Chapter 11 Reorganization

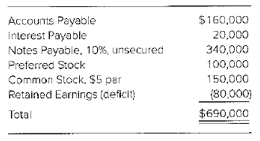

During the recent recession, Polydorous Inc. accumulated a deficit in

A plan of reorganization is filed with the court, which approves it after review and obtaining creditor and investor votes. The plan of reorganization includes the following actions:

1. The prepetition accounts payable will be restructured according to the following: (a) $40,000 will be paid in cash, (b) $20,000 will be eliminated, and (c) the remaining $100,000 will be exchanged for a five-year, secured note payable paying 12 percent interest.

2. The interest payable will be restructured as follows: elimination of $10,000 of the interest and payment of the remaining $10,000 in cash.

3. The 10 percent, unsecured notes payable will be restructured as follows: (a) $60,000 of them will be eliminated, (b) $10,000 of them will be paid in cash, (c) $240,000 of them will be exchanges for a five-year, 12 percent secured note, and (d) the remaining $30,000 will be exchanged for 3,000 shares of newly issued common stock having a par value of $10.

4. The preferred shareholder will exchange their stock for 5,000 shares of newly issued $10 par common stock.

5. The common shareholder will exchange their stock for 2,000 shares of newly issued $10 common stock.

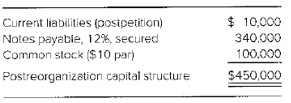

After extensive analysis, the company's reorganization value is determined to be $510,000 prior to any payments of cash required by the reorganization plan. An additional $10,000 in current liabilities have been incurred since the petition was filed. After the reorganization is completed, the capital structure of the company will be as follows:

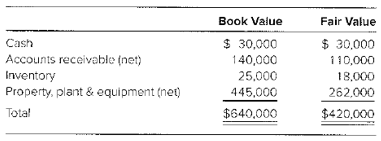

An evaluation of the assets' fair values was made after the company completed its reorganization, immediately prior to the point the company emerged from the proceedings. The following information is available:

Required

a. Prepare a plan of reorganization recovery analysis for the stockholders' equity accounts of Polydorous Inc. on the day plan of reorganization is approved. (Hint: The liabilities on the plan's approval are $530,000, which is $520,000 from prepetition payables plus $10,000 in additional accounts incurred postpetition.)

b. Prepare an analysis showing whether the company qualifies for fresh start accounting as it emerges from the reorganization.

c. Prepare

d. Prepare the

a

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs. It allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

A plan of reorganization recovery analysis for the liabilities and stockholders’ equity

Answer to Problem 20.6P

Pre-petition liabilities $520,000 and equity $700,000

Explanation of Solution

| Recovery | |||||||||

| Pre-confirmation ($) | Elimination of debt & equity ($) | Surviving debt ($) | Cash ($) | 12%Secured Notes ($) | Common% | Stock value ($) | Total($) | Recovery % | |

| Post − petition liabilities | (10,000) | (10,000) | (10,000) | 100 | |||||

| Claims/ Interest: | |||||||||

| Accounts payable | (160,000) | 20,000 | (40,000) | (100,000) | (140,000) | 88 | |||

| Interest payable | (20,000) | 10,000 | (10,000) | (10,000) | 50 | ||||

| Notes payable 10% | (340,000) | 60,000 | (10,000) | (240,000) | 30 | (30,000) | (280,000) | 82 | |

| Total | (520,000) | 90,000 | |||||||

| Preferred shareholders | (100,000) | 50,000 | 50 | (50,000) | (50,000) | ||||

| Common shareholders | (150,000) | 130,000 | 20 | (20,000) | (20,000) | ||||

| Retained earnings deficit | 80,000 | (80,000) | |||||||

| Total | (700,000) | 190,000 | (10,000) | (60,000) | (340,000) | 100% | (100,000) | (510,000) | |

b

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs. It allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The analysis showing whether the company qualifies for fresh start accounting as it emerges from the reorganization.

Answer to Problem 20.6P

The analysis shows that company qualifies for the fresh start accounting as it emerges from reorganization.

Explanation of Solution

First condition for fresh start:

| Post-petition liabilities | $10,000 |

| Liabilities deferred pursuant to chapter 11 | 520,000 |

| Total post-petition liabilities and claims | $530,000 |

| Reorganization value | (520,000) |

| Excess of liabilities over reorganization value | $20,000 |

Second condition:

Holders of existing voting shares immediately before confirmation receive 20% of voting shares of emerging entity.

Therefore, both conditions for a fresh start occur, and fresh start accounting is used to account for the company.

c

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs, it allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The entries for execution of the plan of reorganization with its general restructuring of debt and capital.

Explanation of Solution

| Particulars | Debit $ | Credit $ |

| Liabilities subjected to compromise | 520,000 | |

| Cash | 60,000 | |

| Notes payable | 340,000 | |

| Common stock | 30,000 | |

| Gain on debt discharge | 90,000 | |

| (Recognition of debt discharge) | ||

| Preferred stock | 100,000 | |

| Common stock old | 150,000 | |

| Common stock new | 70,000 | |

| Additional paid-in capital | 180,000 | |

| (Recording of exchange of stock) | ||

| Reorganization value in excess of amounts | ||

| Allocation to identifiable assets | 30,000 | |

| Gain on debt discharge | 90,000 | |

| Additional paid-in capital | 180,000 | |

| Accounts receivable | 30,000 | |

| Inventory | 7,000 | |

| Property, plant, and equipment | 183,000 | |

| Retained earnings deficit | 80,000 | |

| (Record fresh start accounting and elimination of deficit) |

Schedule to support allocation of reorganization value:

| Book value | Fair value | difference | |

| Cash | $30,000 | $30,000 | 0 |

| Accounts receivable | 140,000 | 110,000 | (30,000) |

| Inventory | 25,000 | 18,000 | (7,000) |

| Property, plant and equipment | 445,000 | 262,000 | (183,000) |

| Reorganization value in excess of amounts allocable to identifiable assets | 0 | 30,000 | 30,000 |

| Total | $640,000 | $450,000 | $(190,000) |

d

Reorganization: Chapter 11 of bankruptcy involves a reorganization of a debtor’s business affairs, it allows legal protection from creditors’ during the time needed to reorganize and return to a profitable level. A company in financial distress files for bankruptcy may receive protection from creditors, the company continues to operate while it prepares a plan for reorganization.

The balance sheet for the company on completion of the plan of reorganization.

Answer to Problem 20.6P

Balance sheet total as per balance sheet $450,000

Explanation of Solution

Note showing effect of plan of reorganization balance sheet:

| Pre-confirmation $ | Adjustments | Re-organized balance sheet $ | |||

| DebtDischarge $ | Exchange of Stock $ | FreshStart $ | |||

| Assets: | |||||

| Cash | 90,000 | (60,000) | 30,000 | ||

| Accounts receivable | 140,000 | (30,000) | 110,000 | ||

| Inventory | 25,000 | (7,000) | 18,000 | ||

| 255,000 | (60,000) | 0 | (37,000) | 158,000 | |

| Property, plant & equipment | 445,000 | (183,000) | 262,000 | ||

| Reorganization value in Excess amount allocated to identifiable assets | 30,000 | 30,000 | |||

| Total assets | 700,000 | (60,000) | 0 | (190,000) | 450,000 |

| Liabilities: | |||||

| Not subjected to compromise: | |||||

| Current liabilities | (10,000) | (10,000) | |||

| Subjected to compromise | (520,000) | 520,000 | |||

| Notes payable | (340,000) | (340,000) | |||

| Total liabilities | (530,000) | 180,000 | 0 | 0 | (350,000) |

| Shareholders’ equity | |||||

| Preferred stock | (100,000) | 100,000 | |||

| Common stock old | (150,000) | 150,000 | |||

| Common stock new | (30,000) | (70,000) | (100,000) | ||

| Additional paid-in capital | (180,000) | 180,000 | |||

| Retained earnings | 80,000 | (90,000) | 90,000 | ||

| (80,000) | 0 | ||||

| Total Liabilities and Equity | (700,000) | 60,000 | 190,000 | (450,000) | |

P Company

Balance sheet

| $ | |

| Assets: | |

| Cash | 30,000 |

| Accounts receivable | 110,000 |

| Inventory | 18,000 |

| Total current assets | 158,000 |

| Property, plant and equipment | 262,000 |

| Reorganization value | 30,000 |

| Total assets | 450,000 |

| Liabilities: | |

| Accounts payable | 10,000 |

| Notes payable | 340,000 |

| Total liabilities | 350,000 |

| Shareholders’ equity: | |

| Common stock | 100,000 |

| Total liabilities and shareholders’ equity | 450,000 |

Want to see more full solutions like this?

Chapter 20 Solutions

Advanced Financial Accounting

Additional Business Textbook Solutions

PRIN.OF CORPORATE FINANCE

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Marketing: An Introduction (13th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- I need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning