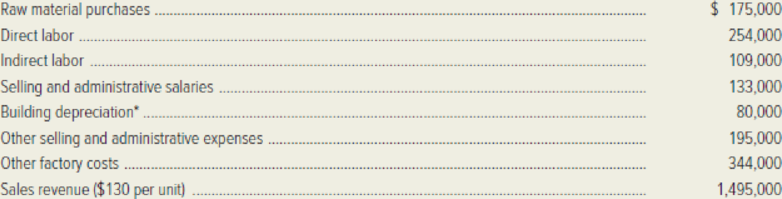

The following selected information was extracted from the 20x1 accounting records of Lone Oak Products:

*Seventy-five percent of the company’s building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions.

Inventory data:

*The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.

Required:

- 1. Calculate Lone Oak’s manufacturing overhead for the year.

- 2. Calculate Lone Oak’s cost of goods manufactured.

- 3. Compute the company’s cost of goods sold.

- 4. Determine net income for 20x1, assuming a 30% income tax rate.

- 5. Determine the number of completed units manufactured during the year.

- 6. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: indirect labor is $115,000 and other

factory costs amount to $516,000.

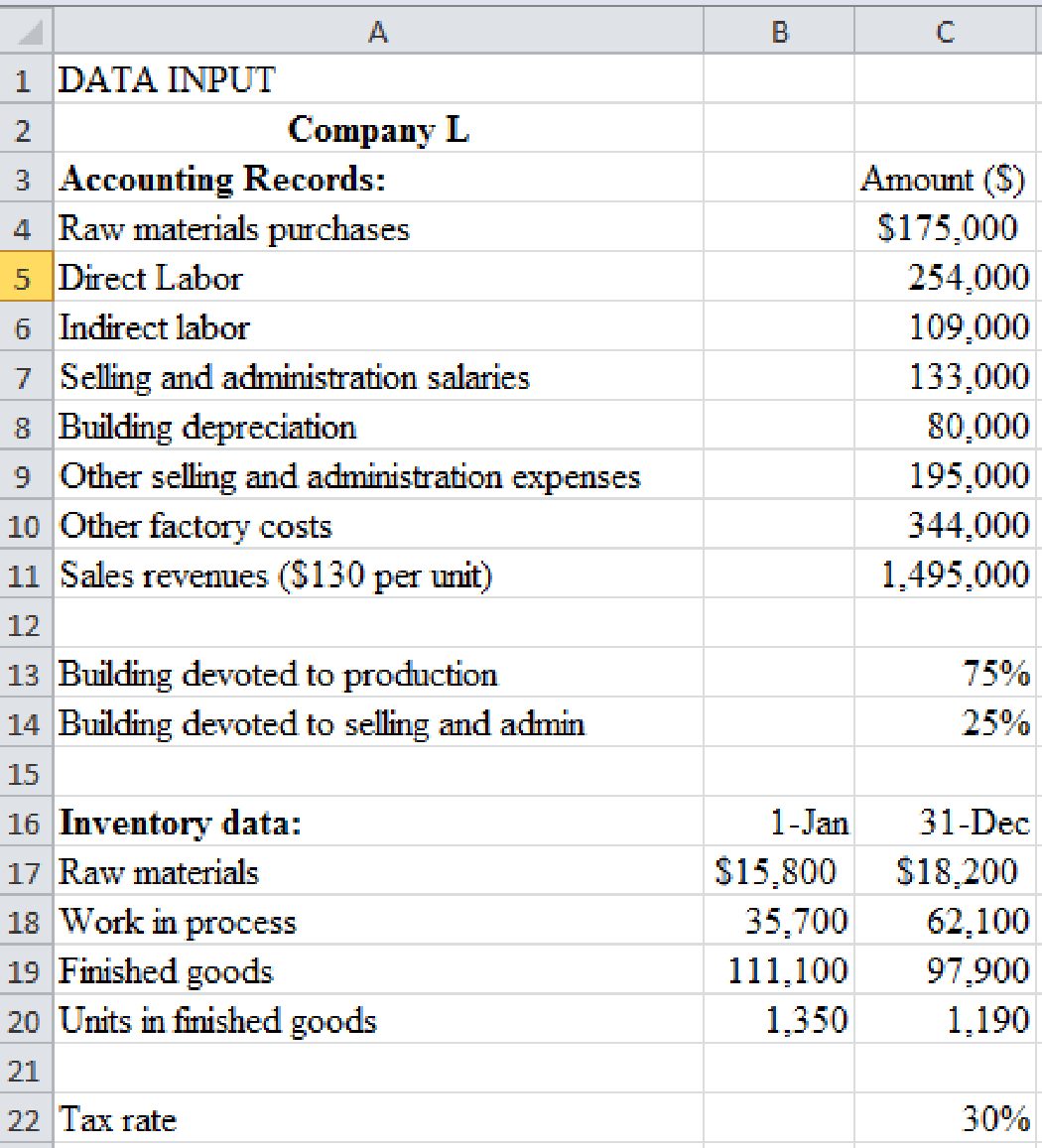

1.

Calculate the manufacturing overhead for L company.

Explanation of Solution

Manufacturing overhead: Manufacturing overhead includes all manufacturing cost except direct material and direct labor costs.

Calculate the manufacturing overhead.

2.

Calculate the cost of goods manufactured by L Company.

Explanation of Solution

Cost of goods manufactured: cost of good manufactured is the total cost of direct material, direct labor, and manufacturing overhead transferred from Work-in-Process to Finished-Goods during an accounting period.

Calculate the cost of goods manufactured.

| Cost of goods manufactured by L company | ||

| Particulars | Amount ($) | Amount ($) |

| Direct material: | ||

| Raw-material inventory, January 1 | $15,800 | |

| Add: Purchases of raw material | 175,000 | |

| Raw material available for use | $190,800 | |

| Deduct: Raw material inventory, December 31 | (18,200) | |

| Raw material used | $172,600 | |

| Direct labor | 254,000 | |

| Manufacturing overhead | 513,000 | |

| Total manufacturing costs | $939,600 | |

| Add: Work in process inventory, January 1 | 35,700 | |

| Sub total | $975,300 | |

| Deduct: Work in progress inventory, December 31 | (62,100) | |

| Cost of goods manufactured | $913,200 | |

Table (1)

3.

Calculate the Cost of goods sold by L Company.

Explanation of Solution

Cost of goods sold: Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period.

Calculate the cost of goods sold.

| Cost of goods sold | |

| Particulars | Amount ($) |

| Finished goods inventory, January 1 | $111,100 |

| Add: Cost of goods manufactured | 913,200 |

| Cost of goods available for sale | $1,024,000 |

| Deduct: Finished goods inventory, December 31 | 97,900 |

| Cost of goods sold | $926,400 |

Table (2)

4.

Calculate the net income for L Company and assume income tax rate as 30%.

Explanation of Solution

Net income: The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Calculate the net income for L Company

| Net income for L Company | ||

| Particulars | Amount ($) | Amount ($) |

| Sales revenue | $1,495,000 | |

| Less: Cost of goods sold | 926,400 | |

| Gross margin | $568,600 | |

| Selling and administration expenses: | ||

| Salaries | $133,000 | |

| Building depreciation ($80,000*25%) | 20,000 | |

| Other | 195,000 | 348,000 |

| Income before taxes | $220,000 | |

| Income tax expense ($220,600*30%) | 66,180 | |

| Net income | $154,420 | |

Table (3)

5.

Calculate the number of finished units manufactured during the year.

Explanation of Solution

Calculate the number of finished units manufactured during the year.

Calculate the total units sold during the year.

Calculate the units came from finished goods inventory.

6.

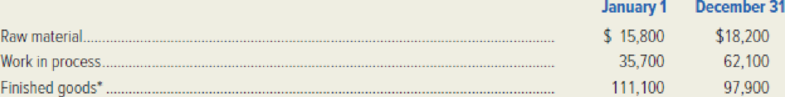

Prepare the excel spread sheet to solve the preceding requirements.

Explanation of Solution

Table (4)

Want to see more full solutions like this?

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,