Concept explainers

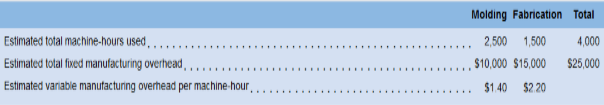

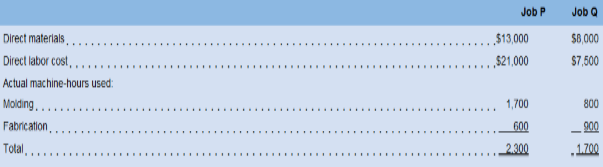

Sweeten Company bad no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during March—Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

Sweeten Company bad no under applied or over applied

Required:

For questions 1-8, assume that Sweeten Company uses a plant wide predetermined overhead rate with machine-hours as the allocation base.

For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.

6. If Job Q included 30 units; what was its unit product cost?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Joe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning