Concept explainers

Cost Allocation and Regulated Prices

The City of Imperial Falls contracts with Evergreen Waste Collection to provide solid waste collection to households and businesses. Until recently, Evergreen had an exclusive franchise to provide this service in Imperial Falls, which meant that other waste collection firms could not operate legally in the city. The price per pound of waste collected was regulated at 20 percent above the

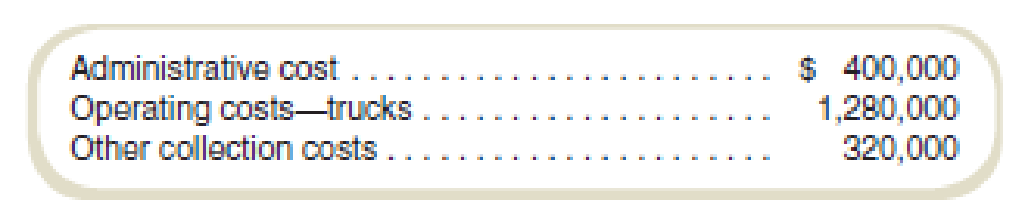

Cost data for the most recent year of operations for Evergreen are as follows:

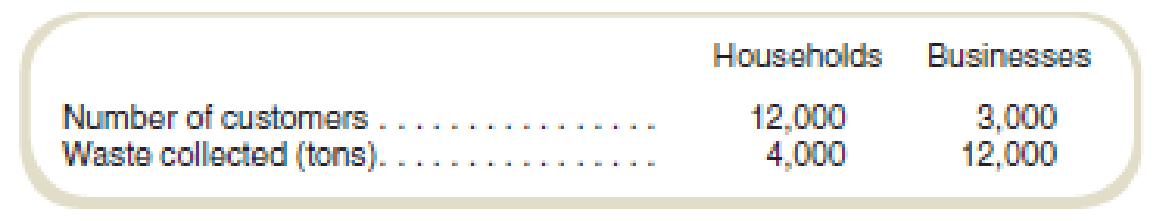

Data on customers for the most recent year are:

The City Council of Imperial Falls is considering allowing other private waste haulers to collect waste from businesses, but not from households. Service to businesses from other waste collection firms would not be subject to price regulation. Based on information from neighboring cities, the price that other private waste collection firms will charge is estimated to be $0.04 per pound (= $80 per ton).

Evergreen’s CEO has approached the city council with a proposal to change the way costs are allocated to households and businesses, which will result in different rates for households and businesses. She proposes that administrative costs and truck operating costs be allocated based on the number of customers and the other collection costs be allocated based on pounds collected. The total costs allocated to households would then be divided by the estimated number of pounds collected from households to determine the cost of collection. The rate would then be 20 percent above the cost. The rate for businesses would be determined using the same calculation.

Required

- a. Based on cost data from the most recent year, what is the price per pound charged by Evergreen for waste collection under the current system (the same rate for both types of customers)?

- b. Based on cost and waste data from the most recent year, what would be the price per pound charged to households and to businesses by Evergreen for waste collection if the CEO’s proposal were accepted?

- c. As a staff member to one of the council members, would you support the proposal to change the way costs are allocated? Explain.

a.

Calculate the price per pound charged by Company E for waste collection under the current system.

Answer to Problem 71P

The price per pound is $0.075 for waste collection under the current system.

Explanation of Solution

Price of the unit:

Price of a unit is the amount per unit that is charged by the customer to generate the sales of the business. It is calculated above the cost of the product in order to generate sales.

Calculate the price per pound:

Thus, the price per pound is $0.075 for waste collection under the current system. The premium on rate is 20%. So the net premium rate is 1.2.

Working note 1:

Calculate the average cost per pound:

Working note 2:

Calculate the total cost of collection:

| Particulars | Amount |

| Administrative cost | $400,000 |

| Operating costs—trucks | $1,280,000 |

| Other collection costs | $320,000 |

| Total cost of collection | $2,000,000 |

Table: (1)

Working note 3:

Calculate the total waste collection:

| Particulars | Amount |

| Waste collection of household | 4,000 |

| Waste collection of businesses | 12,000 |

| Total waste collection (tons) | 16,000 |

Table: (2)

Thus, the total waste collection is 16,000 tons. It will be $32,000,000 in the pound. One ton is equal to 2000 pound.

b.

Calculate the price per pound charged to households and businesses by Evergreen for waste collection if the CEO’s proposal were accepted.

Answer to Problem 71P

The price per pound is $0.21 and $0.03 for household and business respectively that should be charged to households and businesses by Evergreen for waste collection if the CEO’s proposal were accepted.

Explanation of Solution

Price of the unit:

Price of a unit is the amount per unit that is charged by the customer to generate the sales of the business. It is calculated above the cost of the product in order to generate sales.

Calculate the price per pound:

| Particulars | Household | Businesses |

| Customer cost | $1,344,000 (1) | $336,000 (2) |

| Other cost | $80,000(3) | $240,000 (4) |

| Total cost | $1,424,000 | $576,000 |

|

Total number of pound | 8,000,000 | 24,000,000 |

| Average cost per pound | $0.178 | $0.024 |

| Price premium (1.2) | 1.20 | 1.20 |

| Net price | $0.21 | $0.03 |

Table: (1)

Thus, the net price is $0.21 and $0.03 for household and business respectively.

Working note 1:

Calculate the customer cost for a household:

Working note 2:

Calculate the customer cost for businesses:

Working note 3:

Calculate the other cost for household:

Working note 4:

Calculate the other cost for businesses:

c.

Give opinion on the change in the cost allocation.

Explanation of Solution

Allocation of cost:

Allocation of cost refers to the cost of distribution of the common cost among the various departments on the basis of the resource utilized by the department.

Opinion on cost allocation:

Cost allocation can play a very important in price determination. Price in the first allocation was $0.075, and it was $0.24 in the second allocation. Second cost allocation allows the business to evaluate the cost of each unit (businesses and household). In future reference, this allocation can be used as it will calculate all the variables of each unit.

Thus, if there is any bottleneck in any of the unit, then it can be identified by the second allocation of cost.

Want to see more full solutions like this?

Chapter 2 Solutions

COST ACCOUNTING W/CONNECT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,