Concept explainers

Using transactions from the following assignments, record

Based on Serial Problem SP 2

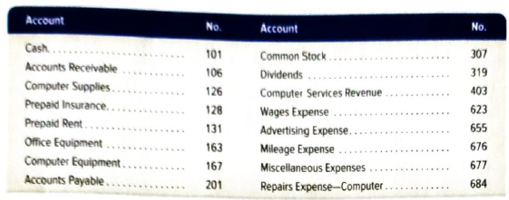

On October 1, 2018, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. Rey adopts the calendar year for reporting purposes and expects to prepare the company’s first set of financial statements on December 31, 2018. The company’s initial chart of accounts follows.

Required

- Prepare journal entries to record each of the following transactions for Business Solutions.

| Oct. |

1.

Introduction: Journal entry is a technique of booking and recording financial transactions on any company. Ledger is used to record all economic transactions of the account by account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.

To prepare: The general journal entries for the following transaction.

Explanation of Solution

Journal entries of KT for the month of April are shown below.

| Date | Particular | PR | Dr. | Cr. |

| Oct 1 | Cash | 20,000 | ||

| Office equipment | 45,000 | |||

| Computer equipment | 8,000 | |||

| To Common stock | 73,000 | |||

| (Owner’s investment) | ||||

| 2 Oct | Prepaid rent | 3,300 | ||

| cash | 3,300 | |||

| (rent paid in advance) | ||||

| 3 Oct | Computer supplies | 1,420 | ||

| Account payable company H | 1,420 | |||

| (purchase of supplies on credit from company H) | ||||

| 5 Oct | Prepaid insurance | 2,220 | ||

| Cash | 2,220 | |||

| (payment of insurance) | ||||

| 6 Oct | Account receivable company E | 4,800 | ||

| Service revenue | 4,800 | |||

| (service provided on credit) | ||||

| 8 Oct | Account payable company H | 1,420 | ||

| Cash | 1,420 | |||

| (cash to company H) | ||||

| 12 Oct | Account receivable company E | 1,400 | ||

| Service revenue | 1,400 | |||

| (service provided on credit) | ||||

| 15 Oct | Cash | 4,800 | ||

| Account receivable company E | 4,800 | |||

| (cash received from company E) | ||||

| 17 Oct | Repair computer equipment | 805 | ||

| Cash | 805 | |||

| (cash paid for repair of computer equipment) | ||||

| 20 Oct | Advertisement | 1,728 | ||

| Cash | 1,728 | |||

| (cash paid for advertisement ) | ||||

| 22 Oct | Cash | 1,400 | ||

| Account receivable company E | 1,400 | |||

| (cash received from company E) | ||||

| 28 Oct | Account receivable | 5,208 | ||

| Service revenue | 5,208 | |||

| 31 Oct | Wages expense | 875 | ||

| Cash | 875 | |||

| (Cash paid for wages) | ||||

| 31 Oct | Dividend cash | 3600 | ||

| (dividend paid in cash) | 3600 | |||

| 1 Nov | Miscellaneous expense | 320 | ||

| Cash | 320 | |||

| (cash paid for miscellaneous expense) | ||||

| 2 Nov | Cash | 4,633 | ||

| Service revenue | 4,633 | |||

| (cash received for provided revenue) | ||||

| 5 Nov | Computer supplies | 1,125 | ||

| Cash | 1125 | |||

| (purchase of computer supplies on cash) | ||||

| 8 Nov | Account receivable Company G | 5,668 | ||

| Service revenue | 5,668 | |||

| (service provided on credit) | ||||

| 18 Nov | Cash | 2,208 | ||

| Account receivable company I | 2,208 | |||

| (cash received from company I) | ||||

| 22 Nov | Donation | 250 | ||

| Cash | 250 | |||

| (cash given as donation) | ||||

| 24 Nov | Account receivable Company A | 3950 | ||

| Computer service revenue | 3950 | |||

| (to record service revenue) | ||||

| 28 Nov | Miscellaneous expense | 384 | ||

| Cash | 384 | |||

| (cash paid for miscellaneous expense) | ||||

| 30 Nov | Wages expense | 1750 | ||

| Cash | 1750 | |||

| (cash paid for wages) | ||||

| 30 Nov | Dividend | 2000 | ||

| Cash | 2000 | |||

| (Dividend paid) | ||||

2.

Introduction: Journal entry is a technique of booking and recording financial transactions on any company. Ledger is used to record all economic transactions of the account by account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.

To prepare: T account for the following transactions.

Explanation of Solution

| Cash Account No.101 | ||||

| Date | PR | Debit | Credit | Balance |

| 1 Oct | 45000 | 45,000 | ||

| 2 Oct | 3300 | 41,700 | ||

| 3 Oct | 2220 | 39,480 | ||

| 5 Oct | 1420 | 38,060 | ||

| 6 Oct | 4800 | 42,860 | ||

| 8 Oct | 875 | 41,985 | ||

| 12 Oct | 805 | 41,180 | ||

| 15 Oct | 1728 | 39,452 | ||

| 17 Oct | 1400 | 40,850 | ||

| 20 Oct | 3600 | 37,252 | ||

| 22 Oct | 320 | 36,932 | ||

| 28 Oct | 4633 | 41,565 | ||

| 31 Oct | 1125 | 40,440 | ||

| 31 Oct | 2208 | 42,648 | ||

| 15 Nov | 250 | 42,398 | ||

| 1 Nov | 3841 | 42,014 | ||

| 2 Nov | 1750 | 40,264 | ||

| 30 Nov | 2000 | 38,264 | ||

| Accounts Receivable company E | Account no. 106 | |||

| Date | PR | Debit | Credit | Balance |

| 6 Oct | 4800 | 4800 | ||

| 12 Oct | 1400 | 6200 | ||

| 15 Oct | 4800 | 1400 | ||

| 22 Oct | 1400 | 0 |

| Account receivable company E | Account no.108 | |||

| Date | PR | Debit | Credit | Balance |

| 8 Oct | 5668 | 5668 | ||

| Account receivable company I | Account no. 108 | |||

| Date | PR | Debit | Credit | Balance |

| 6 Oct | 5208 | 5208 | ||

| 15 Oct | 2208 | 3000 | ||

| Account payable | Account no.201 | |||

| Date | PR | Debit | Credit | Balance |

| 6 Oct | 1420 | 1420 | ||

| 15 Oct | 1420 | 0 | ||

| Supplies | Account no. 126 | |||

| Date | PR | Debit | Credit | Balance |

| 3 Oct | 1420 | 1420 | ||

| 5 Nov | 1125 | 2545 | ||

| Equipment | Account no. 163 | |||

| Date | PR | Debit | Credit | Balance |

| 1 Oct | 8000 | 8000 | ||

| Prepaid insurance | Account no.128 | |||

| Date | PR | Debit | Credit | Balance |

| 2 oct | 2220 | 2220 |

| Prepaid rent | Account no. 131 | |||

| Date | PR | Debit | Credit | Balance |

| 1 oct | 3300 | 3300 |

| Computer supplies | Account no. 167 | |||

| Date | PR | Debit | Credit | Balance |

| 1 Oct | 20000 | 20000 |

| Common stock | Account no. 307 | |||

| Date | PR | Debit | Credit | Balance |

| 1 oct | 45000 | 45000 | ||

| 1 Oct | 20000 | 65000 | ||

| 1 Oct | 8000 | 73000 |

| Dividend | Account no. 319 | |||

| Date | PR | Debit | Credit | Balance |

| 31 oct | 2000 | 2000 | ||

| 31 oct | 3600 | 5600 |

| Computer Service revenue | Account no. 403 | |||

| Date | PR | Debit | Credit | Balance |

| 24 Nov | 3950 | 3950 | ||

| 6 Oct | 4800 | 8750 | ||

| 12 Oct | 1400 | 10150 | ||

| 28 Oct | 5208 | 15358 | ||

| 8 Nov | 5668 | 21026 |

3.

Introduction: Journal entry is a technique of booking and recording financial transactions on any company. Ledger is used to record all economic transactions of the account by account type, with debits and credits in separate columns and a beginning monetary balance and ending monetary balance for each account.

To prepare: Trail balance.

Answer to Problem 8GLP

Total of trail balance is $98,659

Explanation of Solution

| S Trail balance | ||

| Particular | Dr. | Cr. |

| Cash | 38,264 | |

| Account receivable | 12,618 | |

| Equipment | 8,000 | |

| Supplies | 2,545 | |

| Prepaid insurance | 2,220 | |

| Prepaid rent | 3,300 | |

| Account payable | 0 | |

| Wages expense | 2,625 | |

| Common stock | 73,000 | |

| Divided | 5,600 | |

| Service revenue | 21,709 | |

| Computer service revenue | 3950 | |

| Donation | 250 | |

| Computer equipment | 20,000 | |

| Repair expense | 805 | |

| Advertisement | 1728 | |

| Mileage expense | 320 | |

| Miscellaneous expense | 384 | |

| Total | 98,659 | 98,659 |

Want to see more full solutions like this?

Chapter 2 Solutions

Loose Leaf for Financial Accounting: Information for Decisions

- Financial accountingarrow_forwardOn August 1, 2022, Fletcher Corporation sells machinery for $180,000. The machinery originally cost $500,000, had an estimated 5-year life, and an expected salvage value of $50,000. The Accumulated Depreciation account had a balance of $325,000 on January 1, 2022, using the straight-line method. The gain or loss on disposal is__.arrow_forwardHello teacher please help me this question solutionarrow_forward

- How much is the gross profit margin?arrow_forwardAns ?arrow_forwardMint Corp. began operations on January 1, Year 1, and had the following items for the year: Sales revenue $6,680,000 Costs and expenses (excluding income taxes) 5,180,000 Dividends declared 160,000 Dividends payable 50,000 Mint's tax rate is 30%. In Mint's December 31, Year 1, balance sheet, what amount should be reported as total retained earnings? A. $890,000 B. $940,000 C. $1,050,000 D. $1,500,000 Explanation Retained earnings is the accumulated net income (loss) of an entity since its inception, less the accumulated declareddividends to shareholders (ie, the income/earnings still retained in the business). At the end of each accounting period, net income and dividends are closed into retained earnings to update the account for the financial statements. Mint's net income is $1,500,000 before taxes and $1,050,000 after taxes (Choices C and D): Sales revenues $6,680,000 Less: Costs and expenses (before…arrow_forward

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College