You just started a summer internship with the successful management consulting firm of Kirk, Spock, and McCoy. Your first day on the job was a busy one, as the following problems were presented to you.

Required: Supply the requested comments in each of the following independent situations.

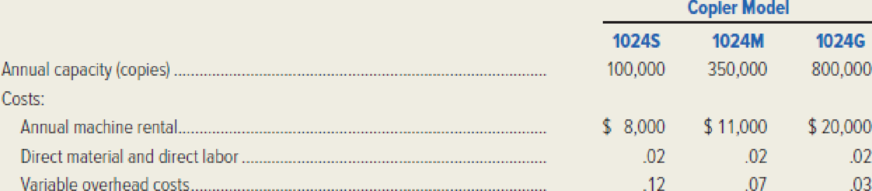

- 1. FastQ Company, a specialist in printing, has established 500 convenience copying centers throughout the country. In order to upgrade its services, the company is considering three new models of laser copying machines for use in producing high-quality copies. These high-quality copies would be added to the growing list of products offered in the FastQ shops. The selling price to the customer for each laser copy would be the same, no matter which machine is installed in the shop. The three models of laser copying machines under consideration are 1024S, a small-volume model; 1024M, a medium-volume model; and 1024G, a large-volume model. The annual rental costs and the operating costs vary with the size of each machine. The machine capacities and costs are as follows:

- a. Calculate the volume level in copies where FastQ Company would be indifferent to acquiring either the small-volume model laser copier, 1024S, or the medium-volume model laser copier, 1024M.

- b. The management of FastQ Company is able to estimate the number of copies to be sold at each establishment. Present a decision rule that would enable FastQ Company to select the most profitable machine without having to make a separate cost calculation for each establishment. (Hint: To specify a decision rule, determine the volume at which FastQ would be indifferent between the small and medium copiers. Then determine the volume at which FastQ would be indifferent between the medium and large copiers.)

- 2. Alderon Enterprises is evaluating a special order it has received for a ceramic fixture to be used in aircraft engines. Alderon has recently been operating at less than full capacity, so the firm’s management will accept the order if the price offered exceeds the costs that will be incurred in producing it. You have been asked for advice on how to determine the cost of two raw materials that would be required to produce the order.

- a. The special order will require 800 gallons of endor, a highly perishable material that is purchased as needed. Alderon currently has 1,200 gallons of endor on hand, since the material is used in virtually all of the company’s products. The last time endor was purchased, Alderon paid $5.00 per gallon. However, the average price paid for the endor in stock was only $4.75. The market price for endor is quite volatile, with the current price at $5.50. If the special order is accepted, Alderon will have to place a new order next week to replace the 800 gallons of endor used. By then the price is expected to reach $5.75 per gallon.

Using the cost terminology introduced in this chapter, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of endor if the special order is produced?

- b. The special order also would require 1,500 kilograms of tatooine, a material not normally required in any of Alderon’s regular products. The company does happen to have 2,000 kilograms of tatooine on hand, since it formerly manufactured a ceramic product that used the material. Alderon recently received an offer of $14,000 from Solo Industries for its entire supply of tatooine. However, Solo Industries is not interested in buying any quantity less than Alderon’s entire 2,000-kilogram stock. Alderon’s management is unenthusiastic about Solo’s offer, since Alderon paid $20,000 for the tatooine. Moreover, if the tatooine were purchased at today’s market price, it would cost $11.00 per kilogram. Due to the volatility of the tatooine, Alderon will need to get rid of its entire supply one way or another. If the material is not used in production or sold, Alderon will have to pay $1,000 for each 500 kilograms that is transported away and disposed of in a hazardous waste disposal site.

Using the cost terminology introduced in this chapter, comment on each of the cost figures mentioned in the preceding discussion. What is the real cost of tatooine to be used in the special order?

- 3. A local PBS station has decided to produce a TV series on state-of-the-art manufacturing. The director of the TV series, Justin Tyme, is currently attempting to analyze some of the projected costs for the series. Tyme intends to take a TV production crew on location to shoot various manufacturing scenes as they occur. If the four-week series is shown in the 8:00–9:00 P.M. prime-time slot, the station will have to cancel a wildlife show that is currently scheduled. Management projects a 10 percent viewing audience for the wildlife show, and each 1 percent is expected to bring in donations of $10,000. In contrast, the manufacturing show is expected to be watched by 15 percent of the viewing audience. However, each 1 percent of the viewership will likely generate only $5,000 in donations. If the wildlife show is canceled, it can be sold to network television for $25,000.

Using the cost terminology introduced in this chapter, comment on each of the financial amounts mentioned in the scenario above. What are the relative merits of the two shows regarding the projected revenue to the station?

1 a.

Calculate the volume level in copies for F Company, if the company indifferent among the 1024S copier model and 1024M copier.

Explanation of Solution

F Company is confused to acquire the 1024S copier or 1024M copier, at this point the cost of 1024S and 1024M are same. The value X is considered being the volume level for the 1024S copier and 1024M.

Working notes:

Calculate the total variable cost of the 1024S copier.

Calculate the variable cost of the 1024M copier.

Therefore, the F Company will be indifferent to acquire the 1024S or 1024M machine at an annual volume of 60,000 copies.

1 b.

Calculate the volume level in copies for F Company, if the company indifferent among the 1024S copier model, 1024M copier and 1024G copier models.

Explanation of Solution

Select the most profitable copier, when the volume is estimated and establish the points where F Company is indifferent to each machine. The value X is considered being the volume level for the 1024S copier and 1024M.

For the 1024M machine compared to 1024G machine.

Working notes:

Calculate the variable cost of the 1024M copier.

Calculate the total variable cost of the 1024M copier.

Select the alternatives as show in the following table.

| Anticipated Annual Volume | Optimal Model Choice |

| 0−60,000 | 1024S |

| 60,000−225,000 | 1024M |

| 225,000 and higher | 1024G |

Table (1)

2 a.

Find the real cost of endor, if the special order is produced.

Explanation of Solution

The price of the endor in hand is $5 per gallon, and the average cost of the endor inventory is $4.75 per gallon, are sunk cost. These costs were incurred in the past and will have no impact on future costs. They cannot change any future action and are irrelevant to future decision. The current price of $5 per gallon is not relevant to the current special order. If the special order is accepted by A enterprises then they replace the 800 gallons by purchasing endor at the rate of $5.75 per gallon. Therefore, the real cost of endor will be $4,600

2 b.

Find the real cost of tatooine used for the special order.

Explanation of Solution

The value of the tatooine in hand $20,000 is a sunk cost because it is incurred in the past and irrelevant for the future decision. From now onwards A enterprises decided to no more purchase of the tatooine and the current price of tatooine $11 per kilogram is irrelevant. If A enterprises accept the special order, they use 1,500 kilogram of tatooine from their stock and lose their opportunity of selling the entire 2,000 kilogram of stock for $14,000. Thus, $14,000 is an opportunity cost of A enterprises for using the tatooine instead of selling to the S industries. If A enterprises uses 1,500 kilograms of tatooine in production, then they need to pay $1,000 for the remaining 500 tatooine and it will be disposed as hazardous waste. The disposal cost of $1,000 is an out of pocket cost.

Therefore, the real cost for tatoine used for the special order is $15,000.

3.

Explain the relative merits of the two shows related to the projected revenue to the station.

Explanation of Solution

PBS station projected the donations incurred from wildlife show by $100,000 (Ten percentages from the viewing audience and each one percentage of viewers are expected to bring $10,000). The projected donations from the manufacturing series by $75,000 (Fifteen percentages from the viewing audience and each one percentage of viewers are expected to bring $5,000). Therefore there will be the differential cost of $25,000 between the wildlife show and manufacturing show. If the PBS station aired the manufacturing show, they can sell the wildlife show to the network TV for $25,000. Therefore, PBS station will incur the opportunity cost of $25,000 due to airing the wildlife show.

Hence, as a conclusion, the management found the same merit of two shows, since each show generates the revenue of $100,000.

Supporting calculation:

Calculate the revenue generated for wildlife show.

Wildlife show generated revenue of $100,000

Calculate the revenue generated for manufacturing show.

Manufacturing show generated revenue of $75,000

Want to see more full solutions like this?

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Needam Company has analyzed its production process and identified two primary activities. These activities, their allocation bases, and their estimated costs are listed below. BEE (Click on the icon to view the estimated costs data.) The company manufactures two products: Regular and Super. The products use the following resources in March: BEE (Click on the icon to view the actual data for March.) Read the requirements. Requirement 5. Compute the predetermined overhead allocation rates using activity-based costing. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the all Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Data table Regular Super Number of purchase orders 10 purchase orders Number of parts 600 parts 13 purchase orders 800 parts Activity Purchasing Materials handling - X…arrow_forwardMakenna is a waiter at Albicious Foods in South Carolina. Makenna is single with one other dependent and receives the standard tipped hourly wage. During the week ending October 25, 2024, Makenna worked 44 hours and received $210 in tips. Calculate Makenna's gross pay, assuming tips are included in the overtime rate determination. Use Table 3-2. Required: 1. Complete the payroll register for Makenna. 2a. Does Albicious Foods need to contribute to Makenna’s wages to meet FLSA requirements? 2b. If so, how much should be contributed?arrow_forward10. Record the journal entries for Holley Company for August. 11. Post appropriate entries to the Conversion Costs T-account to determine the amount of underallocated or overallocated overhead. Record the adjusting entry. 10. Record the journal entries for Holley Company for August. (Record debits first, then credits. Exclude explanations from journal entries) Journalize the purchase of raw materials. Date 5 a. Accounts Debit Credit Accounts Payable Accounts Receivable Conversion Costs Cost of Goods Sold Finished Goods Inventory Raw and In-Process Inventory Sales Revenue Wages Payable, Accumulated Depreciation, etc. More info a. Purchased raw materials on account, $30,000. b Incurred labor and overhead costs, $65,000. C d. Completed 900 units with standard costs of $75 for direct materials and $180 for conversion costs. Sold on account 600 units for $400 each. Print Done - Xarrow_forward

- The Coyle Shirt Company manufactures shirts in two departments: Cutting and Sewing. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $630,000, and estimated direct labor hours are 210,000. In June, the company incurred 18,200 direct labor hours. 1. 2. Compute the predetermined overhead allocation rate. Determine the amount of overhead allocated in June. The Coyle Shirt Company has refined its allocation system by separating manufacturing overhead costs into two cost pools-one for each department. (Click the icon to view the estimated costs and allocation data for each department.) 3. Compute the predetermined overhead allocation rates for each department. 4. Determine the total amount of overhead allocated in June. 1. Compute the predetermined overhead allocation rate. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter…arrow_forwardDecentralized businesses can have three responsibility centers that must be evaluated differently because of their functions. • Describe the three responsibility centers and give an example of each from your work. • Give an explanation about how each is evaluated. • Tell us why you would prefer to work in a centralized or decentralized organization. • Discuss which type of responsibility center you would prefer to manage and why.arrow_forwardDo fast this question answer general Accountingarrow_forward

- 12. Identify the following costs as preveron, appraisal, internal failure, or external failure: a. Inspection of final products b. Sales returns of defective products c. Employee training d. Reworking defective products e. Working with suppliers to ensure delivery of high-quality raw materials f. Costs of warranty repairs g. Product testing Type of cost Prevention Appraisal Internal failure External failurearrow_forwardYou invest $1,500 today to purchase a new machine that is expected to generate the following revenues over the next 4 years: Year 0 1 2 3 4 Cash flow -1500 300 475 680 490 Find the internal rate of return (IRR) from this investment. What would be the net present value (NPV) if the interest rate is 10%? An investment project provides cash inflows of $560 per year for 10 years. What is the project’s payback period if the initial cost is $2,500? What if the initial cost is $3,250? An investment project has annual cash inflows of $2,000, $2,500, $3,000, and $4,000, and a discount rate of 11%. What is the discounted payback period for these cash flows if the initial cost is $4,800? What if the initial cost is $5,600?arrow_forwardHow does the treatment of costs differ in ABC systems as opposed to traditional cost systems?arrow_forward

- Hii ticher please given correct answer general accountingarrow_forwardFinancial accountingarrow_forwardOn October 1, 2019, Ball Company issued 10% bonds dated October 1, 2019, with a face amount of $380,000. The bonds mature in 10 years. Interest is paid semiannually on March 31 and September 30. The proceeds from the bond issuance were $384,776.05 to yield 9.80%. Ball Company has a December 31 fiscal year-end and does not use reversing entries. Required: 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest method. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College