Concept explainers

Plantwide Predetermined

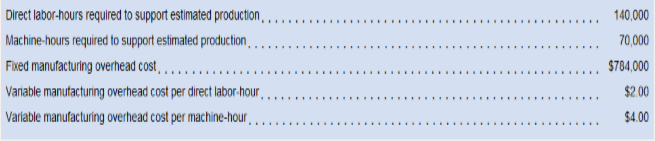

Landen Corporation uses ajob-order costing system. At the beginning of the year, the company made the following estimates:

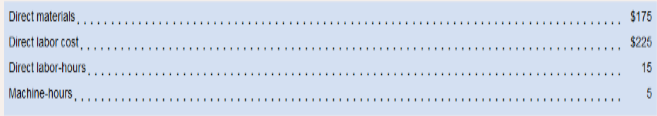

During the year, Job 550 was started and completed. The following information is available with respect to this job:

Required:

1. Assume that Landen has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Underthis approach:

a. Compute the plantwide predetermined overhead rate

b. Compute the total

c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550?

2. Assume that Landen’s controller believes that machine-hours isa better allocation base than direct labor-hours. Under this approach:

a. Compute the plantwide predetermined overhead rate.

b. Compute the total manufacturing cost of Job 550.

c. If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550?

3. Assume that Landen’s controller is right about machine-hours being a more accurate overhead cost allocation base than direct labor-hours. If the company continues to use direct labor-hours as its only overhead cost allocation base what implications does this have forpricing jobs such as Job 550?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Please provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

- Current Attempt in Progress The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1. 2. Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. 4. 5. 6. In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining…arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,