Horngren's Accounting, The Financial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (12th Edition)

12th Edition

ISBN: 9780134642949

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem E2.23E

Preparing a

Learning Ojective 4

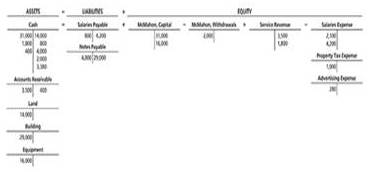

Total Debits $80,700

The T-accounts of McMahon Farm Equipment Repair follow as of May 31, 2018,

Prepare McMahon Farm Equipment Repair’s trial balance as of May 31, 2018.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Need answer general Accounting

Provide correct answer of this question answer general Accounting

Chapter 2 Solutions

Horngren's Accounting, The Financial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (12th Edition)

Ch. 2 - The detailed record of the changes in a particular...Ch. 2 - Which of the following accounts is a liability?...Ch. 2 - The left side of an account is used to record...Ch. 2 - Which of the following statements is correct?...Ch. 2 - Your business purchased office supplies of $2,500...Ch. 2 - Sedlor Properties puchased office supplies on...Ch. 2 - Posting a $2,500 purchase of office supplies on...Ch. 2 - Pixel Copies recorded a cash collection on account...Ch. 2 - Which sequence correctly summarizes the accounting...Ch. 2 - Nathvile Laundry reported assets of $800 and...

Ch. 2 - Identify the three categones of the accounting...Ch. 2 - What is the purpose of the chart of accounts?...Ch. 2 - What does a ledger show? What’s the difference...Ch. 2 - Accounng uses a double-entry system. Explain what...Ch. 2 - What is T-account? On which side is the debit? On...Ch. 2 - Prob. 6RQCh. 2 - Prob. 7RQCh. 2 - Identify which types of accounts have a normal...Ch. 2 - What are source documents? Provide examples of...Ch. 2 - Prob. 10RQCh. 2 - Explain the five steps in journalizing and posting...Ch. 2 - What are the four parts of a journal entry?Ch. 2 - What is involved in the posting process?Ch. 2 - What is the purpose of the trial balance?Ch. 2 - What is the differnce between the trial balance...Ch. 2 - If total debits equal total credits on the trial...Ch. 2 - What is the calculation for the debt ratio?...Ch. 2 - Identifying accounts Learning Objective 1 Consider...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying normal balances Learning Objective 2...Ch. 2 - Prob. S2.4SECh. 2 - Journalizing transactions Learning Objective 3...Ch. 2 - S2-6 Journalizing transactions

Learning...Ch. 2 - Journalizing transactions and posting to...Ch. 2 - Prob. S2.8SECh. 2 - Prob. S2.9SECh. 2 - Using accounting vocabulary Learning Objectives 1,...Ch. 2 - Creating a chart of accounts Learning Objective 1...Ch. 2 - Identifying accounts, increases in accounts, and...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying source documents Learning Objective 3...Ch. 2 - Analyzing and journalizing transactions Learing...Ch. 2 - Analyzing and journalizing transactions Leaning...Ch. 2 - Posting journal entries to T-accounts Learning...Ch. 2 - Analyzing and journalizing transactions Learning...Ch. 2 - Posting journal entries to four-column accounts...Ch. 2 - Analyzing transactions from T-accounts Learning...Ch. 2 - Journalizing transactions from T-accounts Learning...Ch. 2 - Preparing a trial balance Learning Objective 4...Ch. 2 - Preparing a trial balance from T-accounts Learning...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Analyzing accounting errors Learning Ojective 4...Ch. 2 - Prob. E2.26ECh. 2 - E2-27 Correcting errors in a trial...Ch. 2 - Prob. E2.28ECh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.34APGACh. 2 - Prob. P2.35BPGBCh. 2 - Prob. P2.36BPGBCh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. P2.38BPGBCh. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.40BPGBCh. 2 - Prob. P2.41CTCh. 2 - P2-42 Journalizing transactions, posting to...Ch. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Before you begin this assignment, renew the Tymg...Ch. 2 - Prob. 2.1DCCh. 2 - Prob. 2.1EICh. 2 - Prob. 2.1FCCh. 2 - Prob. 2.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License