Horngren's Accounting, The Financial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (12th Edition)

12th Edition

ISBN: 9780134642949

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem E2.13E

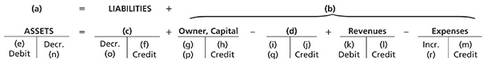

Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the missing information into the

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule03:48

Students have asked these similar questions

Financial Accounting

Need help

Quick answer of this accounting questions

Chapter 2 Solutions

Horngren's Accounting, The Financial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (12th Edition)

Ch. 2 - The detailed record of the changes in a particular...Ch. 2 - Which of the following accounts is a liability?...Ch. 2 - The left side of an account is used to record...Ch. 2 - Which of the following statements is correct?...Ch. 2 - Your business purchased office supplies of $2,500...Ch. 2 - Sedlor Properties puchased office supplies on...Ch. 2 - Posting a $2,500 purchase of office supplies on...Ch. 2 - Pixel Copies recorded a cash collection on account...Ch. 2 - Which sequence correctly summarizes the accounting...Ch. 2 - Nathvile Laundry reported assets of $800 and...

Ch. 2 - Identify the three categones of the accounting...Ch. 2 - What is the purpose of the chart of accounts?...Ch. 2 - What does a ledger show? What’s the difference...Ch. 2 - Accounng uses a double-entry system. Explain what...Ch. 2 - What is T-account? On which side is the debit? On...Ch. 2 - Prob. 6RQCh. 2 - Prob. 7RQCh. 2 - Identify which types of accounts have a normal...Ch. 2 - What are source documents? Provide examples of...Ch. 2 - Prob. 10RQCh. 2 - Explain the five steps in journalizing and posting...Ch. 2 - What are the four parts of a journal entry?Ch. 2 - What is involved in the posting process?Ch. 2 - What is the purpose of the trial balance?Ch. 2 - What is the differnce between the trial balance...Ch. 2 - If total debits equal total credits on the trial...Ch. 2 - What is the calculation for the debt ratio?...Ch. 2 - Identifying accounts Learning Objective 1 Consider...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying normal balances Learning Objective 2...Ch. 2 - Prob. S2.4SECh. 2 - Journalizing transactions Learning Objective 3...Ch. 2 - S2-6 Journalizing transactions

Learning...Ch. 2 - Journalizing transactions and posting to...Ch. 2 - Prob. S2.8SECh. 2 - Prob. S2.9SECh. 2 - Using accounting vocabulary Learning Objectives 1,...Ch. 2 - Creating a chart of accounts Learning Objective 1...Ch. 2 - Identifying accounts, increases in accounts, and...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying source documents Learning Objective 3...Ch. 2 - Analyzing and journalizing transactions Learing...Ch. 2 - Analyzing and journalizing transactions Leaning...Ch. 2 - Posting journal entries to T-accounts Learning...Ch. 2 - Analyzing and journalizing transactions Learning...Ch. 2 - Posting journal entries to four-column accounts...Ch. 2 - Analyzing transactions from T-accounts Learning...Ch. 2 - Journalizing transactions from T-accounts Learning...Ch. 2 - Preparing a trial balance Learning Objective 4...Ch. 2 - Preparing a trial balance from T-accounts Learning...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Analyzing accounting errors Learning Ojective 4...Ch. 2 - Prob. E2.26ECh. 2 - E2-27 Correcting errors in a trial...Ch. 2 - Prob. E2.28ECh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.34APGACh. 2 - Prob. P2.35BPGBCh. 2 - Prob. P2.36BPGBCh. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. P2.38BPGBCh. 2 - Correcting errors in a trial balance Learning...Ch. 2 - Prob. P2.40BPGBCh. 2 - Prob. P2.41CTCh. 2 - P2-42 Journalizing transactions, posting to...Ch. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Before you begin this assignment, renew the Tymg...Ch. 2 - Prob. 2.1DCCh. 2 - Prob. 2.1EICh. 2 - Prob. 2.1FCCh. 2 - Prob. 2.1FSC

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

3. Which method almost always produces the most depreciation in the first year?

a. Units-of-production

b. Strai...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to det...

Foundations Of Finance

Questions For Review

12-4. How is the concept of the value package useful in marketing to consumers and industr...

Business Essentials (12th Edition) (What's New in Intro to Business)

E5-2 Assume that on September 1, Office Depot had an inventory that included a variety of calculators. The comp...

Financial Accounting: Tools for Business Decision Making, 8th Edition

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The direct material price variance isarrow_forwardBradford Enterprises estimated manufacturing overhead for the year at $350,000. Manufacturing overhead for the year was underapplied by $15,000. The company applied $300,000 to Work in Process. The amount of actual overhead would have been_____.arrow_forwardWhat was its charge for depreciation and amortization of this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License