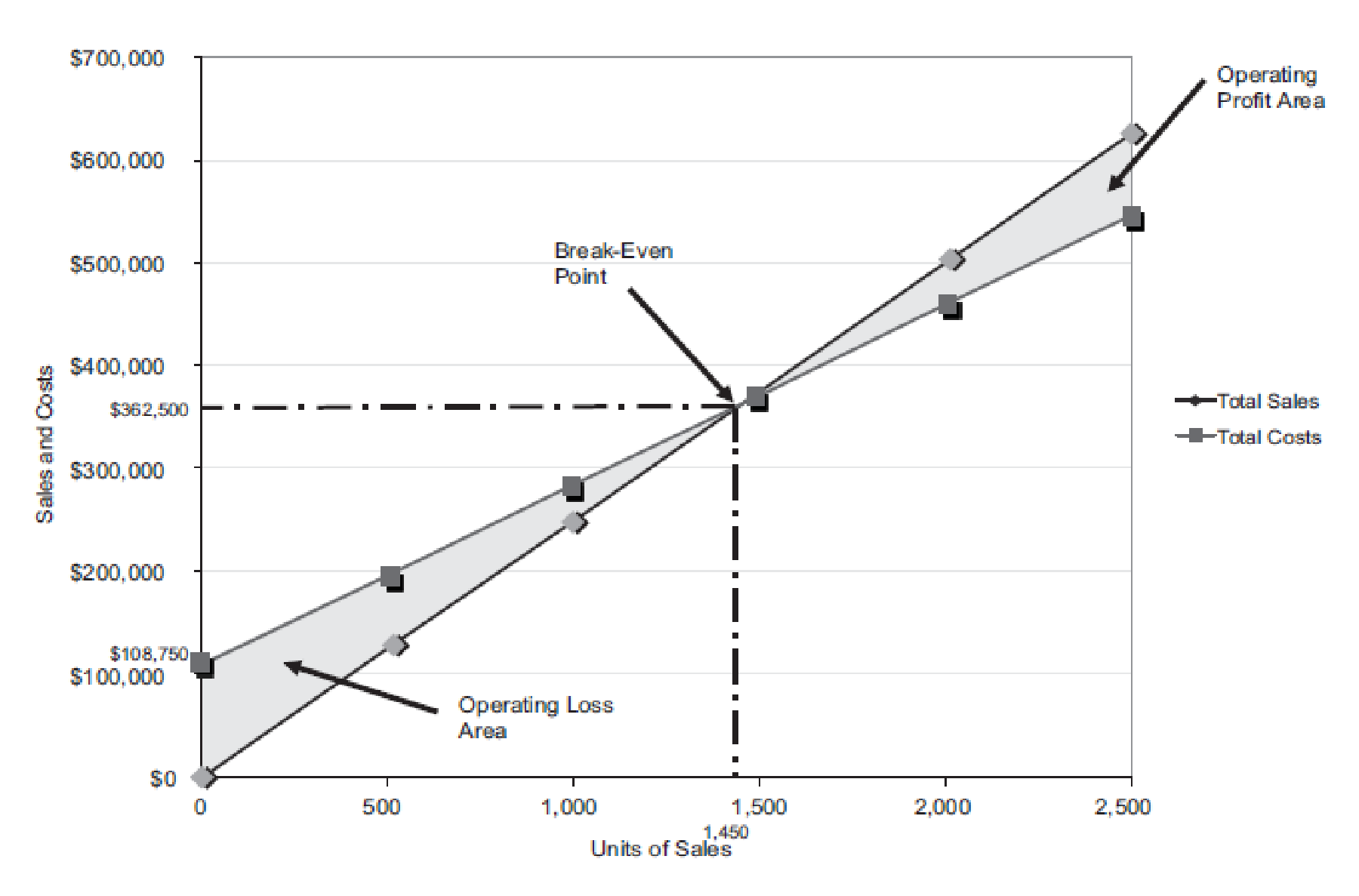

Construct a cost-volume-profit chart indicating the break-even sales for the current year as follows:

Figure (3)

The volume in units of sales is shown on the horizontal axis. The maximum relevant range is 2,500 units. The sales and the total costs (fixed cost and variable cost) in dollars is shown on the vertical axis. The maximum relevant range of sales and total costs is $700,000.

The total sales line is drawn right upward by connecting the first point at $0 to the second point at $625,000

The total cost line is drawn right upward by connecting the first point at

The break-even point is the intersection point where the total sales line and total cost line meet. The vertical dotted line drawn downward from the intersection point reaches at 1,450 units. It indicates the break-even sales (units). The horizontal line drawn to the left towards the vertical axis reaches at $362,500. It indicates the break-even sales (dollars).

The operating profit area is the area where the total sales line exceeds the total cost line. However, the operating loss area is the area where the total cost exceeds the total sales line.

Verify the answer using the break-even equation as follows:

Determine the break-even sales in units.

Fixed cost =$75,000

Increase in fixed cost (billboard advertising) =$33,750

Contribution margin per unit =$75 per unit (1)

Determine the break-even sales in dollars.

Fixed cost =$75,000

Increase in fixed cost (billboard advertising) =$33,750

Contribution margin ratio =30% (2)

4(A)

Compute the income from operations for sales 2,000 units, and verify the answers using the mathematical approach to cost-volume-profit analysis

4(A)

Explanation of Solution

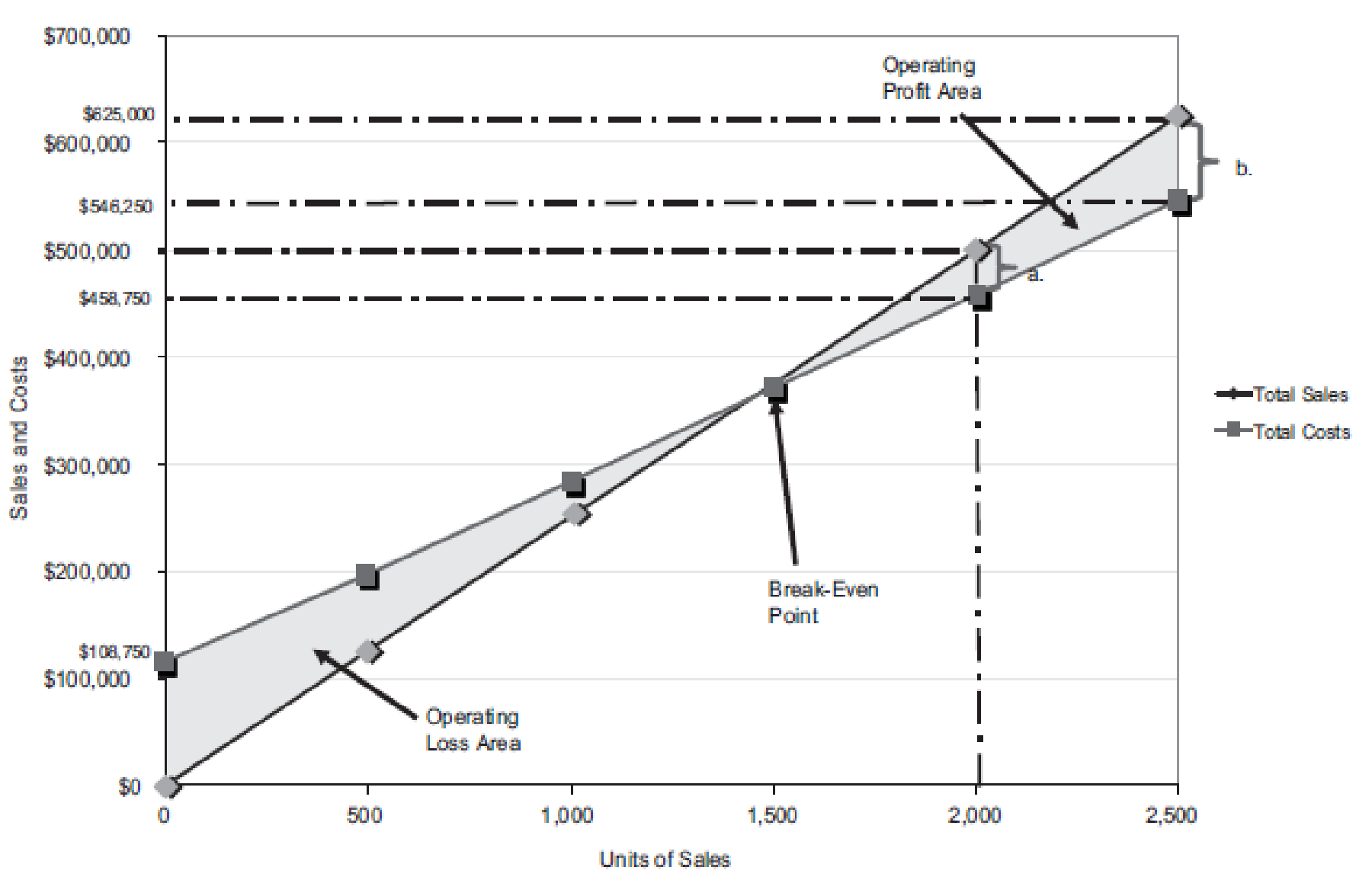

Figure (4)

Last year, the number of units sold is 2,000 units (3). The total sales is $500,000. The total cost is

Similarly, a dotted line is drawn from the total cost at $458,750 on the vertical axis towards the right and a dotted line is drawn upward for the 2,000 units sold from the horizontal axis. The two dotted line meet at a point which indicates the point of total cost at 2,000 units.

The dotted line from sales is above the dotted line for total cost. This indicates the income from operations. Thus, the area in between the two dotted lines is the income from operations of

Verify the answers using the mathematical approach to cost-volume-profit analysis.

Determine the income from operations for the last year.

| Determine the income from operations for 2,000 units | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 500,000 | |

| Less: Total Fixed costs | 108,750 | |

| Variable costs | 350,000 | (458,750) |

| Income from operations | 41,250 | |

Table (3)

4(B)

Compute the maximum income from operations that could have been realized during the year and verify the answer.

4(B)

Explanation of Solution

The maximum relevant range for number of units to be sold is 2,500 units. Thus, the total sales is

Similarly, a dotted line is drawn from the total cost at $546,250 on the vertical axis towards the right and a dotted line is drawn upward for the 2,500 units sold from the horizontal axis. The two dotted line meet at a point which indicates the point of total cost at 2,500 units.

The dotted line from sales is above the dotted line for total cost. This indicates the income from operations. Thus, the area in between the two dotted lines is the income from operations of

Verification:

| Determine the income from operations for 2,500 units | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 625,000 | |

| Less: Total Fixed costs | 108,750 | |

| Variable costs | 437,500 | (546,250) |

| Income from operations | 78,750 | |

Table (4)

Want to see more full solutions like this?

Chapter 20 Solutions

Financial And Managerial Accounting

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub