Concept explainers

Problem 2-62B Comprehensive Problem

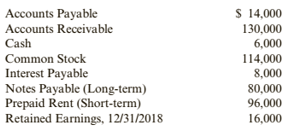

Mulberry Services sells electronic data processing services to firms too Email to own their own computing equipment. Mulberry had the following amounts and amount balances as of January 1, 2019:

During 2019, the following transactions occurred (the events described below are aggregations of many individual events):

- During 2019, Mulberry sold $690,000 of computing services, all on credit.

- Mulberry collected $570,000 from the credit sales in Transaction a and an additional $129,000 from the

accounts receivable outstanding at the beginning of the year. - Mulberry paid the interest payable of $8,000.

- A Wages of $379,000 were paid in cash.

- Repairs and maintenance of $9,000 were incurred and paid.

- The prepaid rent at the beginning of the year was used in 2019. In addition, $28,000 of computer rental costs were incurred and paid. There is no prepaid rent or rent payable at year-end.

- Mulberry purchased computer paper for $13,000 cash in late December. None of the paper was used by year-end.

- Advertising expense of $26,000 was incurred and paid.

- Income tax of $10,300 was incurred and paid in 2019.

- Interest of $5,000 was paid on the long-term loan.

(Continued)

Required:

- Establish a T-account for the accounts listed above and enter the beginning balances. Use a chart of accounts to order the T-accounts.

- Analyze each transaction; Journalize as appropriate. (Note: Ignore the date because these events are aggregations of individual events.)

Post your journal entries to the T-accounts. Add additional T-accounts when needed.- Use the ending balances in the T-accounts to prepare a

trial balance .

T-Accounts:

T-accounts as its name derived from shape of the account, is representation of business transaction in their respective account. It helps in organizing and analyzing the transaction according to their similar nature of account.

Requirement 1

Prepare:

Prepare ledger accounts and enter the beginning balances.

Answer to Problem 62APSA

Cash

| Bal. $16,300 | |

Accounts Receivable

| Bal. $384,000 | |

Accounts Payable

| Bal. $11,900 | |

Interest Payable

| Bal. $11,200 | |

Rent Payable

| Bal. $10,000 | |

Insurance Payable

| Bal. $1,000 | |

Notes Payable

| Bal. $100,000 | |

Common Stock

| Bal. $165,000 | |

Retained Earnings

| Bal. $101,200 | |

Explanation of Solution

| Nature | Accounts Name | Normal Balance | Debit | Credit |

| Asset | Cash | Debit | Increase | Decrease |

| Accounts Receivable | Debit | Increase | Decrease | |

| Liabilities | Accounts Payable | Credit | Decrease | Increase |

| Interest Payable | Credit | Decrease | Increase | |

| Rent Payable | Credit | Decrease | Increase | |

| Insurance Payable | Credit | Decrease | Increase | |

| Notes Payable | Credit | Decrease | Increase | |

| Equity | Common Stock | Credit | Decrease | Increase |

| Retained Earnings | Credit | Decrease | Increase |

Journal Entries:

Journal entries are medium of recording business transactions. A business enterprise must record all the business transaction to evaluate net income or loss and analyze the financial performance of a company during a specified accounting period.

Requirement 2

To Prepare:

Prepare journal entries for the transaction during 2019.

Answer to Problem 62APSA

| Events | Accounts and Explanation | Debit | Credit |

| a. | Accounts Receivable | $994,000 | |

| Service Revenue | $994,000 | ||

| b. | Cash | 384,000 | |

| Accounts Receivable | 384,000 | ||

| c. | Cash | 983,000 | |

| Accounts Receivable | 983,000 | ||

| d. | Rent Payable | 10,000 | |

| Rent Expense | 48,000 | ||

| Cash | 58,000 | ||

| e. | Insurance Payable | 1,000 | |

| Insurance Expense | 4,000 | ||

| Cash | 5,000 | ||

| f. | Utilities Expense | 56,000 | |

| Cash | 56,000 | ||

| g. | Salaries Expense | 702,000 | |

| Cash | 702,000 | ||

| h. | Interest Payable | 11,200 | |

| Interest Expense | 11,000 | ||

| Cash | 22,200 | ||

| i. | Income Tax Expense | 19,700 | |

| Cash | 19,700 |

Explanation of Solution

| Accounting Equation | |||||

| Asset = Liabilities +Stockholders’ Equity | |||||

| a. | Increase (Accounts Receivable) | Increase (Service revenue) | |||

| b. | Increase (Cash) | ||||

| Decrease (Accounts Receivable) | |||||

| c. | Increase (Cash) | ||||

| Decrease (Accounts Receivable) | |||||

| d. | Decrease (Cash) | Decrease (Rent Payable) | Decrease (Rent Expense) | ||

| e. | Decrease (Cash) | Decrease (Insurance Payable) | Decrease (Insurance Expense) | ||

| f. | Decrease (Cash) | Decrease (Utilities Expense) | |||

| g. | Decrease (Cash) | Decrease (Salaries Expense) | |||

| h. | Decrease (Cash) | Decrease (Interest Payable) | Decrease (Interest Expense) | ||

| i. | Decrease (Cash) | Decrease (Income Tax Expense) | |||

Introduction:

T-accounts as its name derived from shape of the account, is representation of business transaction in their respective account. It helps in organizing and analyzing the transaction according to their similar nature of account.

Requirement 3

Prepare:

Posting the journal entries to T-accounts.

Answer to Problem 62APSA

| Accounts | Balance |

| Cash | $520,400 |

| Accounts Receivable | 11,000 |

| Accounts Payable | 11,900 |

| Interest Payable | 0 |

| Rent Payable | 0 |

| Insurance Payable | 0 |

| Notes Payable | 100,000 |

| Common Stock | 165,000 |

| Retained Earnings | 101,200 |

| Service Revenue | 994,000 |

| Rent Expense | 48,000 |

| Insurance Expense | 4,000 |

| Utilities Expense | 56,000 |

| Salaries Expense | 702,000 |

| Interest Expense | 11,000 |

| Income Tax Expense | 19,700 |

Explanation of Solution

Cash

| Bal. $16,300 (b) 384,000 (c) 983,000 | (d) $58,000 (e) 5,000 (f) 56,000 (g) 702,000 (h) 22,200 (i) 19,700 |

| Bal. 520,400 |

Accounts Receivable

| Bal. $384,000 (a) 994,000 | (b) $384,000 (c) 983,000 |

| Bal. 11,000 |

Accounts Payable

| Bal. $11,900 | |

| Bal. 11,900 |

Interest Payable

| (h) 11,200 | Bal. $11,200 |

| Bal. 0 |

Rent Payable

| (d) 10,000 | Bal. $10,000 |

| Bal. 0 |

Insurance Payable

| (e)1,000 | Bal. $1,000 |

| Bal. 0 |

Notes Payable

| Bal. $100,000 | |

| Bal. 100,000 |

Common Stock

| Bal. $165,000 | |

| Bal. 165,000 |

Retained Earnings

| Bal. $101,200 | |

| Bal. 101,200 |

Service Revenue

| Bal. $0 (a) 994,000 | |

| Bal. 994,000 |

Rent Expense

| Bal. $0 (d) 48,000 | |

| Bal. 48,000 |

Insurance Expense

| Bal. $0 (e)4,000 | |

| Bal. 4,000 |

Utilities Expense

| Bal. $0 (f) 56,000 | |

| Bal. 56,000 |

Salaries Expense

| Bal. $0 (g) 702,000 | |

| Bal. 702,000 |

Interest Expense

| Bal. $0 (h)11,000 | |

| Bal. 11,000 |

Income Taxes Expense

| Bal. $0 (i) 19,700 | |

| Bal. 19,700 |

Trial Balance:

A financial statement which integrates all the balance of ledger accounts is termed as a trial balance. The total balance of debit and credit in trial balance should be equal at end of an accounting period.

Requirement 4

Prepare:

Prepare the trial balance as of December 31, 2019.

Answer to Problem 62APSA

The total balance of the trial balance for the year ending December 31, 2019 is $1,372,100.

Explanation of Solution

| Western Sound StudiosTrial Balance December 31, 2019 | |||

| Accounts | Debit | Credit | |

| Cash | $520,400 | ||

| Accounts Receivable | 11,000 | ||

| Accounts Payable | $11,900 | ||

| Notes Payable | 100,000 | ||

| Common Stock | 165,000 | ||

| Retained Earnings | 101,200 | ||

| Service Revenue | 994,000 | ||

| Rent Expense | 48,000 | ||

| Insurance Expense | 4,000 | ||

| Utilities Expense | 56,000 | ||

| Salaries Expense | 702,000 | ||

| Interest Expense | 11,000 | ||

| Income Tax Expense | 19,700 | ||

| Total | $1,372,100 | $1,372,100 | |

Want to see more full solutions like this?

Chapter 2 Solutions

Cornerstones of Financial Accounting - With CengageNow

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardPlease provide the answer to this financial accounting question with proper steps.arrow_forward

- What are the three sections of the statement of cash flows, and what does each section report?no aiarrow_forwardWhat are the three sections of the statement of cash flows, and what does each section report? I need helparrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning