Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 5PB

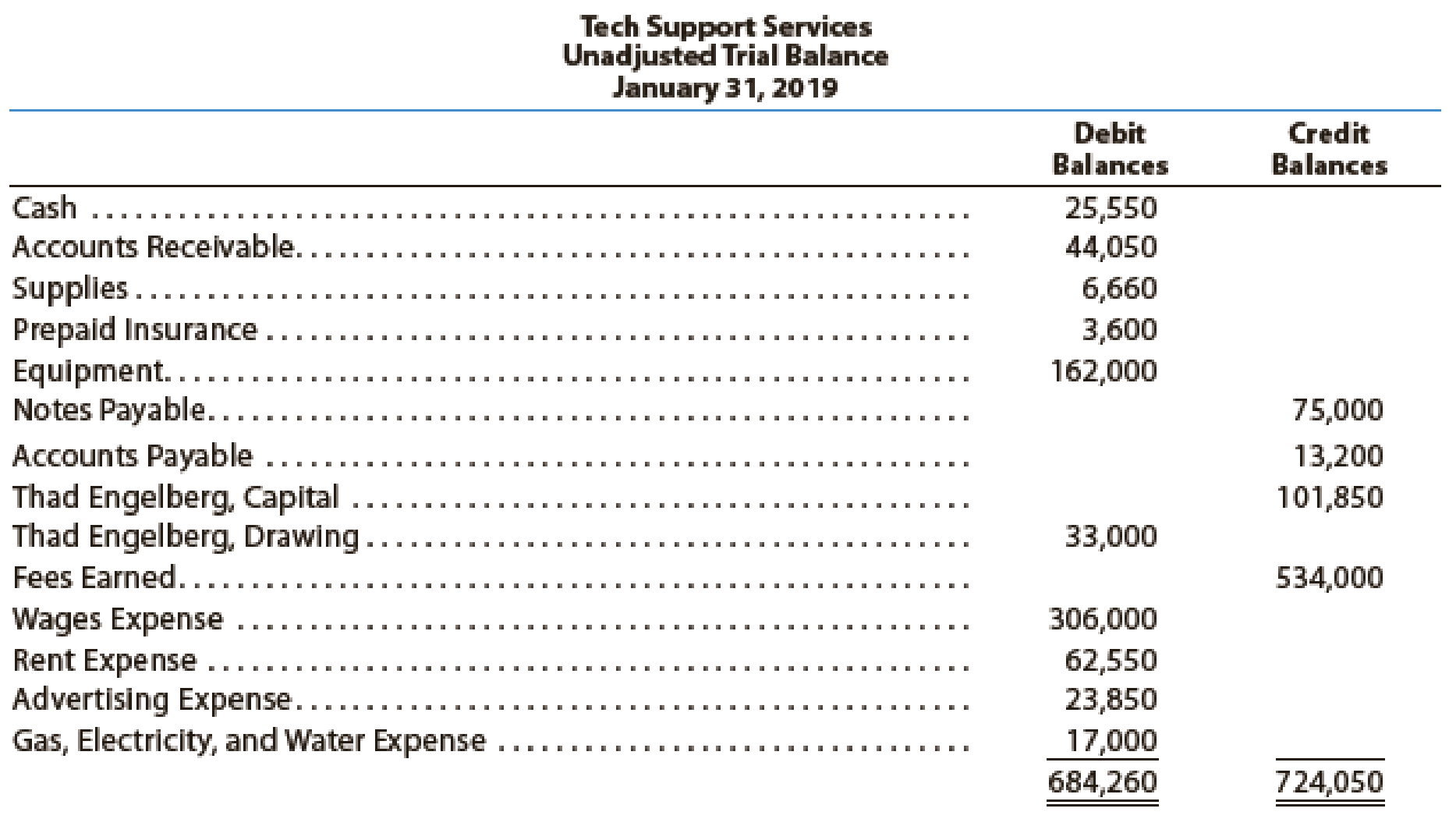

Tech Support Services has the following unadjusted

The debit and credit totals are not equal as a result of the following errors:

- a. The cash entered on the trial balance was overstated by $8,000.

- b. A cash receipt of $4,100 was posted as a debit to Cash of $1,400.

- c. A debit of $12,350 to

Accounts Receivable was not posted. - d. A return of $235 of defective supplies was erroneously posted as a $325 credit to Supplies.

- e. An insurance policy acquired at a cost of $3,000 was posted as a credit to Prepaid Insurance.

- f. The balance of Notes Payable was overstated by $21,000.

- g. A credit of $3,450 in Accounts Payable was overlooked when the balance of the account was determined.

- h. A debit of $6,000 for a withdrawal by the owner was posted as a debit to Thad Engelberg, Capital.

- i. The balance of $28,350 in Advertising Expense was entered as $23,850 in the trial balance.

- j. Miscellaneous Expense, with a balance of $4,600, was omitted from the trial balance.

Instructions

- 1. Prepare a corrected unadjusted trial balance as of January 31, 2019.

- 2.

Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Bodhi Company has three cost pools and two doggie products (leashes and collars). The activity cost pool

of ordering has the cost drive of purchase orders. The activity cost pool of assembly has a cost driver of

parts. The activity cost pool of supervising has the cost driver of labor hours. The accumulated data

relative to those cost drivers is as follows:

Expected Use of

Estimated

Cost Drivers by Product

Cost Drivers

Overhead

Leashes

Collars

Purchase orders

$260,000

70,000

60,000

Parts

400,000

300,000

500,000

Labor hours

300,000

15,000

10,000

$960,000

Instructions: (a) Compute the activity-based overhead rates. (b) Compute the costs assigned to leashes

and collars for each activity cost pool. (c) Compute the total costs assigned to each product.

Torre Corporation incurred the following transactions.

1. Purchased raw materials on account $46,300.

2. Raw Materials of $36,000 were requisitioned to the factory. An analysis of the materials requisition slips

indicated that $6,800 was classified as indirect materials.

3. Factory labor costs incurred were $55,900, of which $51,000 pertained to factory wages payable and

$4,900 pertained to employer payroll taxes payable.

4. Time tickets indicated that $50,000 was direct labor and $5,900 was indirect labor.

5. Overhead costs incurred on account were $80,500.

6. Manufacturing overhead was applied at the rate of 150% of direct labor cost.

7. Goods costing $88,000 were completed and transferred to finished goods.

8. Finished goods costing $75,000 to manufacture were sold on account for $103,000.

Instructions

Journalize the transactions.

Chapter 15 Assignment of direct materials, direct labor and

manufacturing overhead

Stine Company uses a job order cost system. During May, a summary of source documents reveals the

following.

Job Number Materials Requisition Slips Labor Time Tickets

429

430

$2,500

3,500

$1,900

3,000

431

4,400

$10,400

7,600 $12,500

General use

800

1,200

$11,200

$13,700

Stine Company applies manufacturing overhead to jobs at an overhead rate of 60% of direct labor cost.

Instructions

Prepare summary journal entries to record (i) the requisition slips, (ii) the time tickets, (iii) the

assignment of manufacturing overhead to jobs,

Chapter 2 Solutions

Financial Accounting

Ch. 2 - What is the difference between an account and a...Ch. 2 - Prob. 2DQCh. 2 - Prob. 3DQCh. 2 - eCatalog Services Company performed services in...Ch. 2 - If the two totals of a trial balance are equal,...Ch. 2 - Assume that a trial balance is prepared with an...Ch. 2 - Assume that when a purchase of supplies of 2,650...Ch. 2 - Assume that Muscular Consulting erroneously...Ch. 2 - Assume that Sunshine Realty Co. borrowed 300,000...Ch. 2 - Checking accounts are a common form of deposits...

Ch. 2 - State for each account whether it is likely to...Ch. 2 - State for each account whether it is likely to...Ch. 2 - Prepare a journal entry for the purchase of office...Ch. 2 - Prob. 2PEBCh. 2 - Prepare a journal entry on April 30 for fees...Ch. 2 - Prepare a journal entry on August 13 for cash...Ch. 2 - Prepare a journal entry on December 23 for the...Ch. 2 - Prepare a journal entry on June 30 for the...Ch. 2 - Prob. 5PEACh. 2 - On August 1, the supplies account balance was...Ch. 2 - For each of the following errors, considered...Ch. 2 - For each of the following errors, considered...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following errors took place in journalizing...Ch. 2 - Prob. 8PEACh. 2 - Prob. 8PEBCh. 2 - The following accounts appeared in recent...Ch. 2 - Oak Interiors is owned and operated by Fred Biggs,...Ch. 2 - Outdoor Leadership School is a newly organized...Ch. 2 - The following table summarizes the rules of debit...Ch. 2 - During the month, Midwest Labs Co. has a...Ch. 2 - Identify each of the following accounts of...Ch. 2 - Concrete Consulting Co. has the following accounts...Ch. 2 - On September 18, 2019, Afton Company purchased...Ch. 2 - The following selected transactions were completed...Ch. 2 - During the month, Warwick Co. received 515,000 in...Ch. 2 - a. During February, 186,500 was paid to creditors...Ch. 2 - As of January 1, Terrace Waters, Capital had a...Ch. 2 - National Park Tours Co. is a travel agency. The...Ch. 2 - Based upon the T accounts in Exercise 2-13,...Ch. 2 - Based upon the data presented in Exercise 2-13,...Ch. 2 - The accounts in the ledger of Hickory Furniture...Ch. 2 - Indicate which of the following errors, each...Ch. 2 - The following preliminary unadjusted trial balance...Ch. 2 - The following errors occurred in posting from a...Ch. 2 - Identify the errors in the following trial...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following data (in millions) are taken from...Ch. 2 - The following data (in millions) were taken from...Ch. 2 - Connie Young, an architect, opened an office on...Ch. 2 - On January 1, 2019, Sharon Matthews established...Ch. 2 - On June 1, 2019, Kris Storey established an...Ch. 2 - Elite Realty acts as an agent in buying, selling,...Ch. 2 - The Colby Group has the following unadjusted trial...Ch. 2 - Ken Jones, an architect, opened an office on April...Ch. 2 - Prob. 2PBCh. 2 - On October 1, 2019, Jay Pryor established an...Ch. 2 - Valley Realty acts as an agent in buying, selling,...Ch. 2 - Tech Support Services has the following unadjusted...Ch. 2 - The transactions completed by PS Music during June...Ch. 2 - Buddy Dupree is the accounting manager for On-Time...Ch. 2 - Prob. 5CPCh. 2 - The following discussion took place between Tony...Ch. 2 - Prob. 7CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve accarrow_forwardSolve fastarrow_forwardAssume that none of the fixed overhead can be avoided. However, if the robots are purchased from Tienh Inc., Crane can use the released productive resources to generate additional income of $375,000. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Direct materials Direct labor Variable overhead 1A Fixed overhead Opportunity cost Purchase price Totals Make A Buy $ SA Net Income Increase (Decrease) $ Based on the above assumptions, indicate whether the offer should be accepted or rejected? The offerarrow_forward

- The following is a list of balances relating to Phiri Properties Ltd during 2024. The company maintains a memorandum debtors and creditors ledger in which the individual account of customers and suppliers are maintained. These were as follows: Debit balance in debtors account 01/01/2024 66,300 Credit balance in creditors account 01/01/2024 50,600 Sunday credit balance on debtors ledger Goods purchased on credit 724 257,919 Goods sold on credit Cash received from debtors Cash paid to suppliers Discount received Discount allowed Cash purchases Cash sales Bad Debts written off Interest on overdue account of customers 323,614 299,149 210,522 2,663 2,930 3,627 5,922 3,651 277 Returns outwards 2,926 Return inwards 2,805 Accounts settled by contra between debtors and creditors ledgers 1,106 Credit balances in debtors ledgers 31/12/2024. 815 Debit balances in creditors ledger 31/12/2024.698 Required: Prepare the debtors control account as at 31/12/2024. Prepare the creditors control account…arrow_forwardSolnarrow_forwardSolution neededarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License