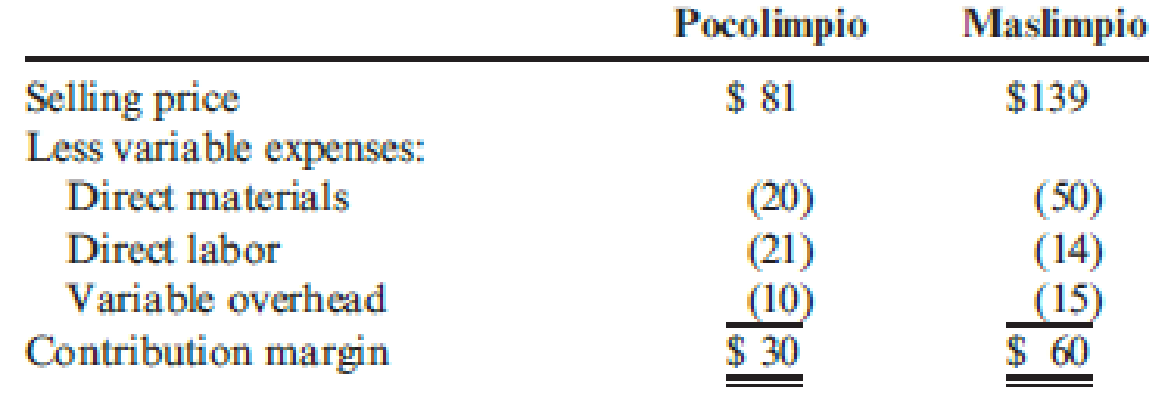

Taylor Company produces two industrial cleansers that use the same liquid chemical input: Pocolimpio and Maslimpio. Pocolimpio uses two quarts of the chemical for every unit produced, and Maslimpio uses five quarts. Currently, Taylor has 6,000 quarts of the material in inventory. All of the material is imported. For the coming year, Taylor plans to import 6,000 quarts to produce 1,000 units of Pocolimpio and 2,000 units of Maslimpio. The detail of each product’s unit contribution margin is as follows:

Taylor Company has received word that the source of the material has been shut down by embargo. Consequently, the company will not be able to import the 6,000 quarts it planned to use in the coming year’s production. There is no other source of the material.

Required:

- 1. Compute the total contribution margin that the company would earn if it could import the 6,000 quarts of the material.

- 2. Determine the optimal usage of the company’s inventory of 6,000 quarts of the material. Compute the total contribution margin for the product mix that you recommend.

- 3. Assume that Pocolimpio uses three direct labor hours for every unit produced and that Maslimpio uses two hours. A total of 6,000 direct labor hours is available for the coming year.

- a. Formulate the linear programming problem faced by Taylor Company. To do so, you must derive mathematical expressions for the objective function and for the materials and labor constraints.

- b. Solve the linear programming problem using the graphical approach.

- c. Compute the total contribution margin produced by the optimal mix.

Trending nowThis is a popular solution!

Chapter 20 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Chapter 15 Homework i 10 0.83 points Saved Help Save & Exit Submit Check my work QS 15-8 (Algo) Computing predetermined overhead rates LO P3 A company estimates the following manufacturing costs at the beginning of the period: direct labor, $520,000; direct materials, $216,000; and factory overhead, $141,000. Required: eBook 1. Compute its predetermined overhead rate as a percent of direct labor. 2. Compute its predetermined overhead rate as a percent of direct materials. Ask Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References Mc Graw Hill Compute its predetermined overhead rate as a percent of direct labor. Overhead Rate Numerator: 1 Denominator: = Overhead Rate = Overhead Rate = 0arrow_forwardhello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning