Cornerstones of Financial Accounting - With CengageNow

4th Edition

ISBN: 9781337760959

Author: Rich

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 47E

OBJECTIVE 9 Exercise 2-47 Debit and Credit Effects of Transactions

Lincoln Corporation was involved in the following transactions during the current year:

- Lincoln borrowed cash from the local bank on a note payable.

- Lincoln purchased operating assets on credit.

- Lincoln paid dividends in cash.

- Lincoln purchased supplies inventory on credit.

- Lincoln used a portion of the supplies purchased in Transaction d.

- Lincoln provided services in exchange for cash from the customer.

- A customer received services from Lincoln on credit.

- The owners invested cash in the business in exchange for common stock.

- The payable from Transaction d was paid in full.

- The receivable from Transaction g was collected in full.

- Lincoln paid wages in cash.

Required:

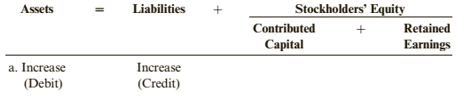

Prepare a table like the one shown below and indicate the effect on assets, liabilities, and stock-holders, equity. Be sure to enter debits and credits in the appropriate columns for each of the transactions. Transaction a is entered as an example:

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Expand upon it and add more info

JH, Inc., is a calendar year, accrual basis corporation with Joe as its sole shareholder (basis in his stock is $90,000). On January 1 of the current year, JH Corporation has accumulated E & P of $200,000. Before considering the effect of the distribution described below, the corporation’s current E & P is $50,000. On November 1, JH distributes an office building to Joe. The office building has an adjusted basis of $80,000 (fair market value of $100,000) and is subject to a mortgage of $110,000. Assume that the building has been depreciated using the ADS method for both income tax and E & P purposes. What are the tax consequences of the distribution to JH and to Joe? (In your answer, be sure to describe the effects on taxable income for both JH and Joe, the impact of the distribution on JH’s E & P, and Joe’s basis in the building.)

Joe is the sole shareholder of JH Corporation. Joe sold his stock to Ethan on October 31 for $150,000. Joe’s basis in JH stock was $50,000 at the start of the year. JH distributed land to Joe immediately before the sale. JH’s basis in the land was $20,000 (fair market value of $25,000). On December 31, Ethan received a $75,000 cash distribution from JH. During the year, JH has $20,000 of current E & P and its accumulated E & P balance on January 1 is $10,000. Which of the following statements is true?

a. Joe recognizes a $110,000 gain on the sale of his stock. b. Joe recognizes a $100,000 gain on the sale of his stock. c. Ethan receives $5,000 of dividend income.d. Joe receives $20,000 of dividend income. e. None of the above.

Chapter 2 Solutions

Cornerstones of Financial Accounting - With CengageNow

Ch. 2 - What is the conceptual framework of accounting?Ch. 2 - Prob. 2DQCh. 2 - Prob. 3DQCh. 2 - Prob. 4DQCh. 2 - Describe the constraint on providing useful...Ch. 2 - Prob. 6DQCh. 2 - Prob. 7DQCh. 2 - Prob. 8DQCh. 2 - Of all the events that occur each day, how would...Ch. 2 - Prob. 10DQ

Ch. 2 - Prob. 11DQCh. 2 - In analyzing a transaction, can a transaction only...Ch. 2 - How do revenues and expenses affect the accounting...Ch. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - The words debit and credit are used in two ways in...Ch. 2 - Prob. 17DQCh. 2 - Prob. 18DQCh. 2 - Prob. 19DQCh. 2 - Prob. 20DQCh. 2 - Prob. 21DQCh. 2 - Prob. 22DQCh. 2 - Prob. 1MCQCh. 2 - Prob. 2MCQCh. 2 - Prob. 3MCQCh. 2 - Prob. 4MCQCh. 2 - Prob. 5MCQCh. 2 - Which principle requires that expenses be recorded...Ch. 2 - Taylor Company recently purchased a piece of...Ch. 2 - Prob. 8MCQCh. 2 - The effects of paying salaries for the current...Ch. 2 - Which of the following statements is false? The...Ch. 2 - Which of the following statements are true? Debits...Ch. 2 - Debits will: increase assets. expenses, and...Ch. 2 - Which of the following statements are true? A...Ch. 2 - Posting: involves transferring the information in...Ch. 2 - A trial balance: lists only revenue and expense...Ch. 2 - CORNERSTONE 2.1 Cornerstone Exercise 2-16...Ch. 2 - Prob. 17CECh. 2 - CORNERSTONE 2.1 Four statements are given below....Ch. 2 - Prob. 19CECh. 2 - Cornerstone Exercise 2-20 Transaction Analysis...Ch. 2 - Cornerstone Exercise 2-21 Transaction Analysis...Ch. 2 - Cornerstone Exercise 2-22 Transaction Analysis The...Ch. 2 - Cornerstone Exercise 2-23 Debit and Credit...Ch. 2 - Cornerstone Exercise 2-24 Journalize Transactions...Ch. 2 - Cornerstone Exercise 2-25 Journalize Transactions...Ch. 2 - Cornerstone Exercise 2-26 Preparing a Trial...Ch. 2 - Prob. 27BECh. 2 - Brief Exercise 2-28 Assumptions and Principles...Ch. 2 - Brief Exercise 2-2? Events and Transactions...Ch. 2 - Brief Exercise 2-30 Transaction Analysis Galle...Ch. 2 - Brief Exercise 2-31 Debit and Credit Procedures...Ch. 2 - Brief Exercise 2-32 Journalize Transactions Galle...Ch. 2 - Brief Exercise 2-33 Posting Journal Entries Listed...Ch. 2 - Brief Exercise 2-34 Preparing a Trial Balance The...Ch. 2 - Prob. 35ECh. 2 - Prob. 36ECh. 2 - Exercise 2-37 Events and Transactions Several...Ch. 2 - Exercise 2-38 Events and Transactions The...Ch. 2 - Exercise 2-39 Transaction Analysis OBJECTIVE e The...Ch. 2 - Exercise 2-40 Transaction Analysis Amanda Webb...Ch. 2 - Exercise 2-41 Transaction Analysis and Business...Ch. 2 - Exercise 2-42 Inferring Transactions from Balance...Ch. 2 - Exercise 2-43 Transaction Analysis Goal Systems, a...Ch. 2 - Exercise 2-44 Transaction Analysis OBJECTIVE 9...Ch. 2 - Prob. 45ECh. 2 - Exercise 2-46 Normal Balances and Financial...Ch. 2 - OBJECTIVE 9 Exercise 2-47 Debit and Credit Effects...Ch. 2 - Prob. 48ECh. 2 - Exercise 2-49 Journalizing Transactions Kauai...Ch. 2 - Exercise 2-50 Journalizing Transactions Remington...Ch. 2 - Exercise 2-51 Transaction Analysis and Journal...Ch. 2 - Exercise 2-52 Accounting Cycle Rosenthal...Ch. 2 - Exercise 2-53 Preparing a Trial Balance...Ch. 2 - Exercise 2-54 Effect of Errors on a Trial Balance...Ch. 2 - Problem 2-55A Events and Transactions The...Ch. 2 - Problem 2-56A Analyzing Transactions Luis Madero,...Ch. 2 - Problem 2-57A Inferring Transactions from...Ch. 2 - Prob. 58APSACh. 2 - Problem 2-59A Journalizing Transactions Monroe...Ch. 2 - Problem 2-60A Journalizing and Posting...Ch. 2 - Problem 2-61A The Accounting Cycle Karleens...Ch. 2 - Problem 2-62B Comprehensive Problem Mulberry...Ch. 2 - Prob. 55BPSBCh. 2 - Prob. 56BPSBCh. 2 - Prob. 57BPSBCh. 2 - Problem 2-58B Debit and Credit Procedures A list...Ch. 2 - Problem 2-593 Journalizing Transactions Monilast...Ch. 2 - Problem 2-603 Journalizing and Posting...Ch. 2 - Problem 2-6B The Accounting Cycle Sweetwater...Ch. 2 - Problem 2-62B Comprehensive Problem Mulberry...Ch. 2 - Prob. 63.1CCh. 2 - Prob. 63.2CCh. 2 - Prob. 63.3CCh. 2 - Prob. 64.1CCh. 2 - Prob. 64.2CCh. 2 - Case 2-64 Analysis of the Effects of Current Asset...Ch. 2 - Prob. 64.4CCh. 2 - Prob. 65.1CCh. 2 - Prob. 65.2CCh. 2 - Prob. 66.1CCh. 2 - Prob. 66.2CCh. 2 - Prob. 66.3CCh. 2 - Case 2-67 Comparative Analysis: Under Armour,...Ch. 2 - Prob. 67.2CCh. 2 - Case 2-67 Comparative Analysis: Under Armour,...Ch. 2 - Case 2-68 Accounting for Partially Completed...Ch. 2 - Prob. 68.2CCh. 2 - Prob. 69.1CCh. 2 - Case 2-69 CONTINUING PROBLEM: FRONT ROW...Ch. 2 - Case 2-69 CONTINUING PROBLEM: FRONT ROW...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY