Concept explainers

Communication

Jamarcus Bradshaw, plant, manager of Georgia Paper Company's papermaking mill, was looking over the cost of production reports for July and August for the Papermaking Department. The reports revealed the following:

| July | August | |

| Pulp and chemicals | $295,600 | $304,100 |

| Conversion cost | 146,000 | 149,600 |

| Total cost | $441,600 | $453,700 |

| Number of tons | + 1,200 | + 1,130 |

| Cost per ton | $ 368 | $ 401.50 |

Jamarcus was concerned about the increased cost per ton from the output of the department. As a result, he asked the plant controller to perform a study to help explain these results. The controller, Leann Brunswick, began the analysis by performing some interviews of key plant personnel in order to understand what the problem might be. Excerpts from an interview with Len Tyson, a paper machine operator, follow:

Len: We have two papermaking machines in the department I have no data, but I think paper machine No. 1 is applying too much pulp and, thus, is wasting both conversion and materials resources. We haven't had repairs on paper machine No. 1 in a while. Maybe this is the problem.

Leann. How does too much pulp result i n wasted resources?

Len: Well, you see, if too much pulp is applied, then we will waste pulp material. The customer will not pay for the extra product we just use more material to make the product. Also, when there is too much pulp, the machine must be slowed down in order to complete the drying process. This results in additional conversion costs.

Leann: Do you have any other suspicions?

Len: Well, as you know, we have two products—green pa per and yellow pa per. They are identical except for the color. The color is added to the papermaking process in the paper machine. I think that during August these two color papers have been behaving differently. I don't have any data, but it seems as though the amount of waste associated with the green paper has increased.

Leann. Why is this?

Len: I understand that there has been a change in specifications for the green paper, starting near the beginning of August This change could be causing the machines to run poorly when making green paper. If that is the case, the cost per ton would increase for green paper.

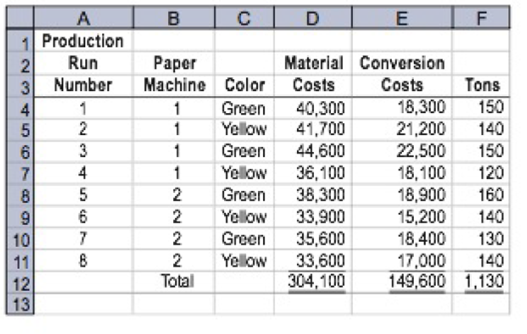

Leann also asked for a database printout providing greater detail on August's operating results. September 9 Requested by: Leann Brunswick Papermaking Department—August detail

Prior to preparing a report, Leann resigned from Georgia Paper Company to start her own business. You have been asked to lake the data that Leann collected and write a memo to Jamarcus Bradshaw with a recommendation to management. Your memo should include analysis of the August data to determine whether the paper machine or the paper color explains the increase in the unit cost from July. Include any supporting schedules that are appropriate. Round all calculations to the nearest cent.

Trending nowThis is a popular solution!

Chapter 20 Solutions

Accounting

- Please give me true answer this financial accounting questionarrow_forwardHarrison Home Maintenance bought equipment for $12,600 on January 1, 2020. It has an estimated useful life of six years and zero residual value. Harrison uses the straight-line method to calculate depreciation and records depreciation expense at the end of every month. As of June 30, 2020, the book value of this equipment shown on its balance sheet will be:arrow_forwardcan you help me witharrow_forward

- What was mark john's beginning capital balance?arrow_forwardRiverside Technologies reported total assets of $1,150,000 and total liabilities of $490,000. If the company had net income of $190,000 and paid $45,000 in dividends, what is its total equity at the end of the year?arrow_forwardThe amount to be recorded on the booksarrow_forward

- Silver Spoon, a fine-dining restaurant, began its operations in 2015. Its fixed assets had a book value of $950,000 in 2016. The restaurant did not purchase any fixed assets in 2016. The annual depreciation expense on fixed assets was $80,000, and the accumulated depreciation account had a balance of $160,000 on December 31, 2016. What was the original cost of fixed assets owned by the restaurant in 2015 when it started its operations?arrow_forwardquick answer of this chose answerarrow_forwardAccounts payable:90000, Accounts receivable: 130000arrow_forward

- Provide correct answer accounting questionarrow_forwarddo fast answer of this accountarrow_forwardZanzibar Limited entered into a lease agreement on July 1 2016 to lease somehighly customized hydraulic equipment to Kaizen Limited. The fair value of theequipment as at that date was $ 700,000. The terms of the lease agreement were: Lease Term 5 Years Equipment Economic Life 6 years Annual rental payment in arrears (Commencing June 30th, 2017) $160,000 Equipment residual value $100,000 Guaranteed residual value by Zanzibar $60,000 Incremental Borrowing rate 8% Interest rate implicit in the lease 6% Note: the lease is cancellable but only with Zanzibar’s permission At the end of the lease term, the equipment is to be returned to Zanzibar Limited.On July 1, 2016, Zanzibar incurred $12,000 in legal fees for setting up the lease. Theannual rental payment includes $10, 000 to reimburse the lessor for maintenancefees incurred on behalf of the lessee. Requirements:a) Discuss the nature of the lease using the appropriate criteria. Justify youranswer using…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,