Advanced Financial Accounting

12th Edition

ISBN: 9781259916977

Author: Christensen, Theodore E., COTTRELL, David M., Budd, Cassy

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 20.4E

Chapter 7 Liquidation

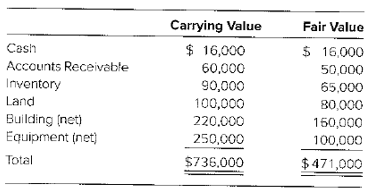

Penn Inc.'s assets have the carrying values and estimated fair values as follows:

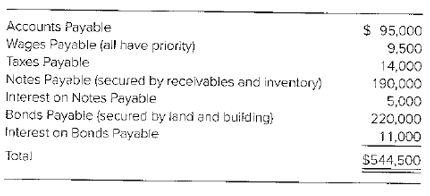

Penn's debts follow:

Required

a. Prepare a schedule to calculate the net estimated amount available for general unsecured creditors.

b. Compute the percentage dividend to general unsecured creditors.

c. Prepare a schedule showing the amount to be paid each of the creditors groups upon distribution of the $471,000 estimated to be realizable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Solve with explanation and accounting question

General accounting

Accounting

Chapter 20 Solutions

Advanced Financial Accounting

Ch. 20 - What are the nonjudicial actions available to a...Ch. 20 - What is the difference between a Chapter 7 action...Ch. 20 - Prob. 20.3QCh. 20 - What is usually included in the plan of...Ch. 20 - Prob. 20.5QCh. 20 - Prob. 20.6QCh. 20 - Prob. 20.7QCh. 20 - Prob. 20.8QCh. 20 - How is the statement of affairs used in planning...Ch. 20 - What are the financial reporting responsibilities...

Ch. 20 - Prob. 20.11QCh. 20 - Creditors' Alternatives The creditors of Lost Hope...Ch. 20 - Prob. 20.3CCh. 20 - Prob. 20.1.1ECh. 20 - Prob. 20.1.2ECh. 20 - Prob. 20.1.3ECh. 20 - Prob. 20.1.4ECh. 20 - Prob. 20.1.5ECh. 20 - Prob. 20.2ECh. 20 - Prob. 20.3.1ECh. 20 - Prob. 20.3.2ECh. 20 - Prob. 20.3.3ECh. 20 - Prob. 20.3.4ECh. 20 - Prob. 20.3.5ECh. 20 - Chapter 7 Liquidation Penn Inc.'s assets have the...Ch. 20 - Prob. 20.5ECh. 20 - Chapter 11 Reorganization During the recent...Ch. 20 - Prob. 20.7PCh. 20 - Chapter 7 Liquidation, Statements of Affairs...Ch. 20 - Prob. 20.9P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License