COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 64P

Cost Allocation with Cost Flow Diagram

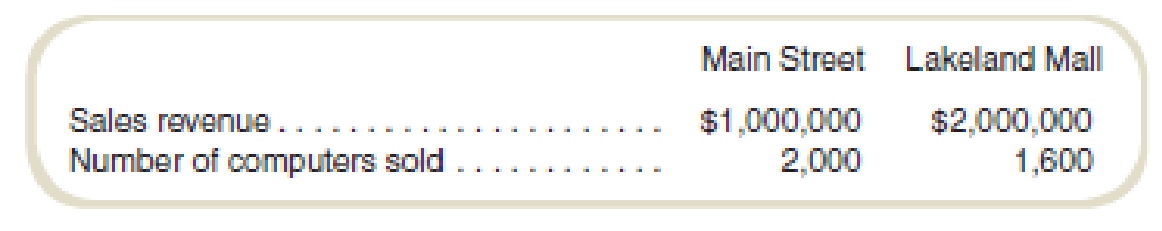

Coastal Computer operates two retail outlets in Oakview, one on Main Street and the other in Lakeland Mall. The stores share the use of a central accounting department. The cost of the accounting department for last year was $180,000. Following are the operating results for the two stores for the year:

Required

- a. Allocate the cost of the central accounting department to the two stores based on:

- 1. Number of computers sold.

- 2. Store revenue.

- b. Draw a cost flow diagram to illustrate your answer to requirement (a), part (2).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please correct answer with accounting question

A company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120-month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of lending for a longer time period. Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest.Record $100,000 cash received from the issuance of

the 120-month installment note with 8% interest. Select the options to display a 120-month installment note with 12% interest. How much of the principal amount is due after the 60th payment?

!??

Chapter 2 Solutions

COST ACCOUNTING W/CONNECT

Ch. 2 - What is the difference in meaning between the...Ch. 2 - What is the difference between product costs and...Ch. 2 - What is the difference between outlay cost and...Ch. 2 - Prob. 4RQCh. 2 - Is cost-of-goods sold an expense?Ch. 2 - Is cost-of-goods a product cost or a period cost?Ch. 2 - What are the similarities between the Direct...Ch. 2 - What are the three categories of product cost in a...Ch. 2 - Prob. 9RQCh. 2 - Prob. 10RQ

Ch. 2 - What do the terms step costs and semivariable...Ch. 2 - What do the terms variable costs and fixed costs...Ch. 2 - How does a value income statement differ from a...Ch. 2 - Why is a value income statement useful to...Ch. 2 - Materials and labor are always direct costs, and...Ch. 2 - Prob. 16CADQCh. 2 - In evaluating product profitability, we can ignore...Ch. 2 - Prob. 18CADQCh. 2 - The friend in question 2-18 decides that she does...Ch. 2 - Consider a digital music service such as those...Ch. 2 - Consider a ride-sharing service such as Uber or...Ch. 2 - Pick a unit of a hospital (for example, intensive...Ch. 2 - The dean of Midstate University Business School is...Ch. 2 - Prob. 24CADQCh. 2 - Prob. 25CADQCh. 2 - Basic Concepts For each of the following...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts Place the number of the appropriate...Ch. 2 - Basic Concepts Intercontinental, Inc., provides...Ch. 2 - Prob. 31ECh. 2 - For each of the following costs incurred in a...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts The following data apply to the...Ch. 2 - Cost AllocationEthical Issues In one of its...Ch. 2 - Cost AllocationEthical Issues Star Buck, a coffee...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Prepare Statements for a Service Company Chucks...Ch. 2 - Prepare Statements for a Service Company Where2...Ch. 2 - Prepare Statements for a Service Company The...Ch. 2 - Prepare Statements for a Service Company Lead!...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Basic Concepts The following data refer to one...Ch. 2 - Basic Concepts The following data refers to one...Ch. 2 - Prepare Statements for a Merchandising Company The...Ch. 2 - Prepare Statements for a Merchandising Company...Ch. 2 - Cost Behavior and Forecasting Dayton, Inc....Ch. 2 - Sophia’s Restaurant served 5,000 meals last...Ch. 2 - Prob. 49ECh. 2 - Components of Full Costs Madrid Corporation has...Ch. 2 - Prob. 51ECh. 2 - Components of Full Costs Larcker Manufacturings...Ch. 2 - Prob. 53ECh. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Value Income Statement Ralphs Restaurant has the...Ch. 2 - Value Income Statement DeLuxe Limo Service has the...Ch. 2 - Cost Concepts The following information comes from...Ch. 2 - Cost Concepts The controller at Lawrence...Ch. 2 - Cost Concepts Columbia Products produced and sold...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Cost Allocation with Cost Flow Diagram Coastal...Ch. 2 - Cost Allocation with Cost Flow Diagram Wayne...Ch. 2 - Cost Allocation with Cost Flow Diagram The library...Ch. 2 - Greenfield Consultants conducts analyses of public...Ch. 2 - Consider the Business Application, “Indirect Costs...Ch. 2 - Find the Unknown Information After a computer...Ch. 2 - Find the Unknown Information Just before class...Ch. 2 - Cost Allocation and Regulated Prices The City of...Ch. 2 - Koufax Materials Corporation produces plastic...Ch. 2 - Reconstruct Financial Statements San Ysidro...Ch. 2 - Westlake, Inc., produces metal fittings for the...Ch. 2 - Finding Unknowns Marys Mugs produces and sells...Ch. 2 - Finding Unknowns BST Partners has developed a new...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What Is A Checking Account?; Author: The Smart Investor;https://www.youtube.com/watch?v=vGymt1Rauak;License: Standard Youtube License