GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

8th Edition

ISBN: 9781260259179

Author: BREWER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 3AE

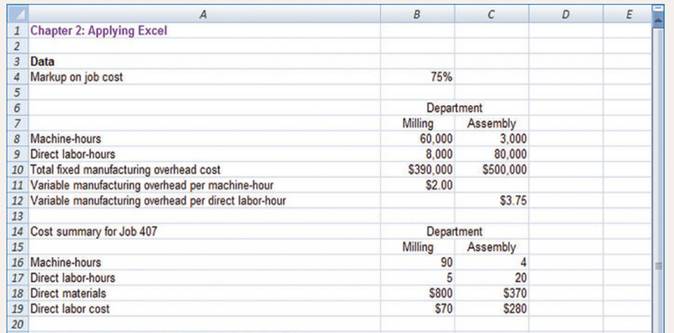

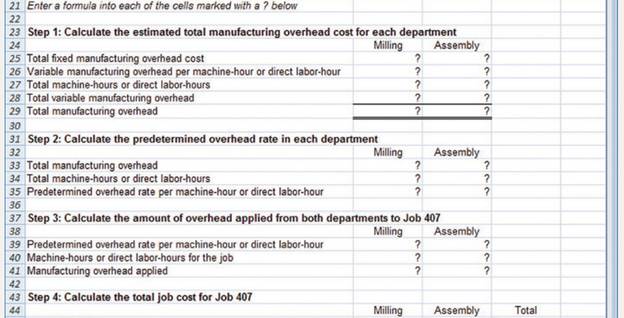

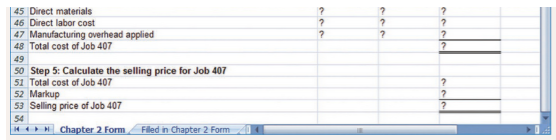

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5. Download the workbook containing this form from Connect, where you will also find instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

3. What happens to the selling price for Job 408 if the total number of machine-hours in the Assembly Department increases from 3,000machine-hours to 6,000 machine-hours? Does it increase, decrease, or stay the same as in part 2 above? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this financial accounting question using valid financial methods?

I don't need ai answer general accounting

General accounting

Chapter 2 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

Ch. 2 - What is job-order costing?Ch. 2 - What is absorption costing?Ch. 2 - What is normal costing?Ch. 2 - How is the unit product cost of a job calculated?Ch. 2 - Explain the four-step process used to compute a...Ch. 2 - What is the purpose of the job cost sheet in a...Ch. 2 - Explain why some production costs must be assigned...Ch. 2 - Why do companies use predetermined overhead rates...Ch. 2 - What factors should be considered in selecting an...Ch. 2 - If a company fully allocates all of its overhead...

Ch. 2 - Prob. 11QCh. 2 - What is underapplied overhead? Overapplied...Ch. 2 - What is a plantwide overhead rate? Why are...Ch. 2 - This Excel worksheet relates to the Dickson...Ch. 2 - This Excel worksheet relates to the Dickson...Ch. 2 - This Excel worksheet relates to the Dickson...Ch. 2 - This Excel worksheet relates to the Dickson...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Sweeten Company bad no jobs in progress at the...Ch. 2 - Harris Fabrics computes its plantwide...Ch. 2 - Luthan Company uses a plant wide predetermined...Ch. 2 - Computing Total Job Costs and Unit Product Costs...Ch. 2 - Computing Total Job Costs and Unit Product Costs...Ch. 2 - Braverman Company has two manufacturing...Ch. 2 - Job-Order Costing for a Service Company Tech...Ch. 2 - Prob. 7ECh. 2 - Newhard Company assigns overhead cost to jobs on...Ch. 2 - Taveras Corporation is currently operating at 50%...Ch. 2 - Prob. 10ECh. 2 - Varying Plantwide Predetermined Overhead Rates...Ch. 2 - Computing Predetermined Overhead Rates and Job...Ch. 2 - Departmental Predetermined Overhead Rates White...Ch. 2 - Prob. 14ECh. 2 - Plantwide and Departmental Predetermined Overhead...Ch. 2 - Plantwide Predetermined Overhead Rates; Pricing...Ch. 2 - Plantwide and Departmental Predetermined Overhead...Ch. 2 - Job-Order Costing for a Service Company Speedy...Ch. 2 - Multiple Predetermined Overhead Rates; Applying...Ch. 2 - Plantwide versus Multiple Predetermined Overhead...Ch. 2 - Plantwide versus Multiple Predetermined Overhead...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

- A company purchased machinery for $120,000 with a useful life of 5 years and a salvage value of $10,000. Using the double-declining balance depreciation method, what is the depreciation expense for Year 2? Answer?arrow_forwardNonearrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY