Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 3CMA

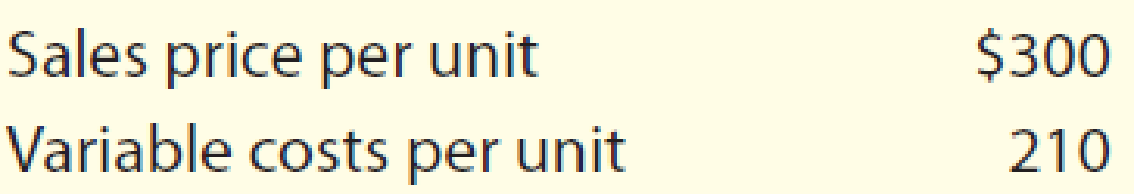

Bolger and Co. manufactures large gaskets for the turbine industry. Bolger’s per-unit sales price and variable costs for the current year are as follows:

Bolger’s total fixed costs aggregate to $360,000. Bolger’s labor agreement is expiring at the end of the year, and management is concerned about the effects of a new labor agreement on its break-even point in units. The controller performed a sensitivity analysis to ascertain the estimated effect of a $10-per-unit direct labor increase and a $10,000 reduction in fixed costs. Based on these data, the break-even point would:

- a. decrease by 1,000 units.

- b. decrease by 125 units.

- c. increase by 375 units.

- d. increase by 500 units.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The comparative balance sheets and an income statement for Raceway Corporation follow.

Balance Sheets

As of December 31

Year 2

Year 1

Assets

Cash

$ 6,300

$ 48,400

Accounts receivable

10,200

7,260

Inventory

45,200

56,000

Prepaid rent

700

2,140

Equipment

140,000

144,000

Accumulated depreciation

(73,400)

(118,000)

Land

116,000

50,000

Total assets

$ 245,000

$ 189,800

Liabilities

Accounts payable (inventory)

$ 37,200

$ 40,000

Salaries payable

12,200

10,600

Stockholders’ equity

Common stock, $50 par value

150,000

120,000

Retained earnings

45,600

19,200

Total liabilities and stockholders’ equity

$ 245,000

$ 189,800

Income Statement

For the Year Ended December 31, Year 2

Sales

$ 480,000

Cost of goods sold

(264,000)

Gross profit

216,000

Operating expenses

Depreciation expense

(11,400)

Rent expense

(7,000)

Salaries expense

(95,200)

Other operating expenses

(76,000)

Net income

$ 26,400

Other Information

Purchased…

Please help holy tamale I have been staring at this for hours.

Could you explain the steps for solving this financial accounting question accurately?

Chapter 20 Solutions

Financial And Managerial Accounting

Ch. 20 - Describe how total variable costs and unit...Ch. 20 - Which of the following costs would be classified...Ch. 20 - Describe how total fixed costs and unit fixed...Ch. 20 - In applying the high-low method of cost estimation...Ch. 20 - If fixed costs increase, what would be the impact...Ch. 20 - Prob. 6DQCh. 20 - Prob. 7DQCh. 20 - Both Austin Company and Hill Company had the same...Ch. 20 - Prob. 9DQCh. 20 - What does operating leverage measure, and how is...

Ch. 20 - High-low method The manufacturing costs of...Ch. 20 - Contribution margin Waite Company sells 250,000...Ch. 20 - Prob. 3BECh. 20 - Prob. 4BECh. 20 - Sales mix and break-even analysis Conley Company...Ch. 20 - Prob. 6BECh. 20 - Margin of safety Jorgensen Company has sales of...Ch. 20 - Classify Costs Following is a list of various...Ch. 20 - Identify cost graphs The following cost graphs...Ch. 20 - Identify activity bases For a major university,...Ch. 20 - Identify activity bases From the following list of...Ch. 20 - Identify fixed and variable costs Intuit Inc....Ch. 20 - Relevant range and fixed and variable costs Child...Ch. 20 - High-low method Ziegler Inc. has decided to use...Ch. 20 - High-low method for a service company Continental...Ch. 20 - Contribution margin ratio Young Company budgets...Ch. 20 - Contribution margin and contribution margin ratio...Ch. 20 - Break-even sales and sales to realize operating...Ch. 20 - Prob. 12ECh. 20 - Prob. 13ECh. 20 - Prob. 14ECh. 20 - Break-even analysis Media outlets such as ESPN and...Ch. 20 - Prob. 16ECh. 20 - Prob. 17ECh. 20 - Prob. 18ECh. 20 - Prob. 19ECh. 20 - Prob. 20ECh. 20 - Prob. 21ECh. 20 - Break-even sales and sales mix for a service...Ch. 20 - Margin of safety A. If Canace Company, with a...Ch. 20 - Prob. 24ECh. 20 - Operating leverage Beck Inc. and Bryant Inc. have...Ch. 20 - Classify costs Seymour Clothing Co. manufactures a...Ch. 20 - Prob. 2PACh. 20 - Prob. 3PACh. 20 - Prob. 4PACh. 20 - Prob. 5PACh. 20 - Contribution margin, break-even sales,...Ch. 20 - Classify costs Cromwell Furniture Company...Ch. 20 - Break-even sales under present and proposed...Ch. 20 - Prob. 3PBCh. 20 - Prob. 4PBCh. 20 - Prob. 5PBCh. 20 - Contribution margin, break-even sales,...Ch. 20 - Prob. 1MADCh. 20 - Prob. 2MADCh. 20 - Prob. 3MADCh. 20 - Break-even number of guests for a theme park...Ch. 20 - Prob. 1TIFCh. 20 - Communication Sun Airlines is a commercial airline...Ch. 20 - Profitability strategies Somerset Inc. has...Ch. 20 - Prob. 5TIFCh. 20 - Analysis of costs for a shipping department Sales...Ch. 20 - Taylor Corporation is analyzing the cost behavior...Ch. 20 - Kimber Company has the following unit costs for...Ch. 20 - Bolger and Co. manufactures large gaskets for the...Ch. 20 - Eagle Brand Inc. produces two products as follows:...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License